Humana Health Benefits: Your Guide to Coverage & Wellness

Navigating the world of health insurance can be daunting, but understanding Humana Health Benefits can empower you to make informed decisions about your coverage and wellness. Humana offers a range of plans designed to meet diverse healthcare needs, from individual and family coverage to employer-sponsored options. With a focus on preventive care, wellness programs, and personalized support, Humana aims to enhance your overall health experience. This guide will provide an overview of Humana’s key benefits, resources for maximizing your coverage, and tips for maintaining a healthy lifestyle, ensuring you have the tools to thrive in your healthcare journey.

Introduction to Humana Health Benefits

Humana Health Benefits offers a comprehensive range of health insurance coverage options tailored to meet the diverse needs of individuals and families. With a focus on wellness and preventive care, Humana aims to empower its members to take control of their health. This article serves as a guide to understanding Humana's offerings, helping you navigate the various plans available, and explore the wellness initiatives designed to support a healthier lifestyle.

Understanding Humana's Health Insurance Plans

Humana provides a variety of health insurance plans, including individual and family plans, employer group plans, Medicare Advantage, and Medicaid options. Each plan is designed to cater to different demographics and health needs, ensuring that members receive tailored coverage.

Individual and Family Plans

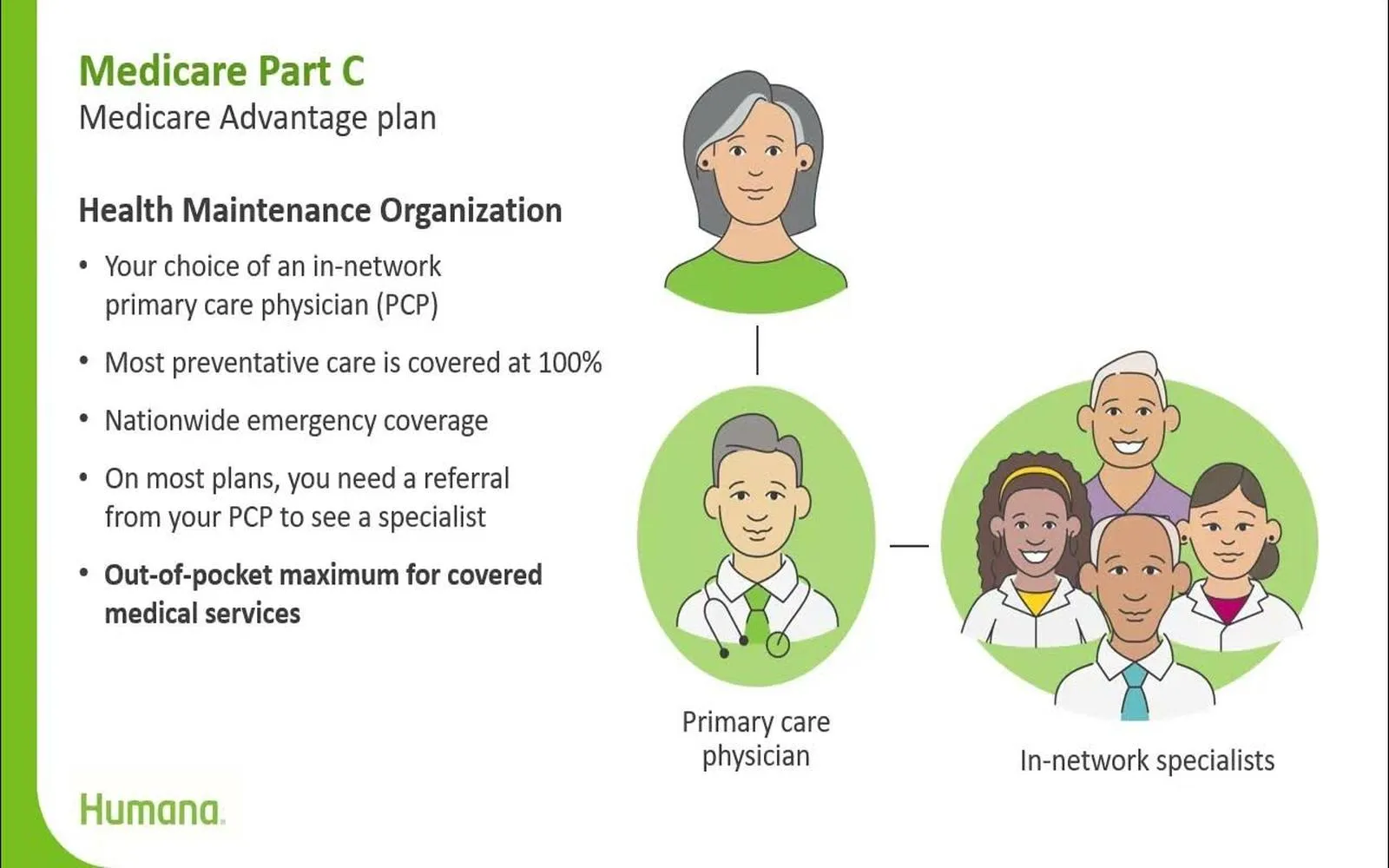

Humana's individual and family plans include options such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). These plans vary in terms of flexibility, costs, and provider access. Members can choose plans based on their healthcare needs and financial situations, with varying premiums, deductibles, and out-of-pocket costs.

Medicare Advantage Plans

Humana’s Medicare Advantage plans provide comprehensive coverage for seniors, combining the benefits of Original Medicare (Parts A and B) with additional services such as vision, dental, and hearing care. These plans often include wellness programs and preventive services aimed at maintaining health and preventing illness.

Medicaid Options

For eligible low-income individuals and families, Humana offers Medicaid plans that provide essential health coverage. These plans cover a wide range of services, including hospital visits, doctor’s appointments, and prescription medications, ensuring access to care for those in need.

Key Benefits of Choosing Humana

Choosing Humana for your health coverage comes with several key benefits. Understanding these advantages can help you make informed decisions about your healthcare needs.

Comprehensive Coverage

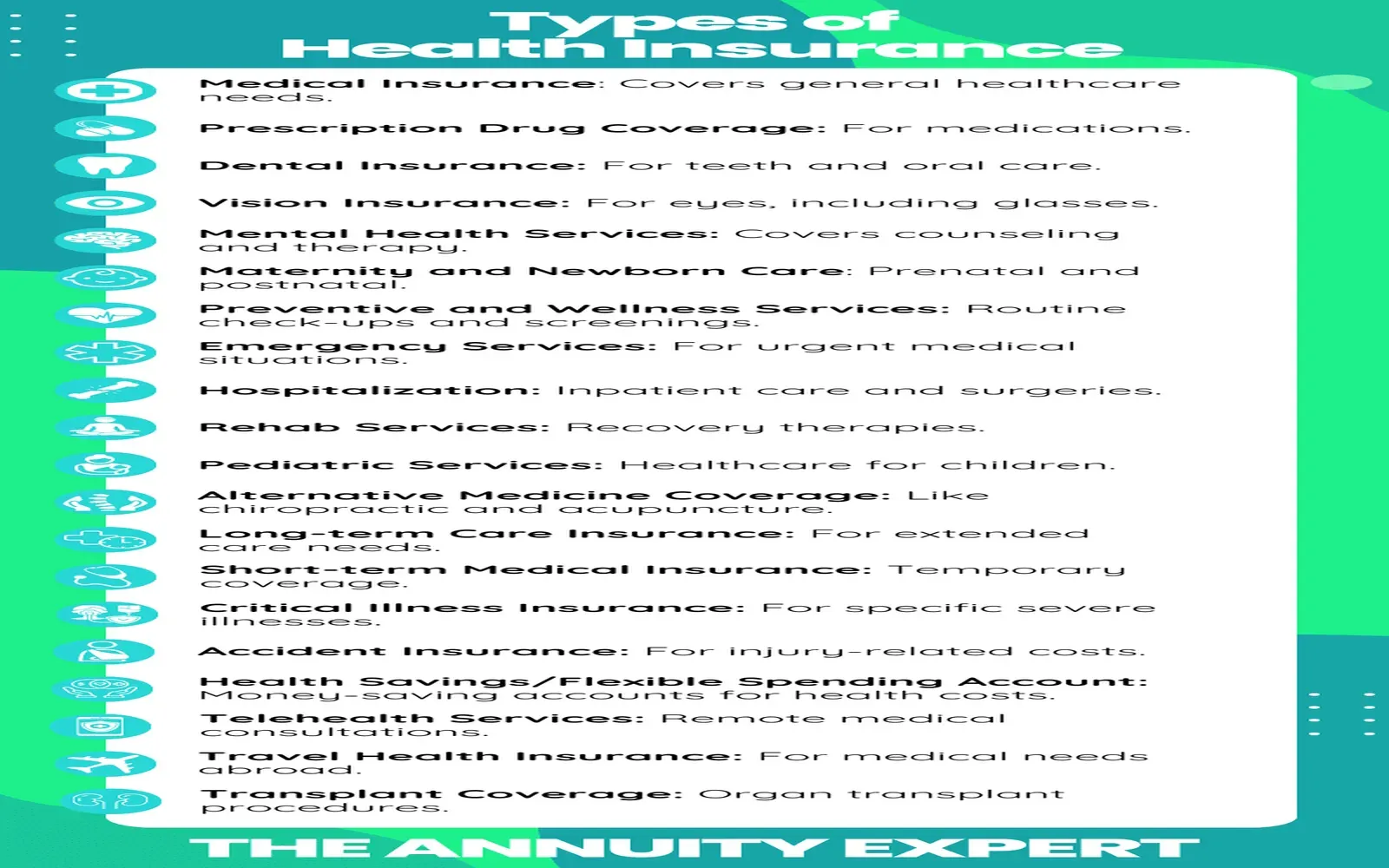

Humana's plans typically cover a broad array of services, including primary care, specialist visits, hospitalization, preventive care, mental health services, and prescription drugs. This comprehensive coverage ensures that members have access to the medical services they need without incurring exorbitant out-of-pocket costs.

Wellness Programs

Humana emphasizes wellness and preventive care through various programs designed to promote healthy lifestyles. These programs may include fitness memberships, nutrition counseling, weight management, smoking cessation support, and chronic disease management. By focusing on prevention, Humana aims to improve health outcomes and reduce overall healthcare costs for its members.

Telehealth Services

With the rise of technology in healthcare, Humana offers telehealth services that allow members to consult with healthcare providers remotely. This convenient option is particularly beneficial for those who may have difficulty accessing traditional in-person visits. Telehealth services can include virtual consultations for non-emergency medical issues, mental health support, and follow-up appointments.

Member Support and Resources

Humana provides a wealth of resources and support for its members, including 24/7 customer service, online account management, and access to a mobile app. These tools allow members to track their health benefits, schedule appointments, and find healthcare providers easily. Additionally, Humana’s online resources include educational materials and health assessments to help members stay informed about their health.

Understanding Costs and Coverage Levels

One of the most critical aspects of health insurance is understanding the costs associated with different plans. Humana offers various coverage levels, each with its premium, deductible, and out-of-pocket maximums.

Premiums and Deductibles

The premium is the amount you pay monthly for your health insurance coverage, while the deductible is the amount you must pay out-of-pocket before your insurance starts to cover costs. Humana plans may have different premium and deductible structures, and it’s essential to evaluate these costs in light of your anticipated healthcare needs.

Out-of-Pocket Maximums

The out-of-pocket maximum is the highest amount you will pay in a given year for covered healthcare expenses. Once you reach this limit, Humana will cover 100% of the costs of covered services for the rest of the year. Understanding the out-of-pocket maximum is crucial for budgeting your healthcare expenses.

Co-Pays and Co-Insurance

Co-pays are fixed amounts you pay for specific services, like doctor visits or prescriptions. Co-insurance, on the other hand, is the percentage of costs you pay for covered services after meeting your deductible. Both co-pays and co-insurance vary by plan and can significantly impact your out-of-pocket expenses.

Utilizing Humana’s Wellness Resources

Humana’s focus on wellness is a standout feature of its health benefits. By taking advantage of available resources, members can actively participate in their health management and improvement.

Health Coaching

Humana offers health coaching services to help members set and achieve their health goals. Whether you want to lose weight, manage a chronic condition, or improve your overall wellness, health coaches provide personalized support and guidance tailored to your needs.

Online Health Assessments

Humana's online health assessments allow members to evaluate their health status and identify areas for improvement. These assessments cover various health topics, including nutrition, physical activity, and stress management, providing personalized recommendations based on the results.

Fitness Programs and Discounts

To encourage physical activity, Humana partners with fitness centers and gyms to offer discounts and memberships to its members. These programs aim to make fitness more accessible and affordable, promoting a healthier lifestyle.

Nutrition Resources

Humana provides various nutrition resources, including meal planning tools and access to registered dietitians. These resources help members make informed dietary choices and create balanced meal plans that support their health goals.

Conclusion: Choosing Humana for Your Health Needs

In summary, Humana Health Benefits offers a diverse array of health insurance plans designed to meet the needs of individuals and families. With a strong emphasis on wellness, preventive care, and member support, Humana empowers its members to take charge of their health. By understanding the available coverage options, enrollment processes, and wellness resources, you can make informed decisions about your health insurance needs. Whether you are seeking an individual plan, a Medicare Advantage option, or Medicaid coverage, Humana aims to provide comprehensive and accessible healthcare solutions for all its members.

Explore

Comprehensive Guide to Humana Health Coverage Plans: Benefits, Options, and Enrollment Tips

Humana Medicare Plans: Compare Coverage & Benefits

Best Health Insurance Plans for Comprehensive Coverage

Private Health Insurance: Compare Plans, Costs & Benefits

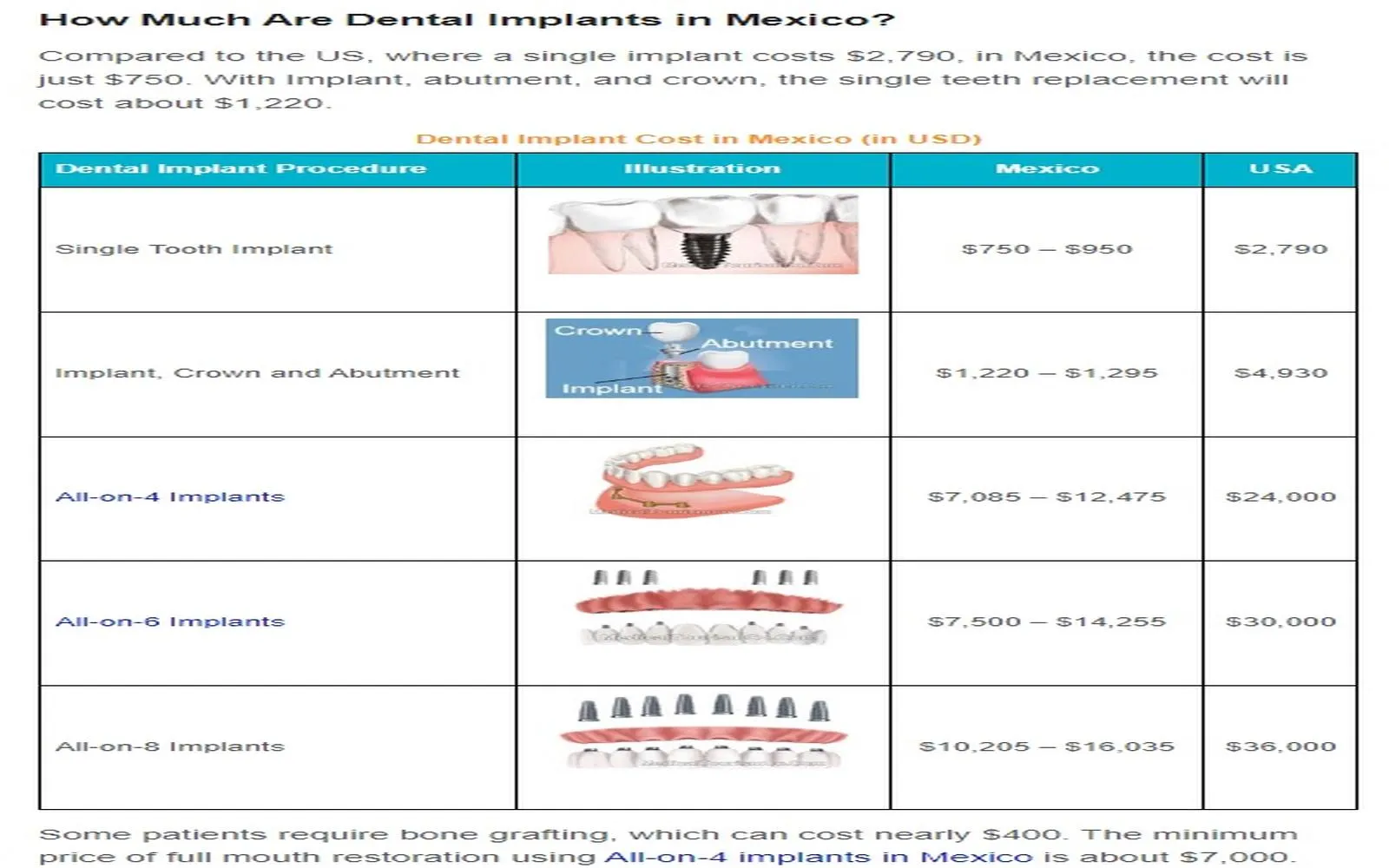

Comprehensive Guide to Dental Insurance with Implant Coverage: What You Need to Know

Car Insurance: What You Need to Know and How to Choose the Right Coverage

Compare AARP Insurance Quotes for Affordable Coverage

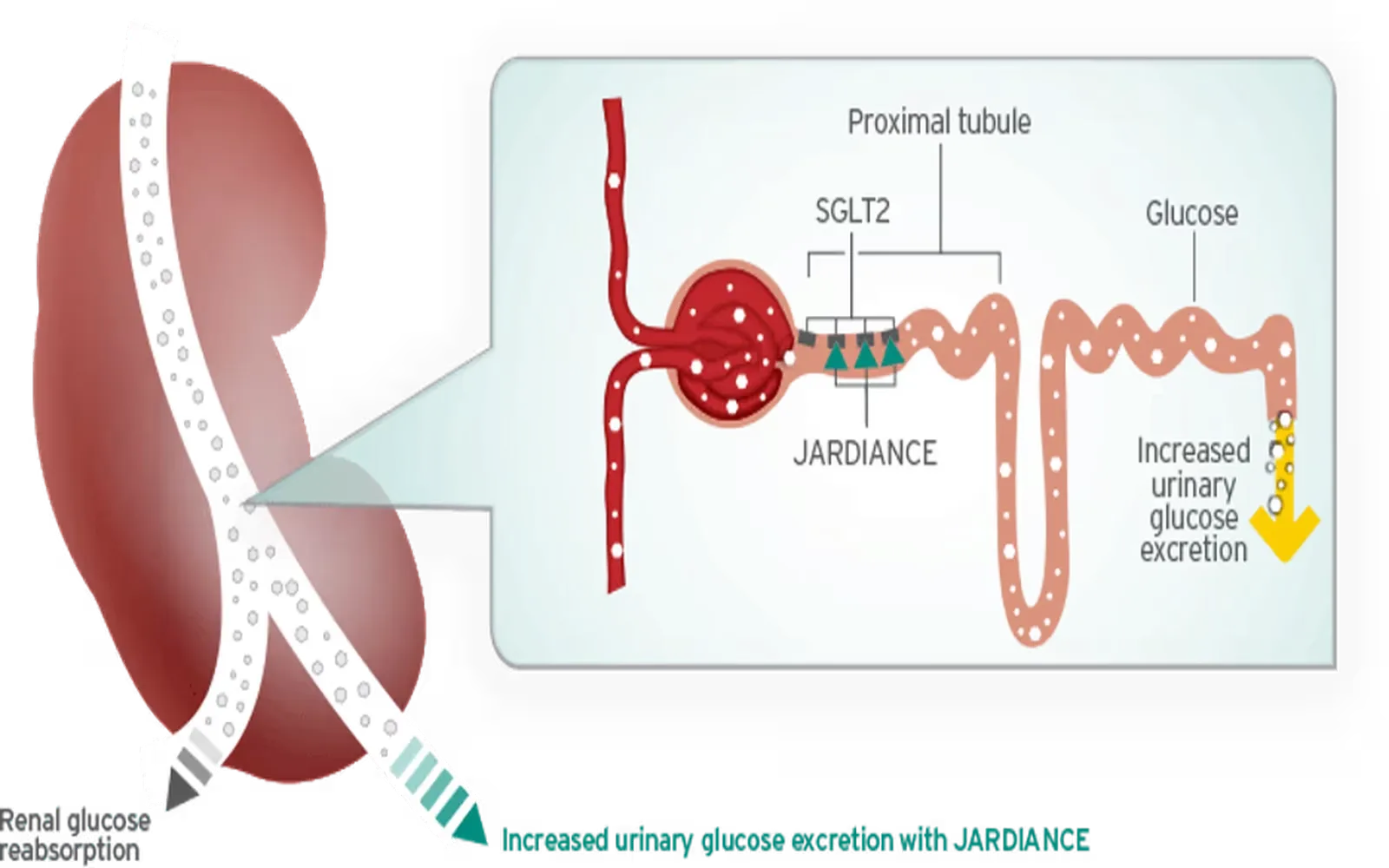

Jardiance & Medicare: Top Coverage Plans for Diabetes Care