Car Insurance: What You Need to Know and How to Choose the Right Coverage

Car insurance is essential for protecting yourself, your passengers, and your vehicle from unexpected accidents and damages. With so many different types of car insurance policies and providers available, it can be overwhelming to choose the right coverage for your needs. In this article, we will break down the key aspects of car insurance and offer guidance on how to make an informed decision.

Types of Car Insurance Coverage

There are several types of car insurance coverage, each designed to protect you in different situations. Below are the most common types of car insurance policies:

| Type of Coverage | What It Covers |

|---|---|

| Liability Insurance | Covers damage to other vehicles and injuries to others if you're at fault. |

| Collision Insurance | Covers damage to your own vehicle in the event of a crash, regardless of fault. |

| Comprehensive Insurance | Covers damage to your vehicle from non-collision events like theft, vandalism, or natural disasters. |

| Personal Injury Protection (PIP) | Covers medical expenses for you and your passengers, regardless of fault. |

| Uninsured/Underinsured Motorist | Protects you if you're in an accident caused by someone who doesn’t have insurance or enough insurance. |

| Medical Payments Coverage | Helps cover medical expenses for you and your passengers after an accident. |

How to Choose the Right Car Insurance

Selecting the right car insurance policy involves evaluating your personal needs, your vehicle, and your budget. Here are some tips to help you make the right choice:

1. Assess Your Needs

- Vehicle Value: If you own an older car, you may not need comprehensive or collision coverage. For newer or high-value cars, it's worth investing in these coverages to protect your investment.

- Driving Habits: If you drive frequently or in high-risk areas, you may want higher coverage limits or additional options like rental car reimbursement or roadside assistance.

2. Compare Multiple Providers

- It's important to shop around and compare quotes from different car insurance providers. This can help you find the best rates and coverage options for your needs.

3. Consider Deductibles and Premiums

- The deductible is the amount you'll pay out-of-pocket before your insurance kicks in. Higher deductibles can lower your premium but may lead to higher costs in the event of a claim. Balance your deductible with your ability to pay for damages.

4. Look for Discounts

- Many insurers offer discounts for safe driving, bundling with other types of insurance (like homeowners insurance), or having certain safety features in your vehicle. Make sure to inquire about any available discounts.

5. Check for Customer Service and Claims Process

- It’s important to choose an insurance provider with excellent customer service and an efficient claims process. Read reviews and ask for recommendations to ensure you'll be well-supported if you need to file a claim.

Factors That Affect Car Insurance Rates

Several factors influence how much you'll pay for car insurance. Understanding these factors can help you find the most affordable coverage:

| Factor | How It Affects Your Rate |

|---|---|

| Driving Record | A clean driving record with no accidents or violations can lower your premium. |

| Age and Gender | Younger drivers and male drivers may pay higher premiums due to higher accident rates. |

| Location | Urban areas tend to have higher premiums due to the increased risk of accidents or theft. |

| Vehicle Type | Expensive, high-performance, or luxury cars usually come with higher insurance costs. |

| Credit Score | In some states, a higher credit score can lower your car insurance premiums. |

| Coverage Amount | Higher coverage limits and lower deductibles will increase your premiums. |

Car Insurance Requirements by State

Car insurance laws vary by state. In some states, minimum liability insurance coverage is required, while others may have additional requirements such as personal injury protection (PIP) or uninsured motorist coverage.

It’s crucial to know the car insurance laws in your state to ensure that you meet the minimum coverage requirements. Some states may also allow you to purchase additional coverage or opt out of certain types of insurance.

| State | Minimum Liability Coverage |

|---|---|

| California | $15,000 for injury/death to one person, $30,000 for injury/death to multiple people, and $5,000 for property damage. |

| Texas | $30,000 for injury/death to one person, $60,000 for injury/death to multiple people, and $25,000 for property damage. |

| Florida | $10,000 for personal injury protection and $10,000 for property damage liability. |

| New York | $25,000 for injury/death to one person, $50,000 for injury/death to multiple people, and $10,000 for property damage. |

How to Save on Car Insurance

Car insurance can be expensive, but there are several ways to lower your premium:

- Increase Your Deductible: Opting for a higher deductible can reduce your monthly premium, but make sure you can afford the deductible in case of an accident.

- Bundle Your Policies: Many insurers offer discounts for bundling car insurance with other policies, such as home or renters insurance.

- Take Advantage of Discounts: Look for discounts such as safe driver discounts, multi-car discounts, and discounts for vehicles with anti-theft devices.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to keep your premiums lower over time.

- Drive a Safer Car: Insuring a vehicle with high safety ratings or anti-theft features can help reduce your rates.

Conclusion

Car insurance is an essential part of responsible vehicle ownership. By understanding the different types of coverage available, assessing your personal needs, and comparing providers, you can find the right insurance plan for your budget and lifestyle. Keep in mind that rates can vary significantly based on factors like driving history, location, and the type of car you drive, so it’s important to shop around and take advantage of discounts.

Choosing the right car insurance ensures that you and your vehicle are protected, while also helping you navigate the complexities of the insurance world. Whether you're looking for the minimum required coverage or comprehensive protection, there are plenty of options to fit your needs.

Explore

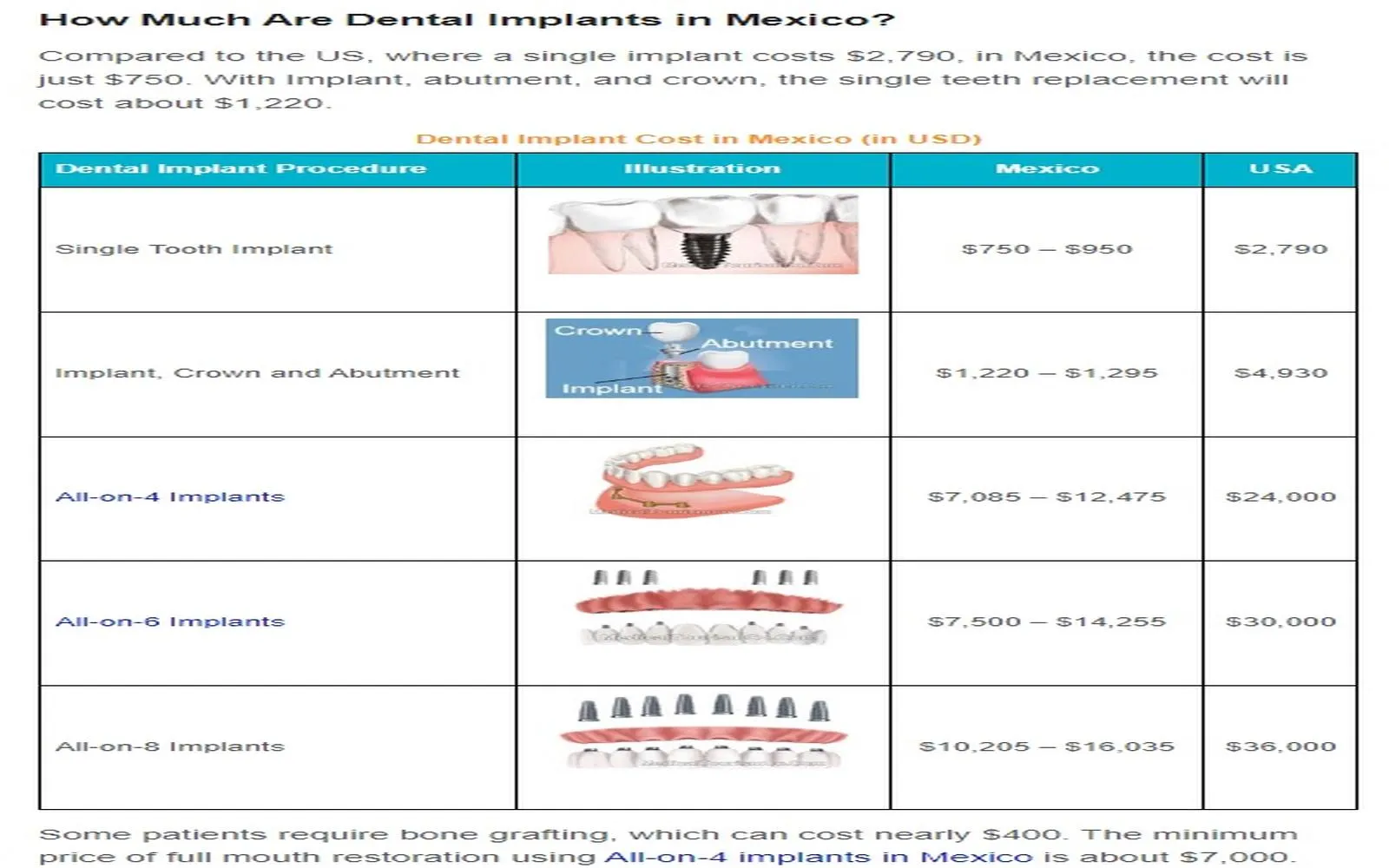

Comprehensive Guide to Dental Insurance with Implant Coverage: What You Need to Know

Why You Need a Personal Injury Lawyer & How to Choose One

Everything You Need to Know About Window Replacement: Costs, Options, and Top Installers

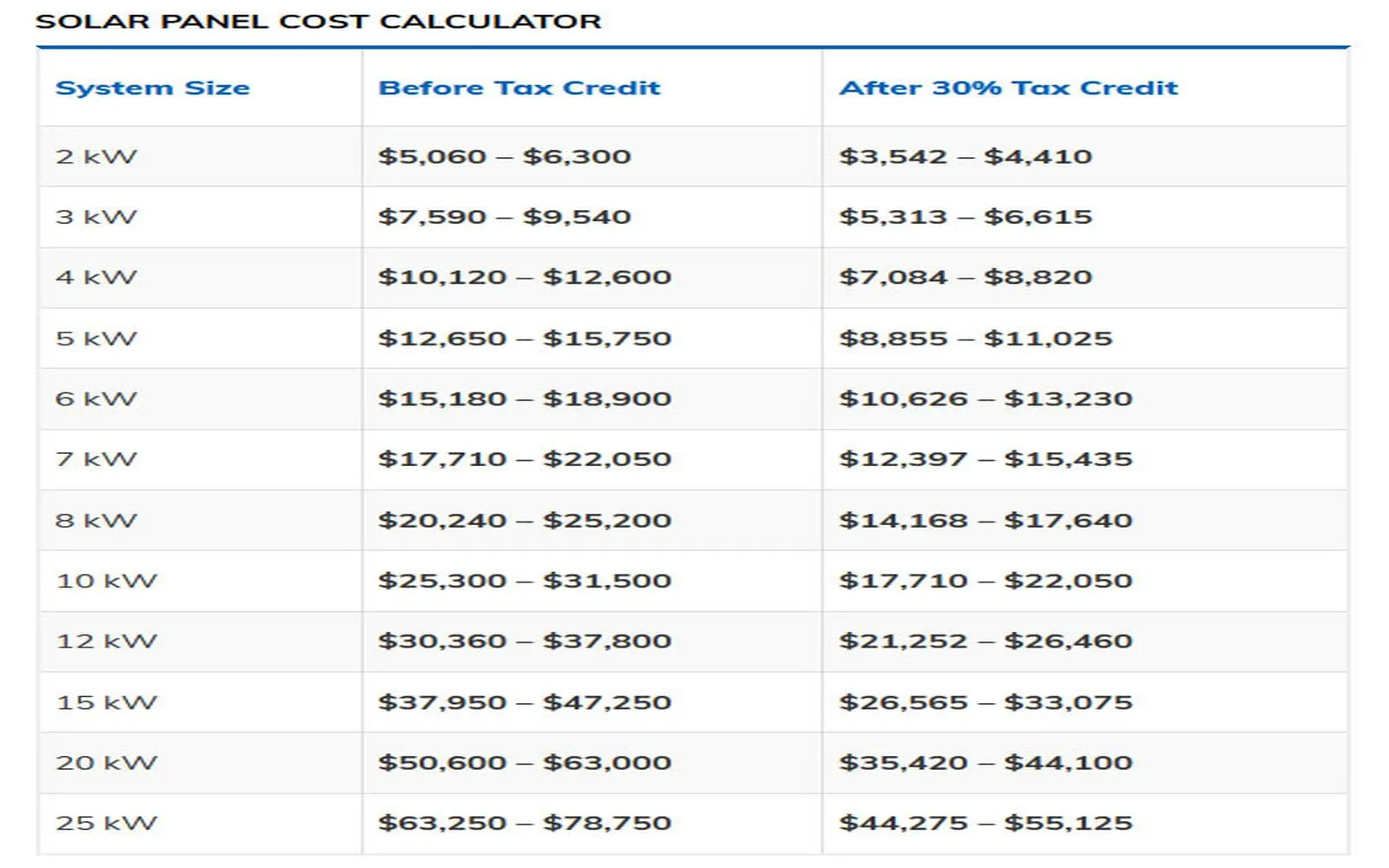

Solar Panel Installation Costs: What Homeowners Need to Know

Compare AARP Insurance Quotes for Affordable Coverage

Best Health Insurance Plans for Comprehensive Coverage

Comprehensive Guide to Humana Health Coverage Plans: Benefits, Options, and Enrollment Tips

Humana Health Benefits: Your Guide to Coverage & Wellness