Compare AARP Insurance Quotes for Affordable Coverage

Understanding AARP Insurance

The American Association of Retired Persons (AARP) is a well-known organization that advocates for the interests of older Americans. One of the significant benefits of AARP membership is access to various insurance products, including health, auto, home, and life insurance. AARP collaborates with several insurance providers to offer tailored coverage options that cater to the needs of older adults. Understanding how to compare AARP insurance quotes can help you find affordable coverage that meets your needs.

The Importance of Comparing Insurance Quotes

When it comes to insurance, one size does not fit all. Every individual's situation is unique, and therefore, their insurance needs will vary. Comparing insurance quotes is crucial for several reasons:

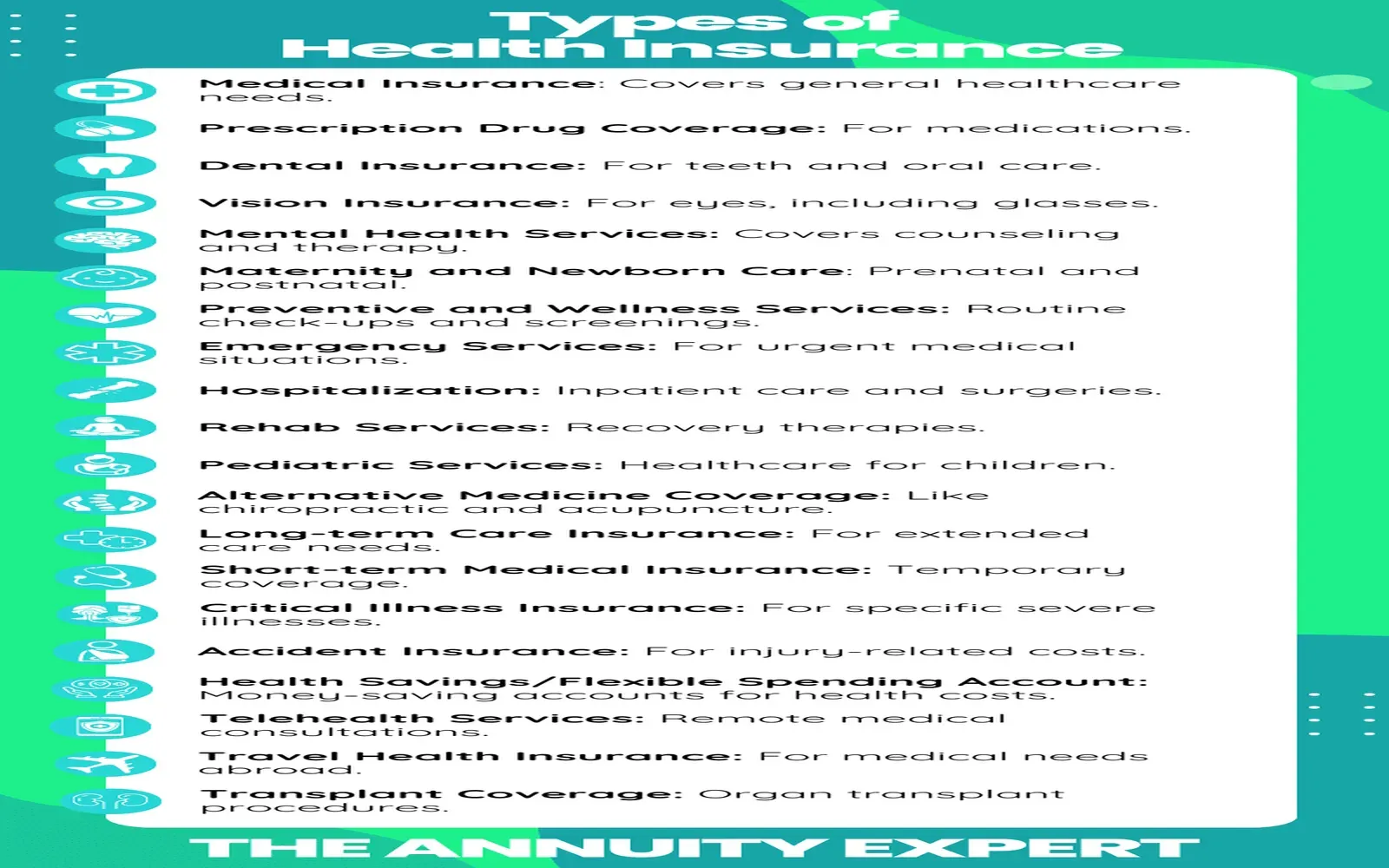

Types of Insurance Offered by AARP

AARP provides a variety of insurance products, making it easier for older adults to find comprehensive coverage. Here’s a closer look at the types of insurance available:

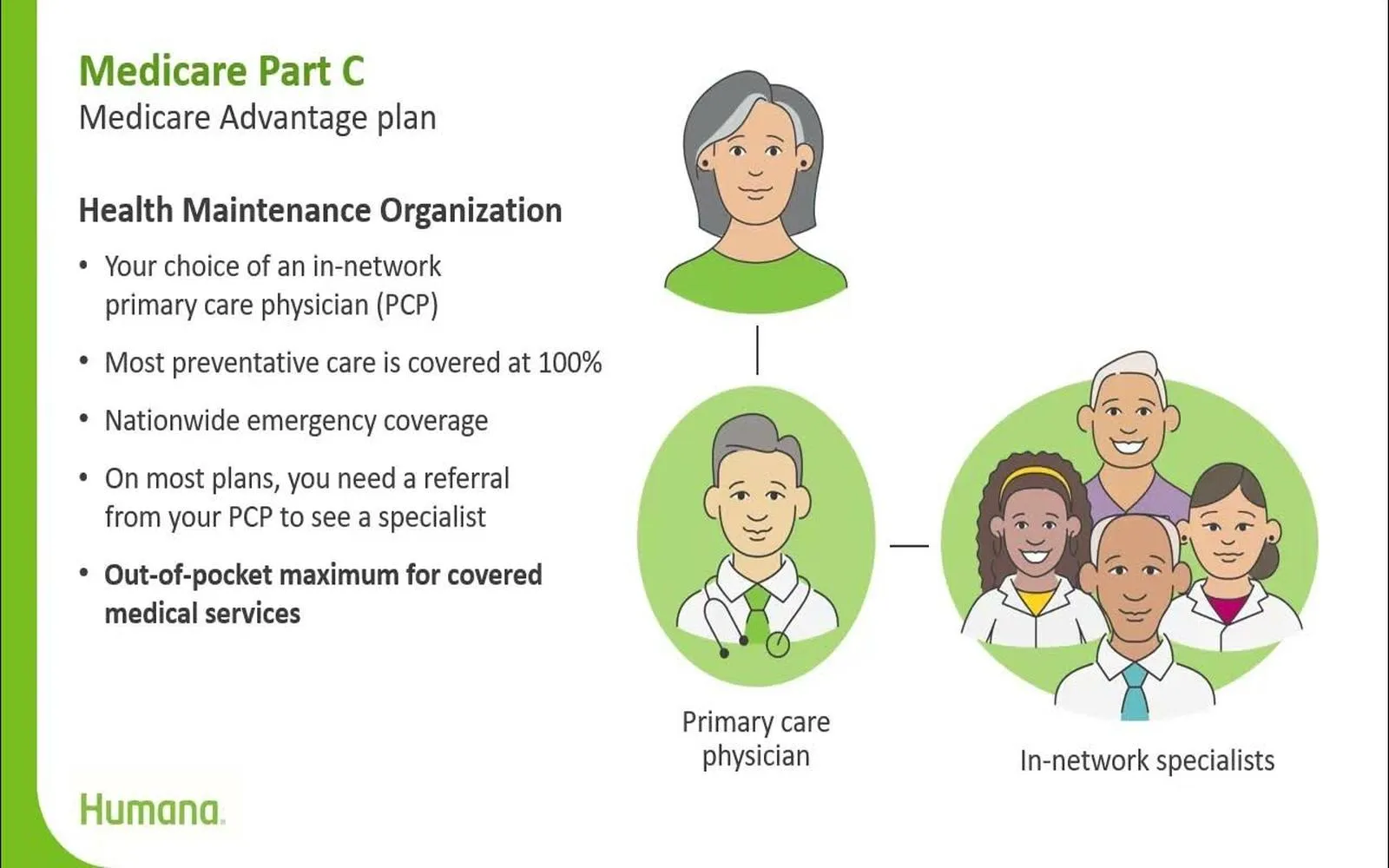

1. Health Insurance

AARP offers health insurance plans aimed primarily at seniors. These plans typically include Medicare Advantage, Medicare Supplement, and prescription drug coverage. It's essential to evaluate your health needs and compare the available options to determine which plan provides the best coverage for your situation.

2. Auto Insurance

AARP's auto insurance is designed to help seniors save money while ensuring they have adequate coverage. Factors to consider when comparing auto insurance quotes include liability limits, coverage for uninsured motorists, and available discounts for safe driving or bundling policies.

3. Home Insurance

Homeowners insurance from AARP protects your home and personal belongings. It’s important to compare quotes from different insurers to understand the coverage limits, deductibles, and any additional riders that may be necessary for specific situations, such as coverage for natural disasters.

4. Life Insurance

AARP offers term and whole life insurance options. When comparing life insurance quotes, consider your financial goals, the amount of coverage needed, and the affordability of premiums over time. AARP’s policies may offer unique benefits tailored for seniors.

How to Compare AARP Insurance Quotes

To effectively compare AARP insurance quotes, follow these steps:

1. Gather Your Information

Before you start comparing quotes, collect all necessary information related to your insurance needs. For auto insurance, this includes your vehicle's make and model, driving history, and any additional drivers. For health insurance, be prepared with information about your medical history and current medications.

2. Use Online Tools

Many websites offer tools that allow you to compare insurance quotes from different providers. AARP's own website also provides resources and links to various insurance products. Input your information to get personalized quotes.

3. Evaluate Coverage Options

When comparing quotes, don’t just look at the price. Pay attention to the different coverage options available. Look for any exclusions or limits in the policy that could affect your decision. For example, some auto insurance policies may have lower premiums but higher deductibles or less coverage for certain types of accidents.

4. Check for Discounts

AARP members often qualify for various discounts. Make sure to inquire about any available discounts, such as those for safe driving, multiple policies, or loyalty. These discounts can significantly reduce your overall premium costs.

5. Read Reviews and Ratings

Before settling on an insurance provider, take the time to read reviews and ratings from current or past customers. Websites like J.D. Power and Consumer Reports provide insights into customer satisfaction, claims processes, and overall reliability.

6. Consult an Insurance Agent

If you find the process overwhelming, consider consulting an insurance agent who specializes in AARP-related products. They can provide personalized assistance and help you navigate the available options while ensuring you get the best coverage for your needs.

Factors Affecting AARP Insurance Quotes

1. Age and Health Status

Your age and overall health can significantly impact your insurance premiums, especially for health and life insurance. Older adults may face higher premiums due to increased health risks. It’s essential to disclose your health status accurately to receive the most accurate quotes.

2. Location

Your geographical location affects your insurance rates. Areas with higher crime rates or more frequent natural disasters may lead to higher home insurance costs. Similarly, auto insurance rates can vary based on the frequency of accidents in your area.

3. Coverage Amount

The level of coverage you choose will directly affect your premium. Higher coverage limits typically result in higher premiums. Assess your needs to determine the appropriate coverage level for your situation.

4. Claims History

Your history of insurance claims can impact your quotes. Frequent claims may lead insurers to consider you a higher risk, resulting in increased premiums. Maintaining a clean claims history is advantageous when seeking affordable coverage.

5. Payment History

Insurance companies often evaluate your payment history when determining rates. A consistent history of timely payments can qualify you for lower premiums, while missed payments may lead to higher costs.

Tips for Finding Affordable AARP Insurance Coverage

1. Bundle Policies

2. Maintain a Good Credit Score

3. Take Advantage of AARP Discounts

4. Review Your Coverage Regularly

5. Shop Around Annually

Conclusion

Explore

Unlock Your Adventure: How to Easily Compare Travel Insurance Quotes Online

Get Instant Travel Insurance Quotes: Compare Plans & Save Today!

Humana Medicare Plans: Compare Coverage & Benefits

Private Health Insurance: Compare Plans, Costs & Benefits

Best Personal Loan Offers: Compare Rates & Benefits

Top Business Internet Providers: Compare Speed, Reliability, and Pricing for Your Company

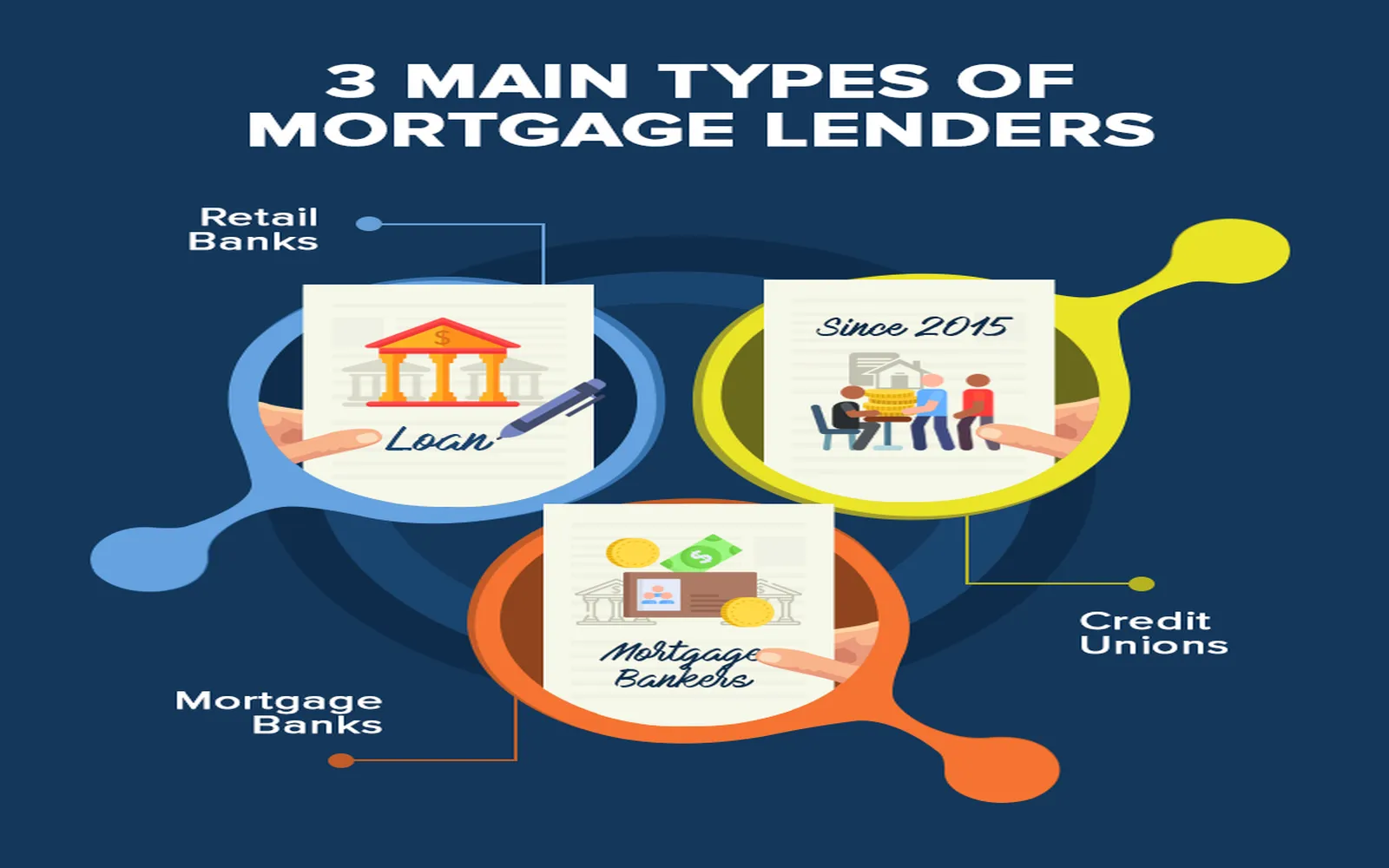

Top Mortgage Lenders in the U.S.: Compare Rates, Services, and Reviews

Navigating the Waters: Your Essential Guide to Flood Insurance Quotes