Best Health Insurance Plans for Comprehensive Coverage

Introduction

Health insurance is a critical component of financial security and well-being. With the rising costs of healthcare, it's essential to choose a health insurance plan that offers comprehensive coverage. This article will explore the best health insurance plans available, focusing on their features, benefits, and what to consider when selecting the right plan for you and your family.

Understanding Comprehensive Coverage

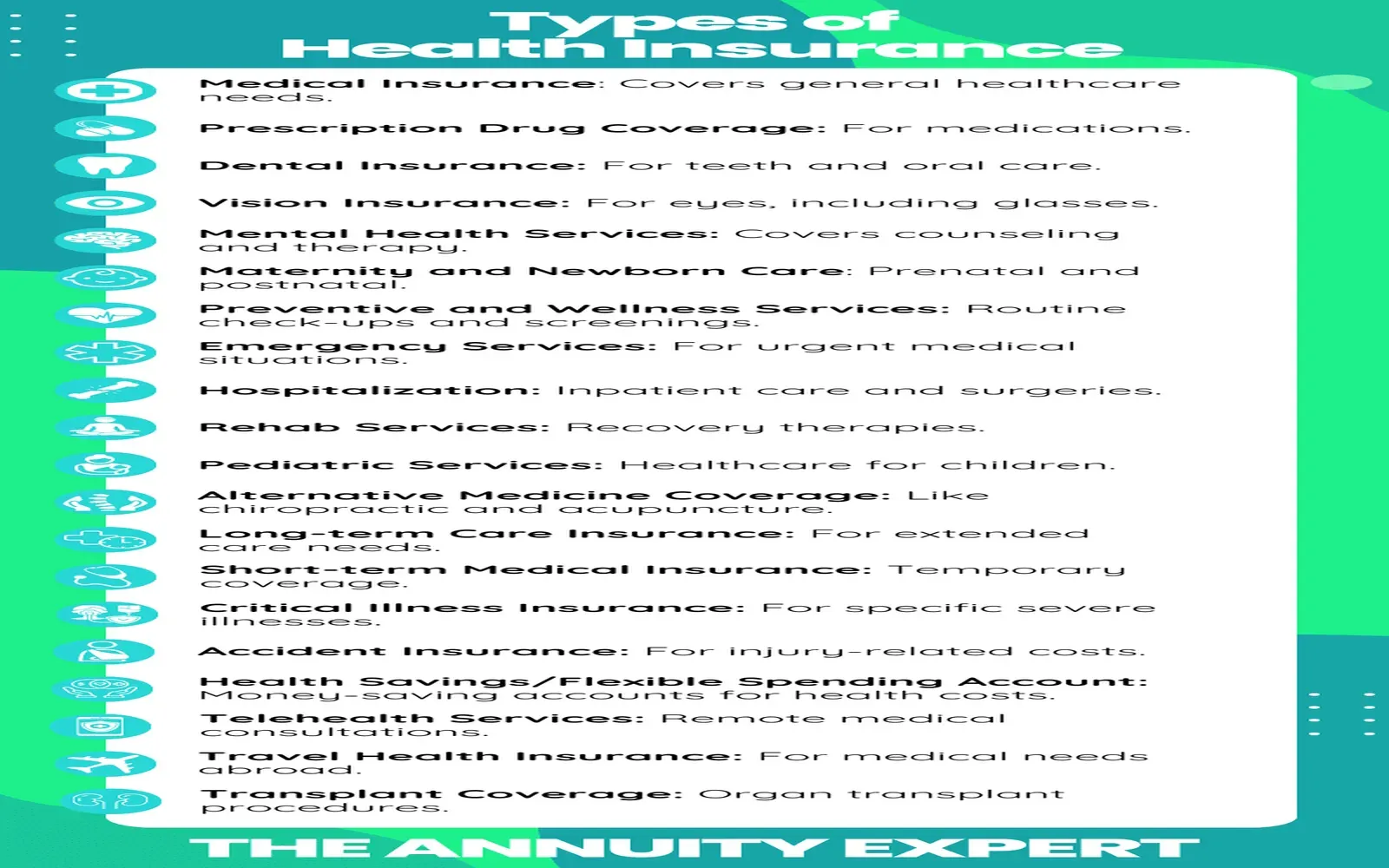

Comprehensive health insurance coverage means that the plan covers a wide array of healthcare services, including preventive care, hospitalization, prescription medications, mental health services, and specialty care. A comprehensive plan should also provide financial protection against high medical expenses, ensuring that you can access necessary care without facing crippling costs.

Key Features of the Best Health Insurance Plans

When evaluating health insurance plans, several key features distinguish the best options from the rest:

Top Health Insurance Plans for Comprehensive Coverage

1. Blue Cross Blue Shield (BCBS)

Blue Cross Blue Shield is one of the largest health insurance providers in the United States, offering a variety of plans that cater to different needs. BCBS plans often feature extensive networks, competitive premiums, and comprehensive coverage options.

With BCBS, you can expect:

2. UnitedHealthcare (UHC)

UnitedHealthcare is known for its comprehensive coverage and innovative health management programs. UHC provides plans that emphasize preventive care and chronic disease management, making it a suitable choice for individuals with ongoing health concerns.

Key features of UHC plans include:

3. Aetna

Aetna is another major player in the health insurance market, offering plans with a focus on preventive care and wellness. Aetna's comprehensive coverage includes a variety of health services, from routine check-ups to complex surgeries.

Aetna's offerings include:

4. Cigna

Cigna is known for its customer service and extensive provider network. The company offers a variety of health insurance plans that prioritize comprehensive coverage and preventive care.

Highlights of Cigna plans include:

5. Kaiser Permanente

Kaiser Permanente is a unique health insurance model that combines insurance coverage with healthcare delivery. This integrated approach allows for a seamless experience, with a focus on preventive care and coordinated treatment.

Benefits of choosing Kaiser Permanente include:

Factors to Consider When Choosing a Health Insurance Plan

Selecting the right health insurance plan requires careful consideration of various factors. Here are some key points to keep in mind:

1. Your Health Needs

Consider your current health status and any ongoing medical conditions. If you have a chronic illness or require regular medical attention, you may benefit from a plan with lower deductibles and comprehensive coverage for specialist visits and medications.

2. Family Coverage

If you're looking for a family plan, evaluate the healthcare needs of all family members. Some plans offer additional benefits, such as pediatric care and maternity coverage, which may be important for growing families.

3. Network of Providers

Check if your preferred doctors and hospitals are in the insurance plan's network. Out-of-network care can be significantly more expensive, so it's essential to ensure that you have access to quality providers when needed.

5. Prescription Drug Coverage

If you take prescription medications regularly, investigate the plan's formulary (the list of covered drugs) and the associated costs. Some plans may have higher copays for certain medications, which can impact your overall expenses.

6. Additional Benefits

Many health insurance plans offer additional benefits such as dental, vision, and wellness programs. Consider which of these extras are important to you and your family, as they can enhance your overall health coverage.

7. Customer Service and Support

Evaluate the insurer's reputation for customer service. Good customer support can make a significant difference when you have questions about your coverage or need help navigating the healthcare system.

Conclusion

Choosing the right health insurance plan is a vital decision that can significantly impact your health and financial well-being. The best health insurance plans for comprehensive coverage include options from Blue Cross Blue Shield, UnitedHealthcare, Aetna, Cigna, and Kaiser Permanente, each offering unique benefits and features. By carefully considering your healthcare needs, family size, provider access, and cost factors, you can select a plan that provides the comprehensive coverage you need to maintain your health and peace of mind.

Explore

Comprehensive Guide to Humana Health Coverage Plans: Benefits, Options, and Enrollment Tips

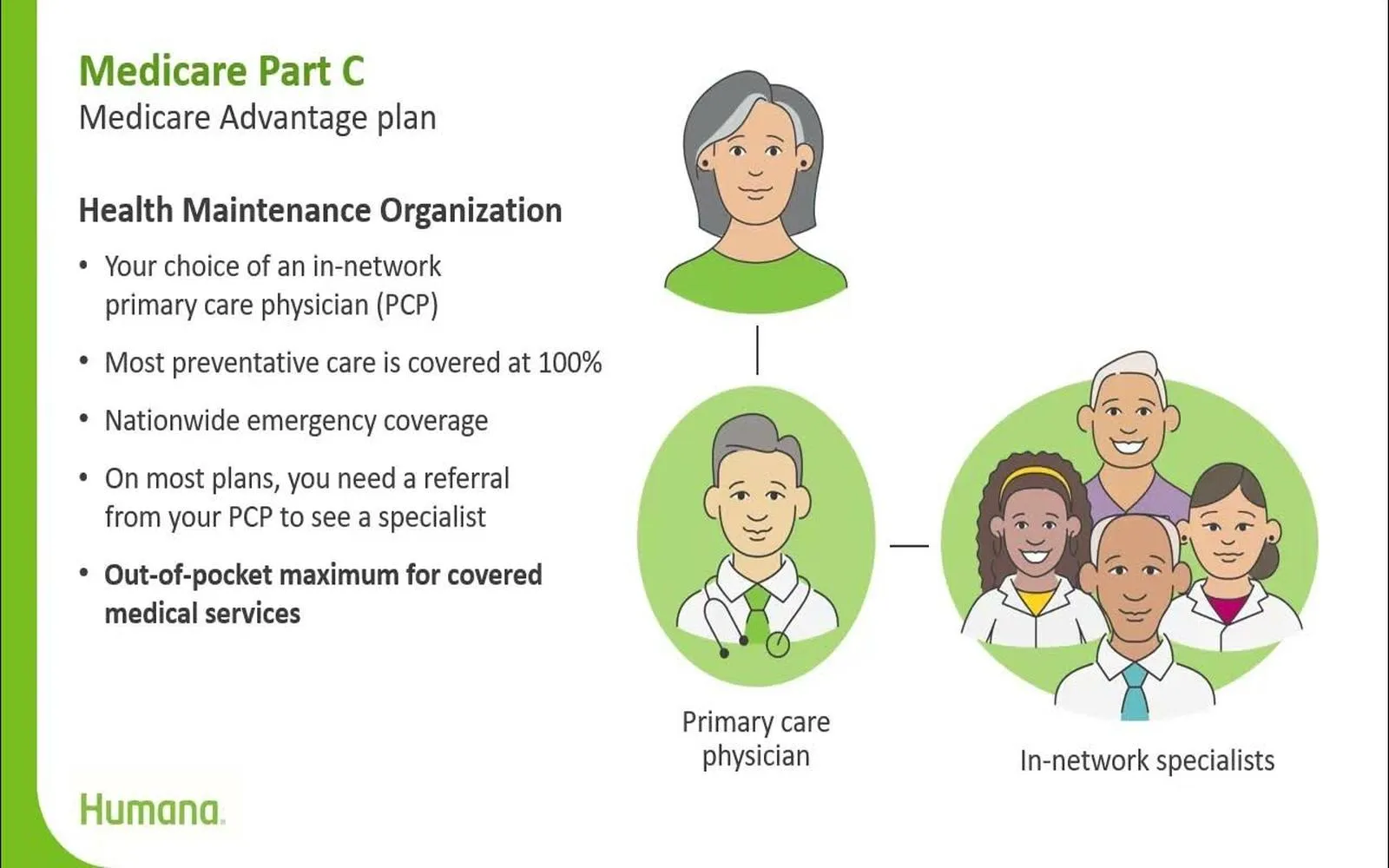

Humana Medicare Plans: Compare Coverage & Benefits

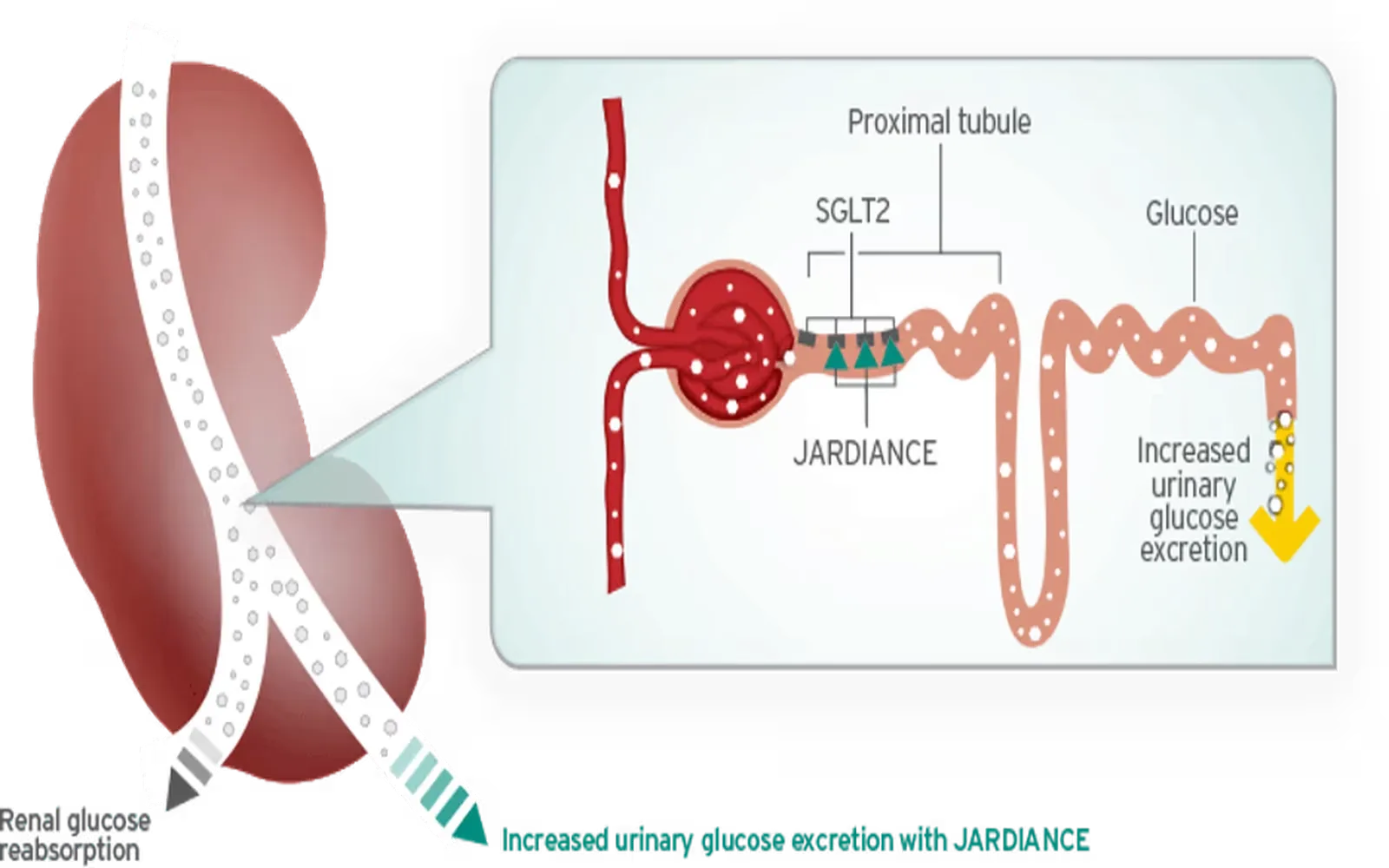

Jardiance & Medicare: Top Coverage Plans for Diabetes Care

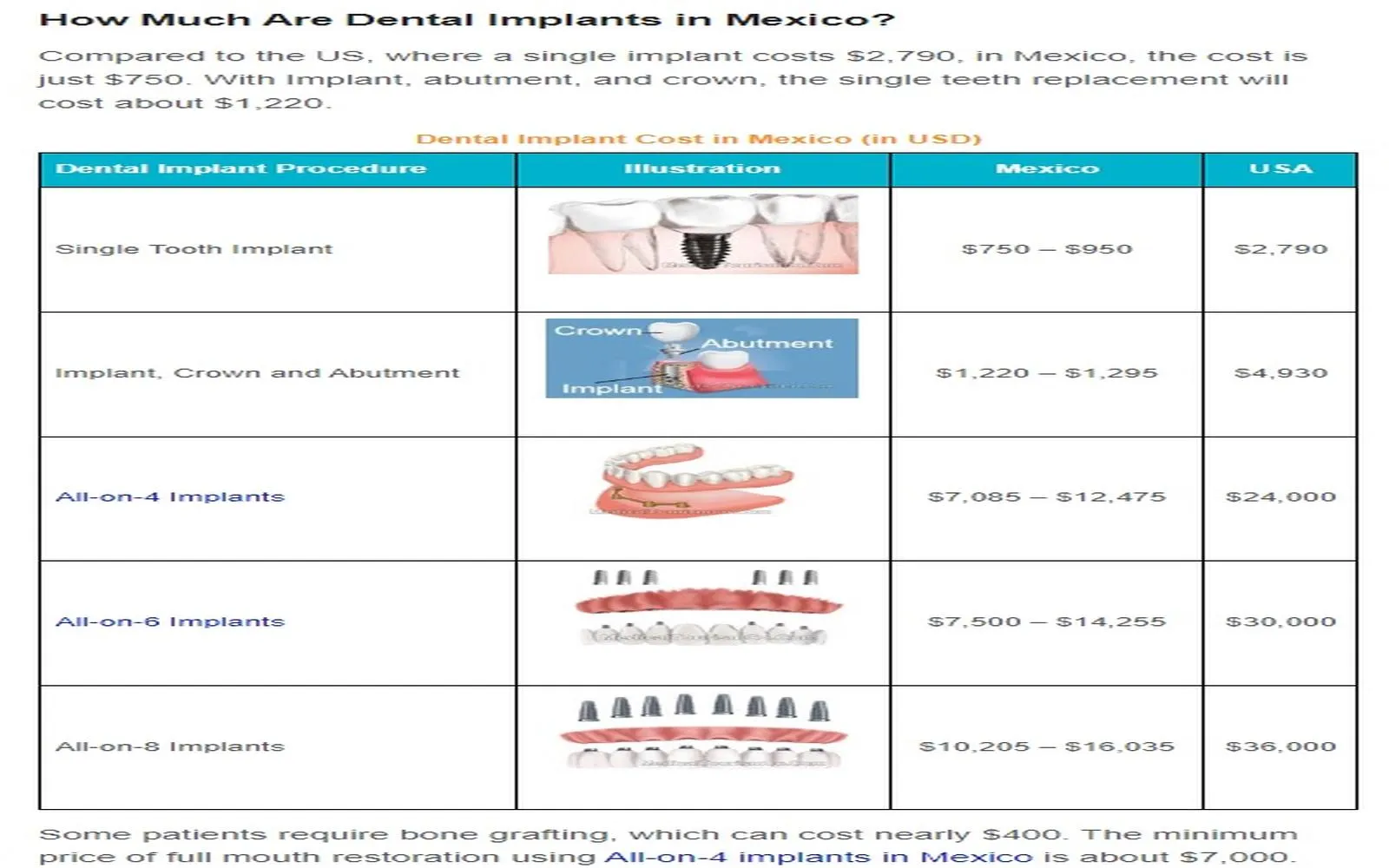

Comprehensive Guide to Dental Insurance with Implant Coverage: What You Need to Know

Humana Health Benefits: Your Guide to Coverage & Wellness

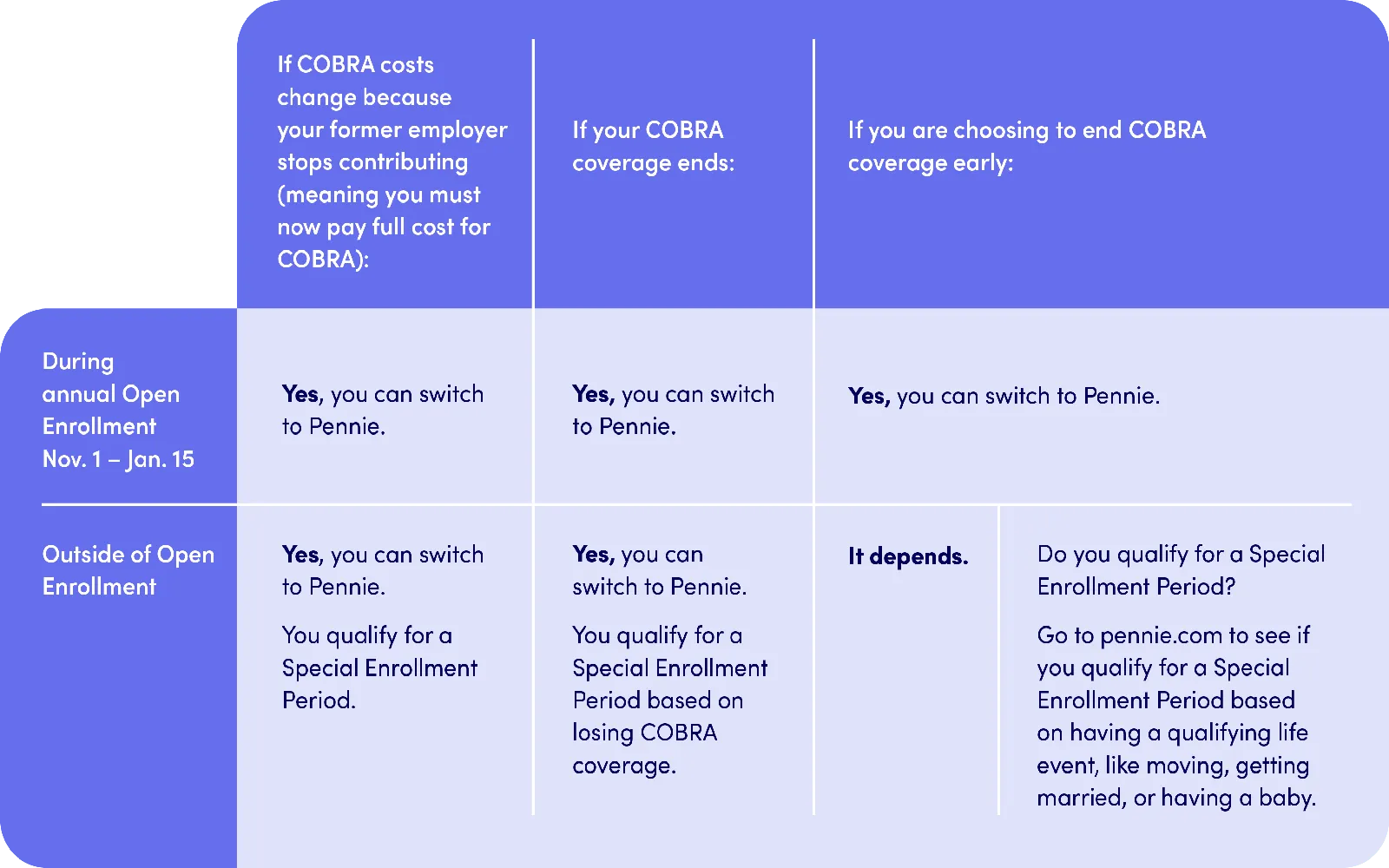

Pennie Insurance Explained: Your Guide to Pennsylvania’s Health Plans

Private Health Insurance: Compare Plans, Costs & Benefits

Car Insurance: What You Need to Know and How to Choose the Right Coverage