Comprehensive Guide to Dental Insurance with Implant Coverage: What You Need to Know

Navigating the world of dental insurance can be challenging, especially when it comes to understanding coverage for dental implants. This comprehensive guide aims to demystify the complexities of dental insurance policies that include implant coverage, helping you make informed decisions about your oral health. From the different types of plans available to the specific benefits and limitations associated with implants, we’ll explore essential information you need to know before selecting a policy. Whether you’re considering implants or simply want to ensure you have the best coverage, this guide will provide valuable insights to support your dental care journey.

Understanding Dental Insurance

Dental insurance is a type of health insurance designed to pay a portion of the costs associated with dental care. It is important for individuals and families to have dental insurance as it helps manage the costs of regular check-ups, cleanings, and necessary dental procedures. Dental insurance plans vary widely, so understanding the specifics of your coverage is crucial to making the most of your benefits.

Types of Dental Insurance Plans

There are primarily three types of dental insurance plans: Preferred Provider Organization (PPO), Health Maintenance Organization (HMO), and Indemnity plans.

PPO Plans

PPO plans offer more flexibility in choosing dentists. Members can see any dentist but will pay less if they use a dentist within the plan's network. These plans typically cover preventive care at 100%, basic procedures at 80%, and major procedures (like implants) at a lower percentage, often around 50% after the deductible is met.

HMO Plans

HMO plans require members to select a primary dentist and obtain referrals for specialists. These plans often have lower premiums but may have limited networks of dentists. Coverage for preventive and basic services is usually higher than for major services.

Indemnity Plans

Indemnity plans allow members to choose any dentist without restrictions. Members pay upfront for services and submit claims for reimbursement. These plans tend to have higher premiums and deductibles, but they often provide more comprehensive coverage for various dental procedures.

What is Dental Implant Coverage?

Dental implants are a popular and effective way to replace missing teeth. They consist of a titanium post surgically placed into the jawbone, which acts as a root for a replacement tooth. Dental implants can be costly, and this is where insurance coverage becomes relevant.

Do Dental Insurance Plans Cover Implants?

Not all dental insurance plans cover implants. It's essential to review your specific policy to determine the extent of coverage for dental implants. Some plans may cover a portion of the procedure, while others may label implants as a cosmetic procedure, thus not eligible for coverage.

Coverage Details

If your plan does provide coverage for implants, it may not cover the entire cost. Most plans will cover a percentage of the implant procedure, which may include:

- Consultation and x-rays

- Surgical placement of the implant

- Abutment and crown placement

Exclusions and Limitations

Even if a plan covers implants, there may be exclusions or limitations. Some common restrictions include:

- Waiting periods before coverage kicks in

- Annual maximums that cap how much the insurance will pay

- Coverage for only certain types of implants

- Requirement of prior authorization before procedures

Factors to Consider When Choosing a Plan with Implant Coverage

When selecting a dental insurance plan, especially one that includes implant coverage, consider the following factors:

1. Network of Dentists

Ensure that your preferred dentist or oral surgeon is in the insurance network. If not, you might face higher out-of-pocket costs.

2. Premiums and Deductibles

Understand the monthly premium and any deductibles required before coverage starts. Plans with lower premiums might have higher deductibles and out-of-pocket costs.

3. Coverage Limits

Be aware of how much the plan covers for implants and if there are annual caps on coverage. This will impact your overall costs significantly.

4. Waiting Periods

Some plans may have waiting periods before you can claim benefits for dental implants. This is crucial to consider if you need immediate treatment.

5. Co-Payments and Co-Insurance

Check the co-payment and co-insurance amounts. Co-payments are fixed amounts you pay for specific services, while co-insurance is the percentage of costs you pay after reaching your deductible.

How to Maximize Your Dental Insurance Benefits

To ensure you’re getting the most out of your dental insurance, consider the following strategies:

1. Schedule Regular Check-Ups

Most insurance plans cover preventive care at 100%. Regular check-ups can help identify issues early, potentially saving you from more extensive and expensive treatments later.

2. Understand Your Benefits

Thoroughly read your policy documents and understand what is covered and what isn’t. This knowledge can help you avoid unexpected expenses.

3. Utilize In-Network Providers

Using in-network providers can significantly reduce your out-of-pocket costs. Ensure you verify that your dentist is part of your insurance network before scheduling appointments.

4. Plan Major Treatments Wisely

If you need a major procedure, consider timing it with the start of a new calendar year. This can allow you to take advantage of your annual maximum coverage.

Additional Options for Dental Implant Coverage

If your dental insurance does not adequately cover implants, consider these additional options:

1. Dental Discount Plans

These plans are not insurance but provide discounts on dental services for a monthly fee. They can be a cost-effective alternative for those needing implants.

2. Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs)

Utilizing an FSA or HSA can help you save money on dental expenses. Contributions to these accounts are made pre-tax, allowing you to use the funds for eligible expenses, including dental implants.

3. Payment Plans

Many dental offices offer payment plans for expensive procedures. This can help spread the cost of implants over time, making it more manageable.

4. Financing Options

Some practices partner with financing companies that offer loans specifically for dental work. It’s worth exploring these options if upfront costs are prohibitive.

Conclusion

Understanding dental insurance, especially regarding implant coverage, is crucial for making informed decisions about your dental health. By familiarizing yourself with the various types of dental plans, coverage specifics, and strategies to maximize your benefits, you can navigate the complexities of dental insurance with confidence. Always remember to review your plan details, ask questions, and explore additional options if needed. With the right approach, you can ensure that you receive the necessary dental care while managing your costs effectively.

Explore

Car Insurance: What You Need to Know and How to Choose the Right Coverage

Everything You Need to Know About Window Replacement: Costs, Options, and Top Installers

Best Health Insurance Plans for Comprehensive Coverage

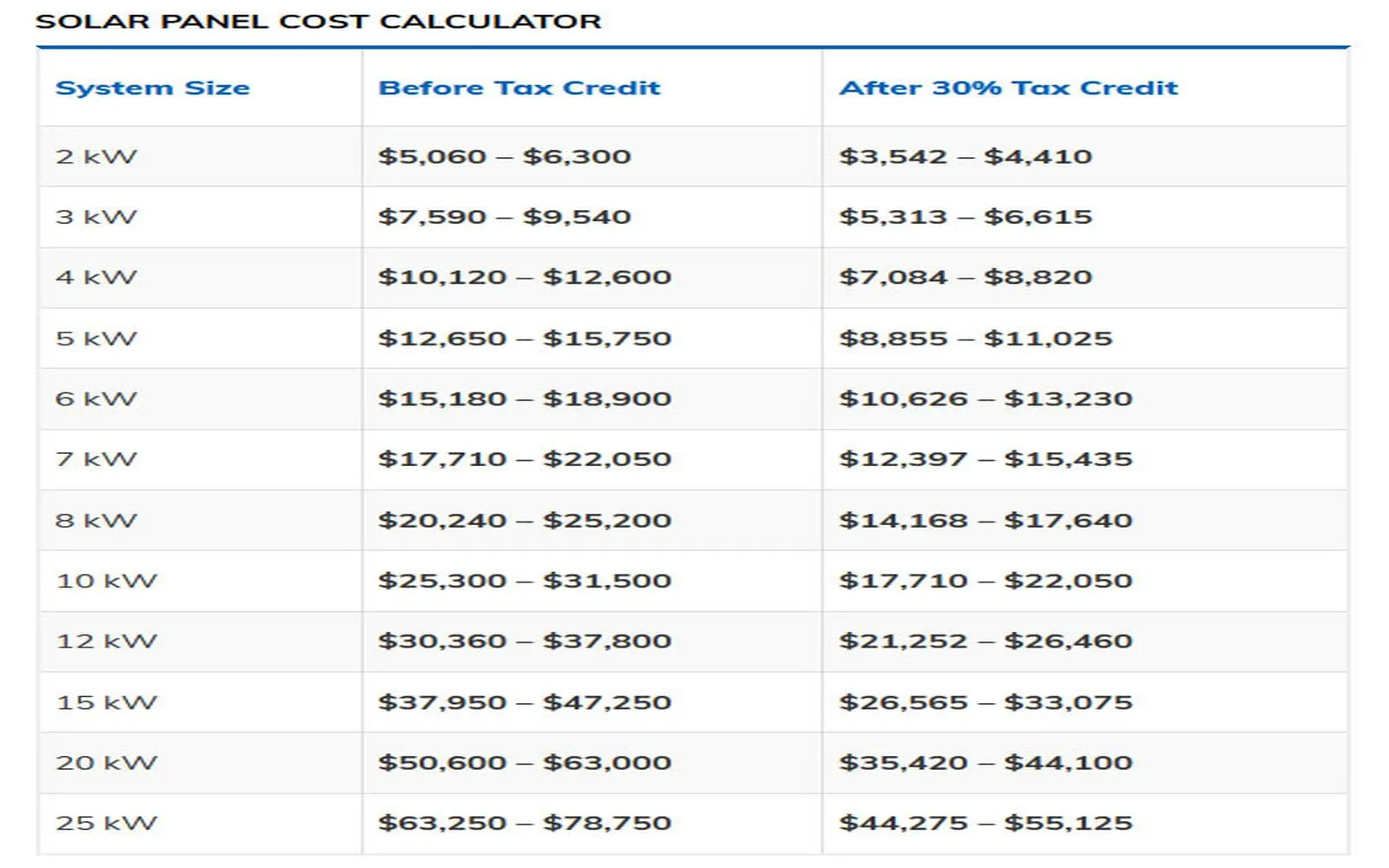

Solar Panel Installation Costs: What Homeowners Need to Know

Comprehensive Guide to Humana Health Coverage Plans: Benefits, Options, and Enrollment Tips

Finding Affordable Dental Implants: A Comprehensive Guide

Compare AARP Insurance Quotes for Affordable Coverage

Humana Health Benefits: Your Guide to Coverage & Wellness