Comprehensive Guide to Humana Health Coverage Plans: Benefits, Options, and Enrollment Tips

Introduction to Humana Health Coverage Plans

Humana is one of the largest health insurance providers in the United States, offering a wide range of health coverage plans designed to meet the diverse needs of individuals, families, and employers. With a commitment to making healthcare more accessible and manageable, Humana provides various options, including Medicare, Medicaid, individual and family plans, and employer-sponsored insurance. This comprehensive guide will explore the benefits, options, and enrollment tips associated with Humana health coverage plans, helping you make an informed decision about your healthcare needs.

Understanding Humana's Health Coverage Options

Humana offers several types of health coverage plans tailored to different demographics and healthcare needs. The primary categories include:

1. Individual and Family Health Plans

These plans are designed for individuals and families who do not have employer-sponsored insurance. Humana offers various options under this category, including:

- Health Maintenance Organization (HMO) Plans: Require members to choose a primary care physician (PCP) and get referrals to see specialists. These plans typically have lower premiums and out-of-pocket costs.

- Preferred Provider Organization (PPO) Plans: Allow members to see any healthcare provider without a referral. While these plans offer more flexibility, they generally come with higher premiums.

- Exclusive Provider Organization (EPO) Plans: Similar to PPO plans but do not cover any out-of-network care except in emergencies. They have lower premiums than PPOs.

- High Deductible Health Plans (HDHP): These plans have higher deductibles and lower premiums, making them suitable for those who want to save on monthly costs and are generally healthy.

2. Medicare Plans

Humana provides various Medicare options to cater to seniors and individuals eligible for Medicare due to disability:

- Medicare Advantage Plans: These plans, also known as Medicare Part C, combine Medicare Part A (hospital insurance) and Part B (medical insurance) into one plan and may include additional benefits like vision and dental coverage.

- Medicare Prescription Drug Plans (Part D): Humana offers standalone prescription drug plans that can be added to Original Medicare to help cover the costs of medications.

- Medigap Plans: Also known as Medicare Supplement Insurance, these plans help cover out-of-pocket costs not included in Original Medicare, such as copayments and deductibles.

3. Employer-Sponsored Insurance

Humana partners with various employers to provide group health insurance plans that often include additional benefits such as wellness programs, telehealth services, and more. These plans can vary based on the employer's offerings and the specific needs of their employees.

Benefits of Choosing Humana Health Coverage Plans

When considering health coverage options, several benefits set Humana apart from other providers:

1. Extensive Provider Network

Humana boasts a large network of healthcare providers, ensuring that members have access to quality care. This extensive network allows for flexibility in choosing healthcare professionals and facilities.

2. Additional Benefits

Many Humana plans come with additional benefits beyond standard coverage, including:

- Vision and dental coverage

- Wellness programs and discounts on gym memberships

- Telehealth services for convenient access to healthcare

- 24/7 nurse hotline for immediate medical advice

3. Personalized Care Support

Humana offers personalized care support, including health coaching and care management services. This support helps members navigate their healthcare journey and manage chronic conditions effectively.

4. Health and Wellness Programs

Humana places a strong emphasis on preventive care and wellness. Their programs often include screenings, vaccinations, and educational resources to help members maintain a healthy lifestyle.

Enrollment Process for Humana Health Coverage Plans

The enrollment process for Humana health coverage plans varies depending on the type of plan you are applying for. Here are some key steps to consider:

1. Determine Eligibility

Before enrolling, it’s essential to determine your eligibility for specific plans. For example, Medicare plans have specific enrollment periods based on age or disability status. Individual and family plans usually allow enrollment during the Open Enrollment Period.

2. Explore Plan Options

Humana provides an online tool to help you compare different health coverage plans. You can assess factors such as premiums, deductibles, copayments, and coverage options to find the best fit for your needs.

3. Gather Necessary Information

When enrolling, you’ll need to provide personal information such as:

- Your Social Security number

- Your income information (for subsidy eligibility)

- Details about any current health coverage

- Preferred doctors and hospitals

4. Complete the Application

You can apply for Humana health coverage plans online, over the phone, or in-person at a Humana office or partner location. Ensure that you provide accurate information to avoid delays in the enrollment process.

5. Review the Plan Details

Once you’ve submitted your application, Humana will provide you with plan details, including coverage specifics, costs, and member ID cards. Review this information carefully to ensure it meets your expectations.

6. Enrollment Periods

Be aware of the enrollment periods for the specific plans:

- Open Enrollment Period: Generally occurs once a year (usually in the fall) for individual and family plans.

- Special Enrollment Period: May be available if you experience a qualifying life event (e.g., moving, losing other coverage).

- Medicare Enrollment Periods: Include Initial Enrollment Period (when you first become eligible), Annual Enrollment Period (October 15 – December 7), and Open Enrollment Period for Medicare Advantage (January 1 – March 31).

Tips for Choosing the Right Humana Health Coverage Plan

Selecting the right health coverage plan can be overwhelming. Here are some tips to help you make the best choice:

1. Assess Your Healthcare Needs

Consider your current health status, frequency of doctor visits, and any medications you take. Understanding your healthcare needs will help you choose a plan that provides adequate coverage.

2. Compare Costs

Evaluate the total cost of each plan, including premiums, deductibles, copayments, and out-of-pocket maximums. A lower premium may not always mean better value if the out-of-pocket costs are high.

3. Check the Provider Network

Ensure that your preferred doctors and hospitals are included in the Humana network. Out-of-network care can be significantly more expensive, so verifying this beforehand is crucial.

4. Review Prescription Drug Coverage

If you take medications, review the plan's formulary to see if your prescriptions are covered and at what cost. This will help you avoid unexpected expenses.

5. Consider Additional Benefits

Look for additional services that may be important to you, such as telehealth access, wellness programs, and preventive care. These benefits can enhance your overall healthcare experience.

6. Seek Professional Guidance

If you are unsure about which plan to choose, consider reaching out to a licensed insurance agent or broker who can provide personalized assistance and answer any questions you may have.

Conclusion

Humana health coverage plans offer a variety of options to meet the diverse needs of individuals, families, and employers. By understanding the different types of plans available, their benefits, and the enrollment process, you can make an informed decision about your healthcare coverage. Remember to assess your healthcare needs, compare costs, and take advantage of additional benefits to ensure you choose the best plan for your circumstances. With the right plan, you can gain access to quality care and support for your health and wellness journey.

Explore

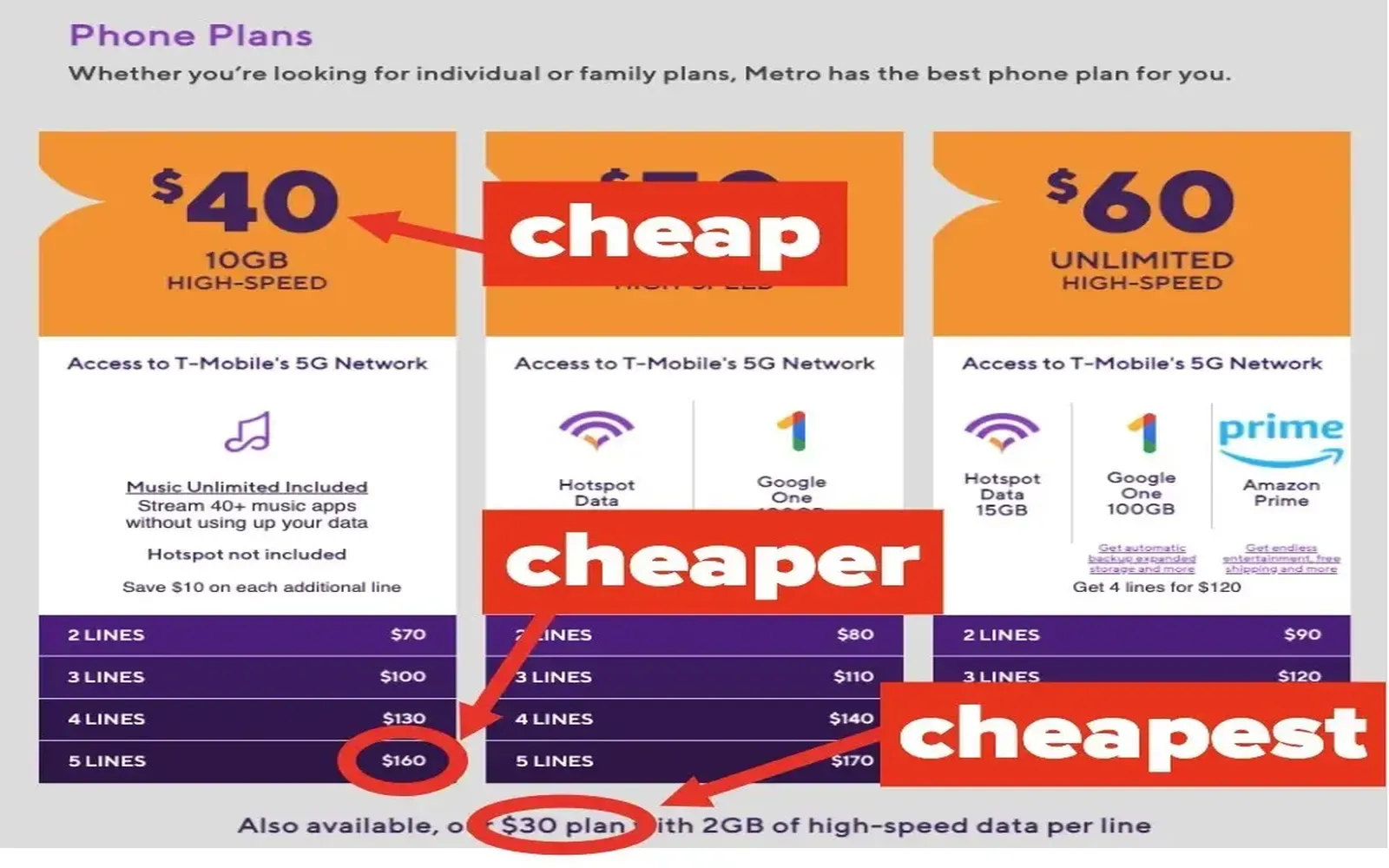

Top 10 Best Cell Phone Plans of 2023: Affordable Options for Every Budget

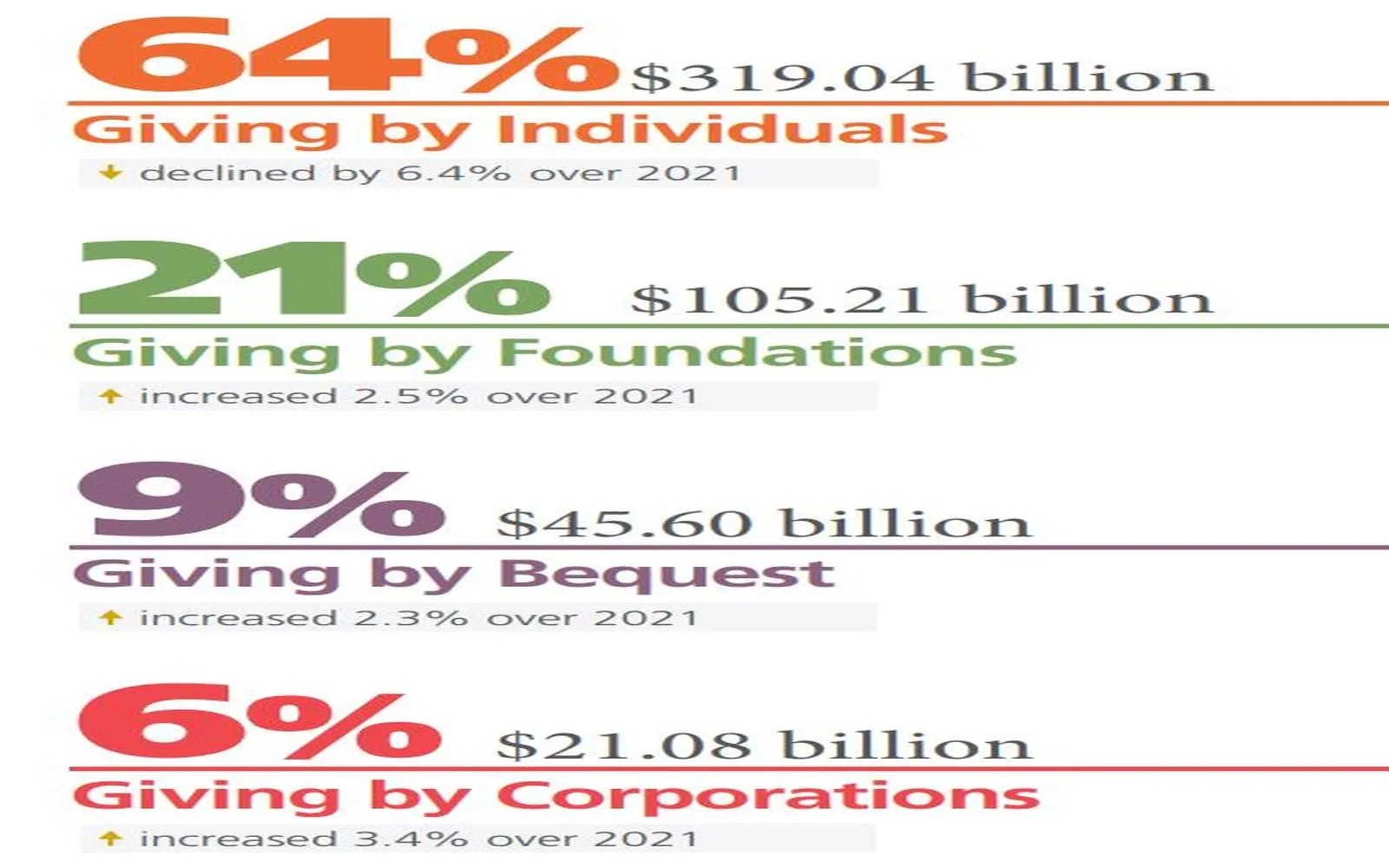

Ultimate Guide: How to Donate Effectively in the USA - Tips and Resources

Unlock Exclusive Business Class Flight Discounts: Tips for Affordable Luxury Travel

Top Affordable Pet Insurance Plans: Protect Your Furry Friends Without Breaking the Bank!

Get Instant Travel Insurance Quotes: Compare Plans & Save Today!

Top Personal Loan Platforms: Your Ultimate Guide to Finding the Best Rates and Terms

Top Accredited Online Business Schools: Your Guide to Quality Education and Career Advancement

Top ERP Systems for Small Businesses: Streamline Your Operations and Boost Growth