Humana Medicare Plans: Compare Coverage & Benefits

Introduction to Humana Medicare Plans

As one of the leading health insurance providers in the United States, Humana offers a variety of Medicare plans designed to meet the diverse needs of seniors and eligible individuals. With a focus on comprehensive coverage, accessibility, and customer support, Humana's Medicare plans provide options that cater to different healthcare needs and preferences. This article will delve into the types of Humana Medicare plans, compare their coverage and benefits, and help you understand how to choose the best plan for your individual situation.

Understanding Medicare

Medicare is a federal health insurance program primarily for individuals aged 65 and older, though younger individuals with specific disabilities or conditions can also qualify. Medicare is divided into several parts, each covering different aspects of healthcare:

Overview of Humana Medicare Plans

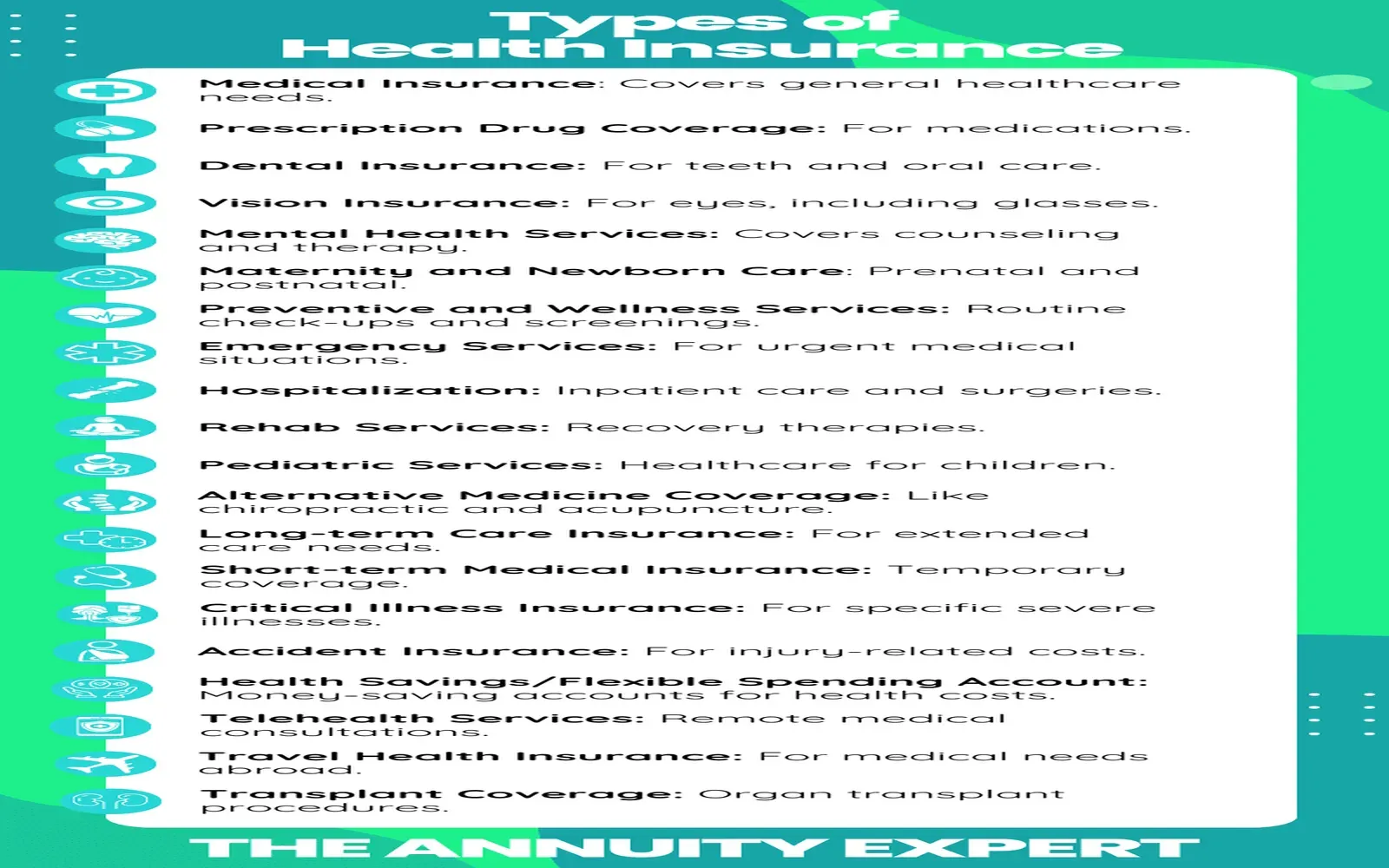

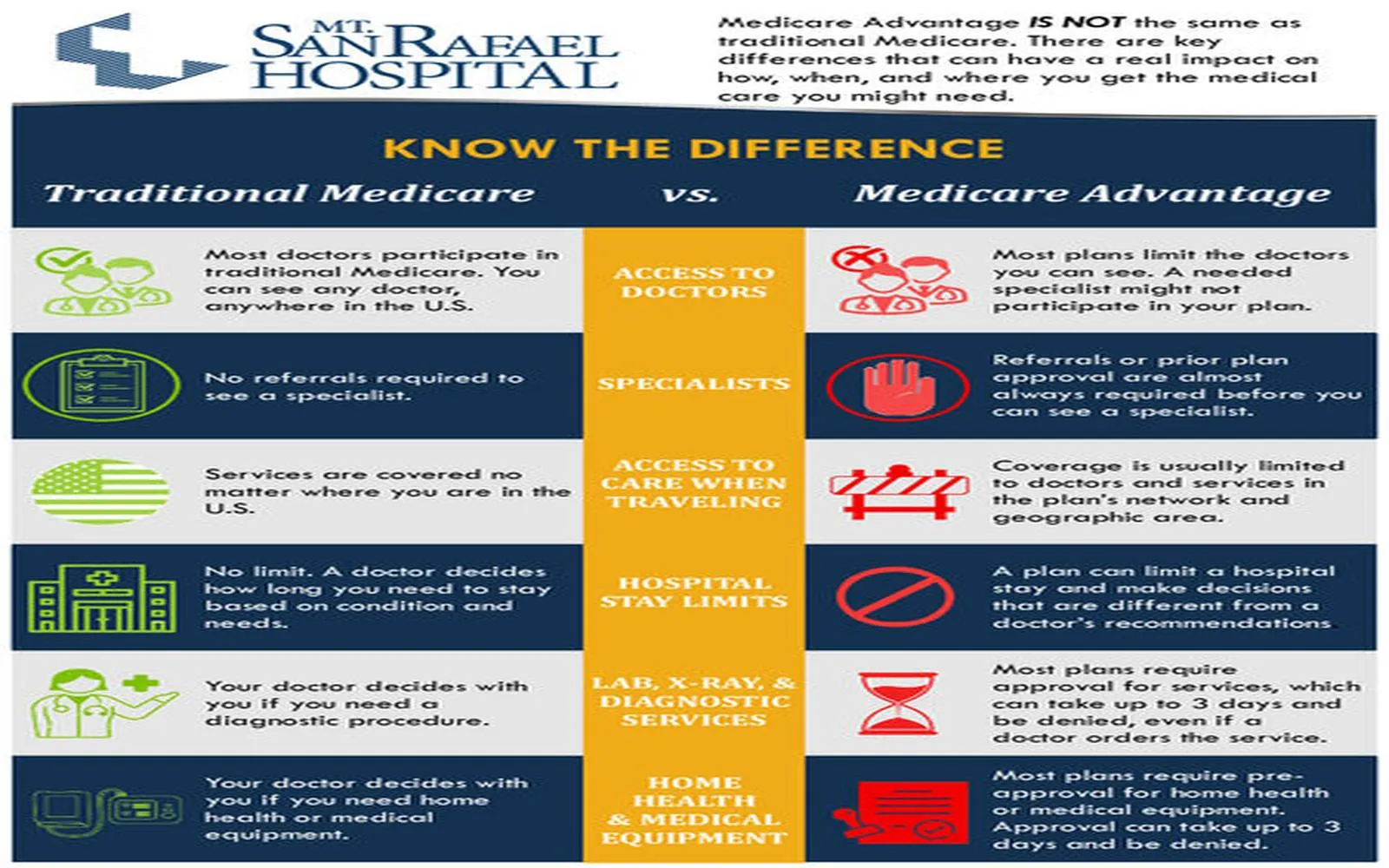

Humana offers several types of Medicare plans, including Medicare Advantage (Part C) plans and Medicare prescription drug (Part D) plans. The specifics of each plan can vary by location and individual needs, but generally, they can be categorized as follows:

1. Humana Medicare Advantage Plans

Humana's Medicare Advantage plans are a popular choice for many seniors. These plans combine the benefits of Medicare Part A and Part B, often with additional perks like vision, dental, and wellness programs. Some key features include:

2. Humana Medicare Prescription Drug Plans (Part D)

For those who need prescription drug coverage, Humana offers standalone Medicare Part D plans. These plans can be added to Original Medicare (Parts A and B) or combined with a Medicare Advantage plan that does not include drug coverage. Key features include:

Comparing Coverage and Benefits

When comparing Humana Medicare plans, it’s essential to evaluate the coverage and benefits each plan offers. Here are the main factors to consider:

1. Premiums and Out-of-Pocket Costs

One of the most significant aspects of any health insurance plan is the cost. Humana’s plans vary in their monthly premiums, deductibles, copayments, and coinsurance. It's crucial to assess your budget and health needs:

2. Network of Providers

The network of healthcare providers available through your Humana plan can significantly influence your healthcare experience. Here’s what to consider:

3. Prescription Drug Coverage

If you take medications regularly, understanding the prescription drug coverage is vital:

4. Additional Benefits

Humana’s Medicare Advantage plans often come with added benefits that can enhance your overall healthcare experience. These may include:

Enrollment in Humana Medicare Plans

Enrollment in Humana Medicare plans typically occurs during specific enrollment periods. Understanding these can help ensure you don’t miss out on your desired coverage:

How to Choose the Right Humana Medicare Plan

With multiple options available, selecting the right Humana Medicare plan can feel overwhelming. Here are some steps to simplify the decision-making process:

1. Assess Your Healthcare Needs

Begin by evaluating your health status, including any chronic conditions, medications, and regular healthcare services you require. Consider the following:

2. Compare Available Plans

Using the information gathered, compare the available Humana plans in your area. Look closely at premiums, deductibles, copayments, and out-of-pocket limits. Use Humana’s online tools or speak with a licensed insurance agent for assistance in comparing plans.

3. Review Provider Networks

Ensure your preferred healthcare providers and specialists are included in the plan’s network. If you have ongoing treatments or need referrals, this can significantly impact your experience.

4. Consider Additional Benefits

Don’t overlook the extra benefits that come with Medicare Advantage plans. These can enhance your overall health and wellness experience, providing services that go beyond basic medical coverage.

5. Contact Humana for Support

If you have questions or need help understanding the details of different plans, don’t hesitate to contact Humana directly. Their customer service representatives can provide clarity on coverage options and help you find the best plan for your needs.

Conclusion

Humana Medicare plans offer a wide range of options for seniors and eligible individuals seeking comprehensive healthcare coverage. By understanding the differences between the various plans, evaluating coverage and benefits, and considering your unique healthcare needs, you can make an informed decision that aligns with your lifestyle and budget. Whether you choose a Medicare Advantage plan with additional benefits or a standalone Part D plan for prescription coverage, Humana aims to provide quality care and support for its members.

Explore

Comprehensive Guide to Humana Health Coverage Plans: Benefits, Options, and Enrollment Tips

Humana Health Benefits: Your Guide to Coverage & Wellness

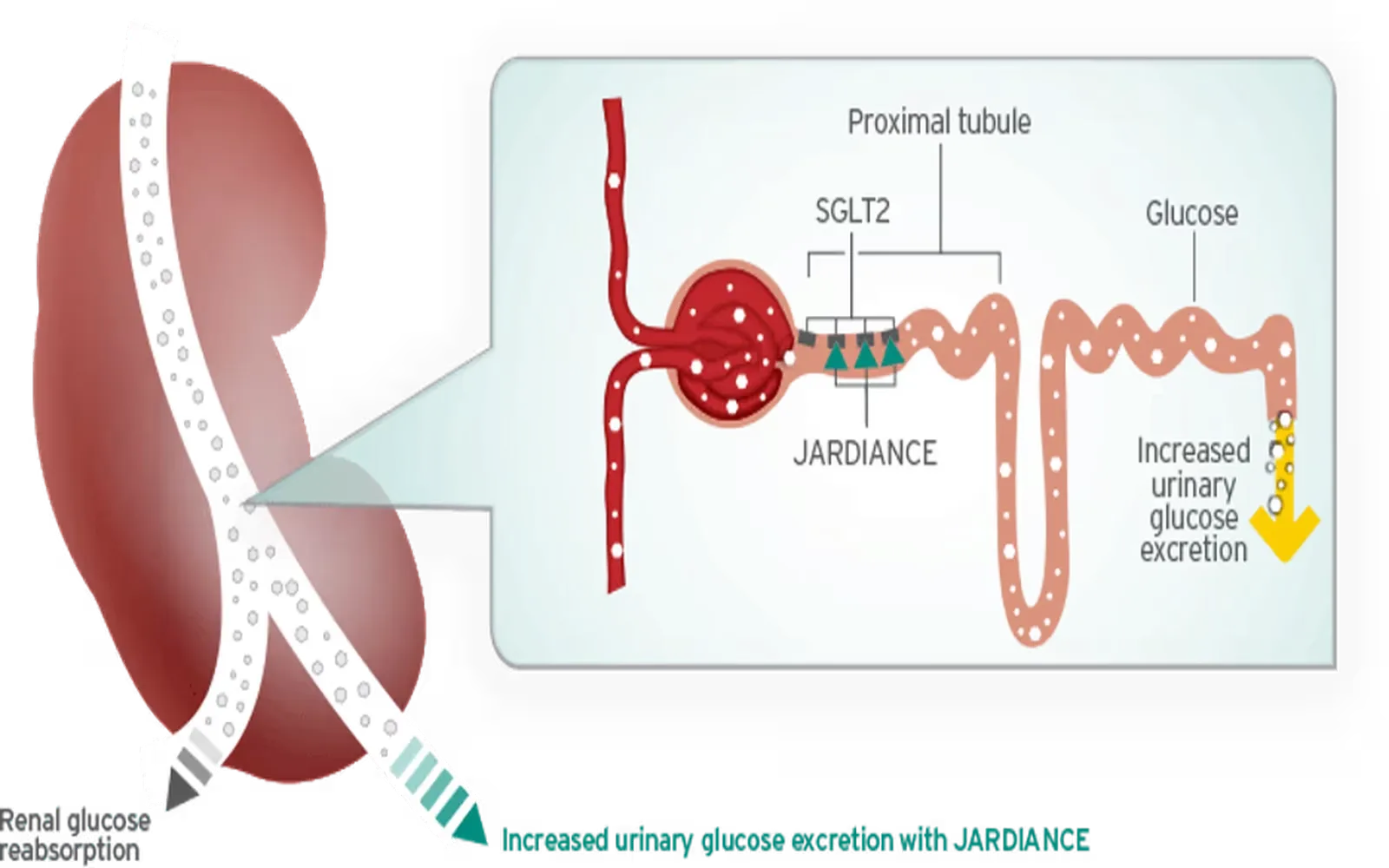

Jardiance & Medicare: Top Coverage Plans for Diabetes Care

Private Health Insurance: Compare Plans, Costs & Benefits

Compare AARP Insurance Quotes for Affordable Coverage

Best Personal Loan Offers: Compare Rates & Benefits

Get Instant Travel Insurance Quotes: Compare Plans & Save Today!

How to Enroll in Medicare Advantage: Step-by-Step Guide