Pennie Insurance Explained: Your Guide to Pennsylvania’s Health Plans

Introduction to Pennie Insurance

Pennie Insurance is Pennsylvania's official health insurance marketplace, designed to help residents find affordable health coverage. Established under the Affordable Care Act (ACA), Pennie serves as a one-stop shop where individuals, families, and small businesses can explore their health insurance options, compare plans, and enroll in coverage that meets their needs. This guide aims to demystify the various aspects of Pennie Insurance, helping you navigate the complexities of health insurance in Pennsylvania.

Understanding Health Insurance Basics

Before diving into the specifics of Pennie Insurance, it's crucial to understand some foundational concepts of health insurance. Health insurance is a contract between an individual and an insurer that provides financial support for medical expenses. Premiums, deductibles, copayments, and out-of-pocket maximums are some of the key terms you should be familiar with:

What is Pennie Insurance?

Pennie Insurance is Pennsylvania's state-based health insurance marketplace, which allows residents to compare and enroll in health plans that comply with the ACA. The platform was launched to improve access to affordable health insurance and streamline the enrollment process. Through Pennie, individuals and families can access various health insurance options, including Medicaid, Children's Health Insurance Program (CHIP), and private health plans.

Eligibility for Pennie Insurance

To apply for coverage through Pennie, you must meet specific eligibility criteria. Generally, you are eligible if you:

It's essential to note that income also plays a critical role in determining eligibility for financial assistance. Depending on your household size and income, you may qualify for tax credits or subsidies to help lower the cost of your health insurance premiums.

The Enrollment Process

The enrollment process for Pennie Insurance is designed to be user-friendly, allowing individuals to navigate their options easily. Here’s a step-by-step breakdown of how to enroll:

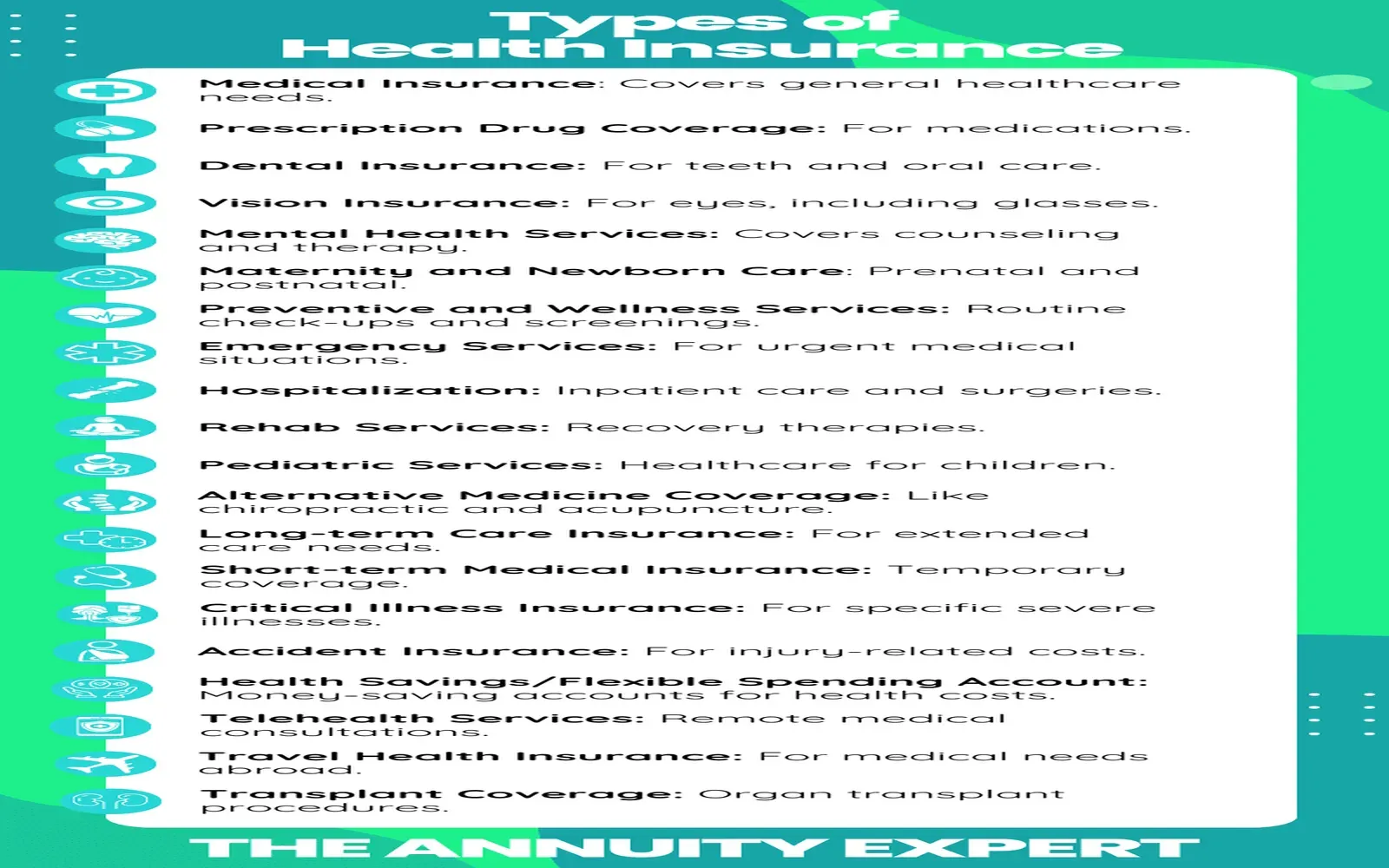

Types of Health Plans Available

Pennie offers a range of health insurance plans that cater to different needs and budgets. Understanding the types of plans available can help you make informed decisions:

Financial Assistance and Subsidies

One of the key benefits of enrolling through Pennie is the availability of financial assistance. Depending on your income and household size, you may qualify for:

To determine your eligibility for financial assistance, it is essential to accurately report your household income during the application process. The Pennie website includes a calculator that can help estimate your potential savings based on your income and family size.

Special Enrollment Periods

While open enrollment is the primary time for individuals to enroll in health insurance, certain life events can trigger a Special Enrollment Period (SEP). These events include:

If you experience any of these changes, you may have a limited time to enroll in a health plan through Pennie. It’s crucial to take action promptly to ensure you have coverage when you need it most.

Understanding Your Health Insurance Plan

Once you have enrolled in a health plan through Pennie, it's essential to familiarize yourself with your coverage details. Here are some key aspects to understand:

Renewing Your Coverage

Health insurance coverage through Pennie typically lasts for one year. However, you’ll need to renew your coverage annually during the open enrollment period. It’s a good opportunity to review your current plan, assess your healthcare needs, and make changes if necessary. If your income or household situation changes, it may also affect your eligibility for financial assistance.

Appealing a Coverage Decision

If your health plan denies coverage for a service or treatment, you have the right to appeal the decision. Each insurance company has its own process for handling appeals, which is usually outlined in your plan documents. Here are some general steps to follow:

Resources and Support

Pennie offers various resources and support options to help you navigate your health insurance journey. These include:

Conclusion

Pennie Insurance is a vital resource for Pennsylvania residents seeking affordable health coverage. By understanding the enrollment process, available plans, financial assistance options, and other essential aspects, you can make informed decisions about your healthcare. Whether you are enrolling for the first time or renewing your coverage, Pennie is here to help you navigate the complexities of health insurance and ensure you have the protection you need for your health and well-being.

Explore

Best Health Insurance Plans for Comprehensive Coverage

Private Health Insurance: Compare Plans, Costs & Benefits

Comprehensive Guide to Humana Health Coverage Plans: Benefits, Options, and Enrollment Tips

Understanding Health Insurance: Your Complete Guide

Top Affordable Pet Insurance Plans: Protect Your Furry Friends Without Breaking the Bank!

Get Instant Travel Insurance Quotes: Compare Plans & Save Today!

Navig Health Insurance for Small Businesses

Discover the Best Cell Phone Plans: Your Guide to Affordable and Flexible Options