Get Instant Travel Insurance Quotes: Compare Plans & Save Today!

Understanding Travel Insurance

Travel insurance is an essential safeguard for any traveler. It provides coverage for unexpected events that can occur while traveling, such as trip cancellations, medical emergencies, lost luggage, and other unforeseen incidents. The peace of mind that comes with having travel insurance cannot be understated, especially when exploring new destinations or embarking on long journeys. However, navigating the various options available can be overwhelming. This is where getting instant travel insurance quotes comes into play.

Why You Need Travel Insurance

Traveling can be unpredictable. Whether you’re planning a short domestic getaway or a long international adventure, there are numerous risks involved. Here are some reasons why obtaining travel insurance is crucial:

- Trip Cancellation: If unforeseen circumstances arise, such as illness or a family emergency, travel insurance can reimburse you for non-refundable expenses.

- Medical Emergencies: Healthcare can be expensive in foreign countries. Travel insurance can cover medical expenses, ensuring you receive necessary care without incurring significant out-of-pocket costs.

- Lost or Stolen Belongings: Insurance can help recover costs associated with lost luggage or stolen personal items, providing support when you need it most.

- Travel Delays: Whether due to weather or mechanical issues, travel delays can lead to additional expenses. Insurance can help cover those costs.

- Peace of Mind: Knowing you have coverage can significantly reduce stress while traveling, allowing you to focus on enjoying your trip.

How to Get Instant Travel Insurance Quotes

Obtaining instant travel insurance quotes has never been easier. With just a few clicks, you can compare different plans and find the best coverage for your needs. Here’s a step-by-step guide on how to get started:

Step 1: Determine Your Coverage Needs

Before you start comparing quotes, take some time to assess what type of coverage you require. Consider the following factors:

- Your destination and duration of travel

- Your age and health status

- Any specific activities you plan to engage in, such as hiking or skiing

- Existing health insurance coverage and whether it applies abroad

Step 2: Use Online Comparison Tools

There are numerous websites dedicated to helping travelers find the best travel insurance plans. These platforms allow you to enter your travel details and receive instant quotes from various insurers. Look for reputable comparison sites. Some popular options include:

- InsureMyTrip

- Squaremouth

- TravelInsurance.com

Step 3: Fill Out Your Information

When using an online comparison tool, you’ll typically need to provide information such as:

- Your travel dates

- Your destination

- The number of travelers

- Your age and health information

Once you submit this information, the comparison tool will generate a list of available travel insurance plans along with their respective quotes.

Step 4: Compare Plans Side by Side

Once you have a list of quotes, it’s time to dive into the details. Look beyond just the price; consider the coverage limits, deductibles, exclusions, and any additional benefits offered. Key factors to compare include:

- Medical coverage limits

- Trip cancellation coverage

- Emergency evacuation and repatriation

- Coverage for pre-existing conditions

- Adventure sports coverage

Step 5: Read Reviews and Ratings

Before making a decision, take some time to read customer reviews and ratings for the insurance providers you are considering. Websites like Trustpilot and Consumer Affairs can provide valuable insights into the customer experience and claims process.

Step 6: Purchase Your Plan

After thoroughly comparing your options, you can purchase your chosen travel insurance plan directly through the comparison site or the insurer’s website. Make sure to review the policy documents carefully before finalizing your purchase.

Types of Travel Insurance Plans

Travel insurance plans can vary significantly in terms of coverage and cost. Here are some common types of travel insurance:

1. Single Trip Insurance

This type of policy covers you for a specific trip. It’s ideal for occasional travelers who do not travel frequently. Single trip insurance generally provides comprehensive coverage for the duration of your trip.

2. Multi-Trip Insurance

For frequent travelers, multi-trip insurance offers coverage for multiple trips over a specified period, usually one year. This type of plan is often more cost-effective for those who travel regularly.

3. Annual Travel Insurance

Similar to multi-trip insurance, annual travel insurance covers all trips taken within a year. It’s a great option for business travelers or families who take multiple vacations throughout the year.

4. Backpacker Insurance

Backpacker insurance is designed for long-term travelers and those venturing into remote locations. This type of policy often includes coverage for a wide range of activities and can be customized based on the traveler’s itinerary.

5. Specialized Insurance

Some insurance providers offer specialized plans for specific activities, such as adventure sports, cruises, or senior travelers. If you have unique needs, look for a plan that caters to your specific situation.

Common Exclusions in Travel Insurance

- Pre-existing medical conditions

- Incidents occurring while under the influence of drugs or alcohol

- Travel to destinations with travel advisories

- Changes in plans for personal reasons

- Lost items not reported to authorities

Tips for Saving on Travel Insurance

While travel insurance is a necessary expense, there are ways to save on your policy. Here are some tips to consider:

1. Compare Multiple Quotes

As discussed, using comparison tools to obtain multiple quotes can help you find the best price for the coverage you need. Don’t settle for the first quote you receive.

2. Consider Group Coverage

If you’re traveling with family or friends, look for group coverage options that can provide a discounted rate for multiple travelers.

3. Assess Your Existing Coverage

Before purchasing a new policy, check if your existing health insurance or credit card offers any travel insurance benefits. You may already have some coverage in place that can reduce your needs.

4. Opt for Higher Deductibles

Choosing a higher deductible can lower your premium. Just ensure that you can afford the deductible amount if a claim arises.

5. Look for Discounts

Many insurance providers offer discounts for various reasons, such as being a member of specific organizations or purchasing your policy well in advance. Always inquire about any available discounts.

Conclusion

Travel insurance is an invaluable investment for any traveler. By securing coverage, you can protect yourself against unexpected incidents that may occur during your trip. Obtaining instant travel insurance quotes allows you to compare plans, ensuring you find the right coverage at the best price. With the right travel insurance, you can embark on your adventures with confidence, knowing you have support in case of unforeseen events. Don't wait; compare plans and save today!

Explore

Unbeatable Travel Deals: Save Big with Travelocity's Latest Offers!

Top 10 Effective Hair Loss Solutions: Restore Your Confidence Today!

Top Affordable Pet Insurance Plans: Protect Your Furry Friends Without Breaking the Bank!

Unlock Exclusive Business Class Flight Discounts: Tips for Affordable Luxury Travel

Top Asbestos Lawsuit Attorneys: Get Expert Legal Help for Your Claims

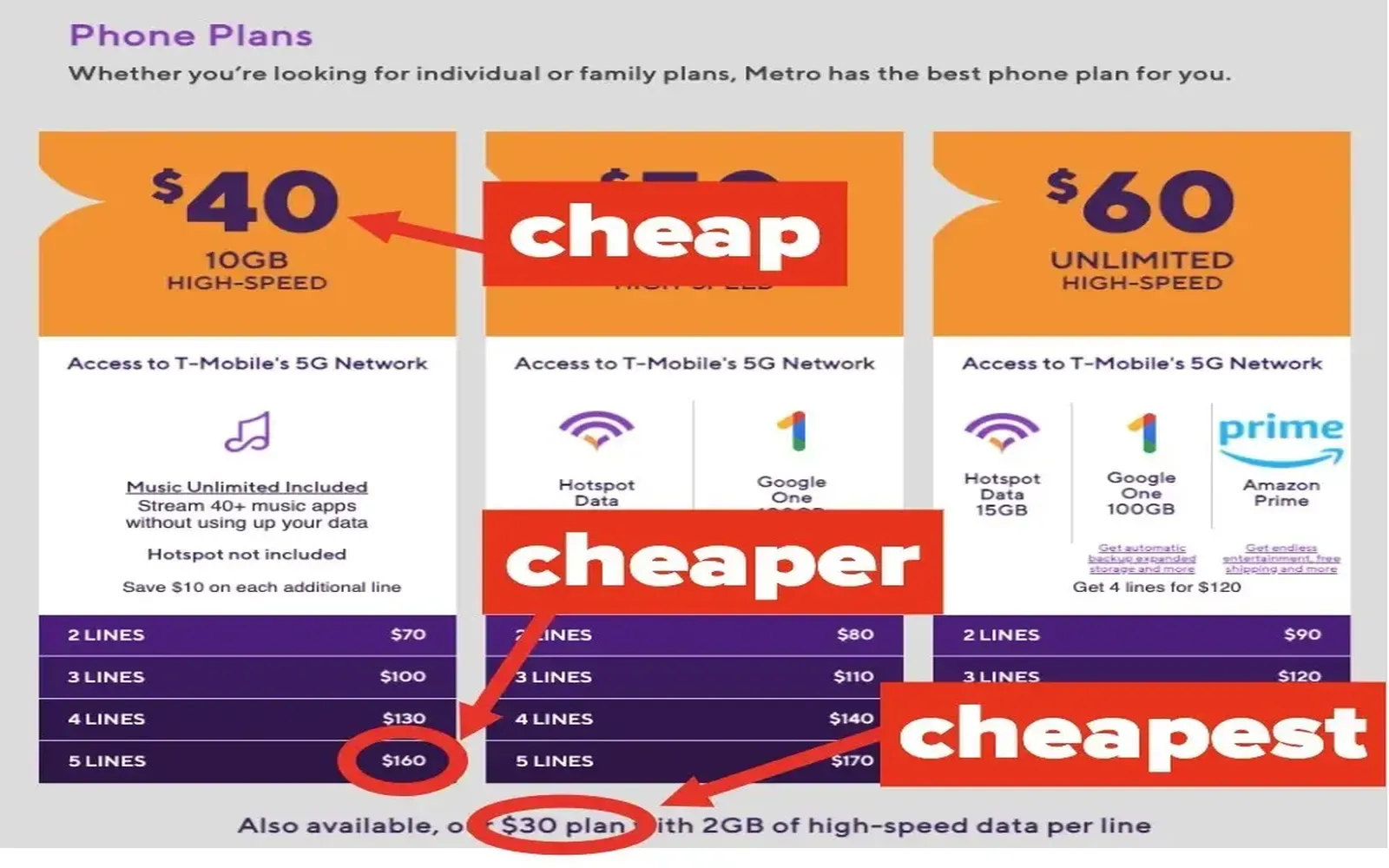

Top 10 Best Cell Phone Plans of 2023: Affordable Options for Every Budget

Comprehensive Guide to Humana Health Coverage Plans: Benefits, Options, and Enrollment Tips

Top Trusted Moving Services: Your Guide to a Stress-Free Relocation