How to Enroll in Medicare Advantage: Step-by-Step Guide

Navigating the world of Medicare can be overwhelming, especially when considering Medicare Advantage plans, which offer an alternative to traditional Medicare. Enrolling in a Medicare Advantage plan is a straightforward process, but it requires attention to detail and understanding of key timelines. This step-by-step guide will walk you through everything you need to know, from determining your eligibility and comparing available plans to completing your enrollment online or via phone. With the right information and preparation, you can secure the coverage that best meets your healthcare needs and budget. Let's get started on your journey to Medicare Advantage!

Understanding Medicare Advantage

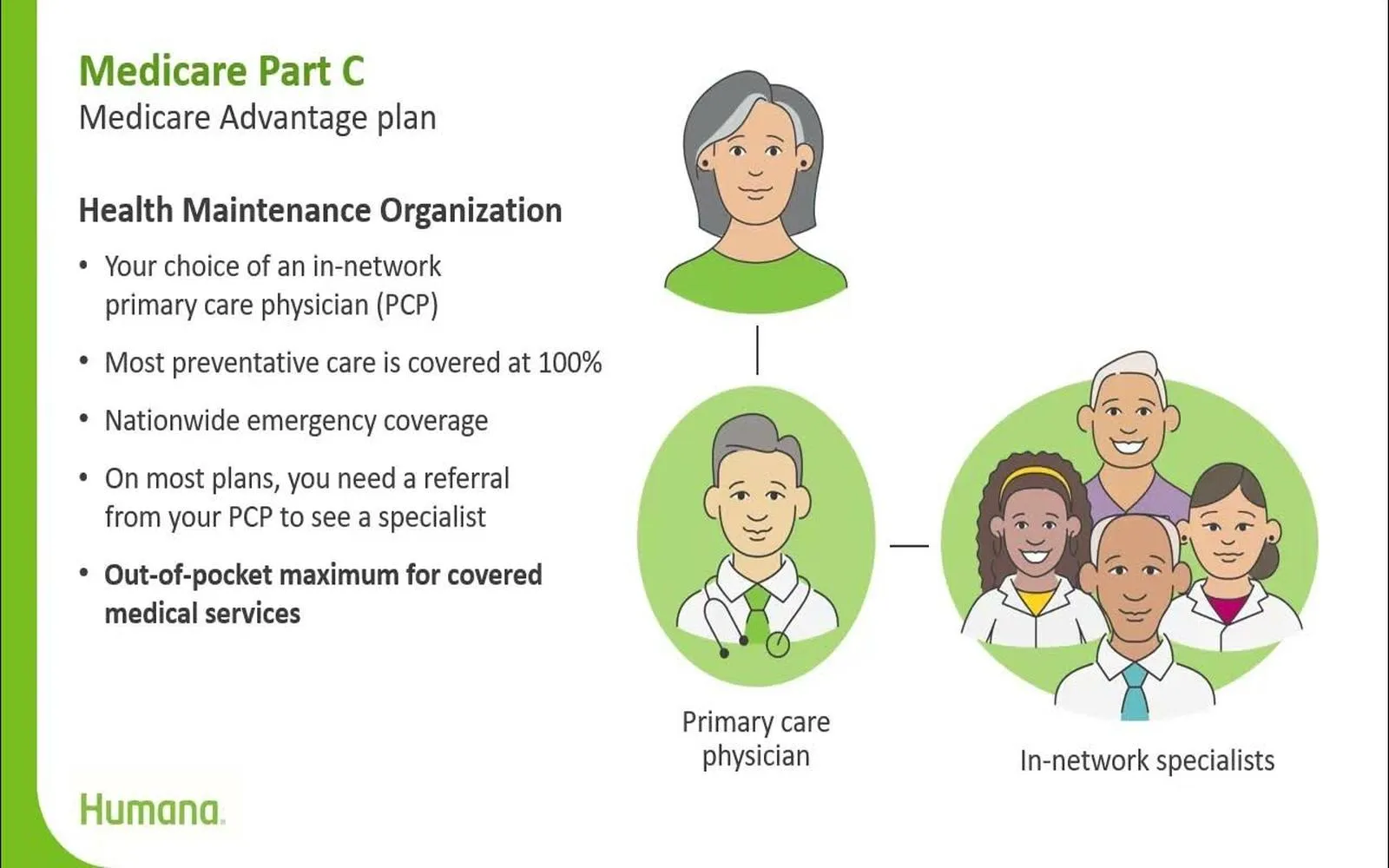

Medicare Advantage, also known as Medicare Part C, is a type of health insurance plan that is offered by private companies approved by Medicare. These plans provide an alternative way to receive your Medicare benefits, combining coverage from both Medicare Part A (hospital insurance) and Part B (medical insurance) into a single plan. Many Medicare Advantage plans also include additional benefits, such as vision, dental, and hearing coverage, which are not typically provided by Original Medicare. This guide will walk you through the steps to enroll in a Medicare Advantage plan.

Step 1: Determine Your Eligibility

The first step in enrolling in a Medicare Advantage plan is to determine your eligibility. Generally, you can enroll in Medicare Advantage if you meet the following criteria:

You are eligible for Medicare Part A and Part B.

You reside in the service area of the Medicare Advantage plan you wish to enroll in.

You are not diagnosed with End-Stage Renal Disease (ESRD), with some exceptions.

Step 2: Understand Enrollment Periods

Enrollment in Medicare Advantage can only occur during specific periods. It is essential to understand these periods to avoid missing the opportunity to enroll:

Initial Enrollment Period (IEP): This is a seven-month period that begins three months before you turn 65, includes the month of your birthday, and ends three months after.

Annual Enrollment Period (AEP): This period runs from October 15 to December 7 each year. During this time, you can enroll in a new Medicare Advantage plan, switch plans, or return to Original Medicare.

Open Enrollment Period (OEP): This period is from January 1 to March 31 each year, allowing those already enrolled in a Medicare Advantage plan to make changes.

Special Enrollment Period (SEP): You may qualify for a SEP if you experience certain life events, such as moving to a new state, losing other health coverage, or certain other specific situations.

Step 3: Research Available Plans

Once you confirm your eligibility and understand the enrollment periods, the next step is to research available Medicare Advantage plans in your area. This research involves:

Using the Medicare Plan Finder: The Medicare website has a tool that allows you to search for Medicare Advantage plans based on your zip code. This tool will provide you with a list of plans available in your area.

Comparing Coverage Options: Review each plan’s coverage details, including medical services, prescription drug coverage, and any additional benefits like dental or vision care.

Checking Costs: Look at monthly premiums, deductibles, copayments, and out-of-pocket maximums for each plan. This will help you determine which plan fits your budget.

Reading Reviews: Online reviews and ratings from current members can provide insight into the quality of the plan, customer service, and overall satisfaction.

Step 4: Review Plan Networks

Medicare Advantage plans often have specific networks of doctors and healthcare providers. It's crucial to check whether your preferred healthcare providers are in-network, as using out-of-network providers can result in higher costs or denial of coverage. Consider the following:

Provider Directory: Each Medicare Advantage plan provides a directory of in-network providers. Make sure to review this list to ensure your doctors are included.

Hospital Affiliations: Check which hospitals are affiliated with the plans you are considering, as this can affect your access to care.

Step 5: Gather Necessary Documentation

Before you begin the enrollment process, gather the necessary documentation. This typically includes:

Your Medicare card (if you already have Medicare Part A and B).

A list of any medications you currently take (to find a plan that covers your prescriptions).

Your Social Security number and date of birth.

Any other personal information that may be required by the plan.

Step 6: Enroll in a Medicare Advantage Plan

Once you’ve chosen a plan, it’s time to enroll. There are several ways to do this:

Online Enrollment: You can often enroll directly through the Medicare Advantage plan’s website. Follow the prompts to complete your enrollment.

Phone Enrollment: You can call the plan directly and enroll over the phone. Be prepared with your documentation and personal information.

In-Person Enrollment: Some insurance agents and brokers can assist you with enrollment. You can also visit your local Social Security office for help.

Using the Medicare Website: You can also enroll through the official Medicare website by following the prompts provided.

Step 7: Confirm Your Enrollment

After you’ve enrolled, it’s essential to confirm that your application has been processed. You can do this by:

Checking Your Mail: You should receive a confirmation letter from your new Medicare Advantage plan outlining your coverage and effective date.

Contacting Customer Service: If you haven’t received confirmation within a few weeks, contact the plan’s customer service to verify your enrollment status.

Step 8: Understand Your Plan Benefits and Responsibilities

Once you are enrolled, familiarize yourself with the benefits and responsibilities of your Medicare Advantage plan. Important aspects to review include:

Coverage Details: Understand what services are covered, including any restrictions or limitations.

Cost Structure: Know your premiums, deductibles, copayments, and out-of-pocket maximums.

Prescription Drug Coverage: Review how your medications are covered and understand the formulary.

Emergency Services: Familiarize yourself with what to do in case of a medical emergency and how to access urgent care services.

Step 9: Keep Track of Your Plan and Annual Review

After enrolling, it’s crucial to keep track of your plan and review it annually. Changes can occur, including changes in coverage, costs, and provider networks. To stay informed:

Annual Notice of Change (ANOC): Your plan will send you an ANOC each fall that outlines any changes for the upcoming year. Review this document carefully.

Reevaluate Your Needs: Each year, consider whether your healthcare needs have changed and whether your current plan continues to meet those needs.

Revisit the Medicare Plan Finder: Use the Medicare Plan Finder tool each year during the AEP to see if there are better options available.

Conclusion

Enrolling in a Medicare Advantage plan can be a straightforward process if you follow the steps outlined in this guide. By understanding your eligibility, researching available plans, and knowing your rights and responsibilities, you can make an informed decision that best fits your healthcare needs. Remember, the key to a successful enrollment is to stay organized and proactive, ensuring that you are well-informed about your options and prepared for any changes in the future.