Top Mortgage Lenders in the U.S.: Compare Rates, Services, and Reviews

Finding the right mortgage lender can make all the difference when buying a home or refinancing an existing loan. The best lenders offer competitive rates, a variety of loan options, and outstanding customer service. Here's a look at some of the top mortgage lenders in the U.S. based on rates, accessibility, and customer satisfaction in 2025.

1. Rocket Mortgage by Quicken Loans

- Why It Stands Out: Known for its fully online application process and fast approvals.

- Best For: Tech-savvy borrowers looking for a streamlined, digital experience.

- Loan Types: Conventional, FHA, VA, Jumbo, refinancing.

- Pros: 24/7 customer support Competitive interest rates Real-time loan tracking tools

2. Wells Fargo

- Why It Stands Out: Offers a broad network of physical branches along with strong online tools.

- Best For: Borrowers who prefer in-person consultations.

- Loan Types: Conventional, FHA, VA, jumbo, and renovation loans.

- Pros: Special programs for first-time homebuyers Down payment assistance available in select states

3. Chase Home Lending

- Why It Stands Out: Combines traditional banking with digital convenience.

- Best For: Existing Chase customers who may qualify for rate discounts.

- Loan Types: Fixed and adjustable-rate, jumbo, FHA, VA.

- Pros: Relationship pricing discounts Strong mobile banking integration

4. Bank of America

- Why It Stands Out: Offers a wide range of loan programs and robust online tools.

- Best For: Low- to moderate-income borrowers using first-time buyer programs.

- Loan Types: Conventional, FHA, VA, home equity, and refinance.

- Pros: Affordable Loan Solution® for qualified buyers Preapproval available online in minutes

5. U.S. Bank

- Why It Stands Out: Offers a good mix of in-person and online services.

- Best For: Borrowers in states where U.S. Bank has a strong presence.

- Loan Types: Conventional, FHA, VA, jumbo, and ARM loans.

- Pros: Transparent rate quotes online Consistent customer service

6. Better Mortgage

- Why It Stands Out: Online-only lender with zero lender fees.

- Best For: Buyers who want to avoid hidden costs and streamline the process.

- Loan Types: Conventional, jumbo, FHA.

- Pros: No origination, underwriting, or processing fees Real-time rate lock

How to Choose the Best Lender

When comparing mortgage lenders, consider:

- Interest Rates and Fees

- Customer Reviews and Support

- Loan Options and Flexibility

- Digital Tools and Application Process

- Eligibility Requirements

Tips Before You Apply

- Check your credit score and improve it if needed.

- Compare quotes from at least 3–5 lenders.

- Understand loan terms, down payments, and closing costs.

- Get preapproved to speed up your home search.

Conclusion

Whether you’re buying your first home, refinancing, or investing in property, the right mortgage lender can simplify the process and save you money. Evaluate your financial goals and loan needs to find a lender that offers the right combination of rates, service, and support.

Explore

Best Personal Loan Offers: Compare Rates & Benefits

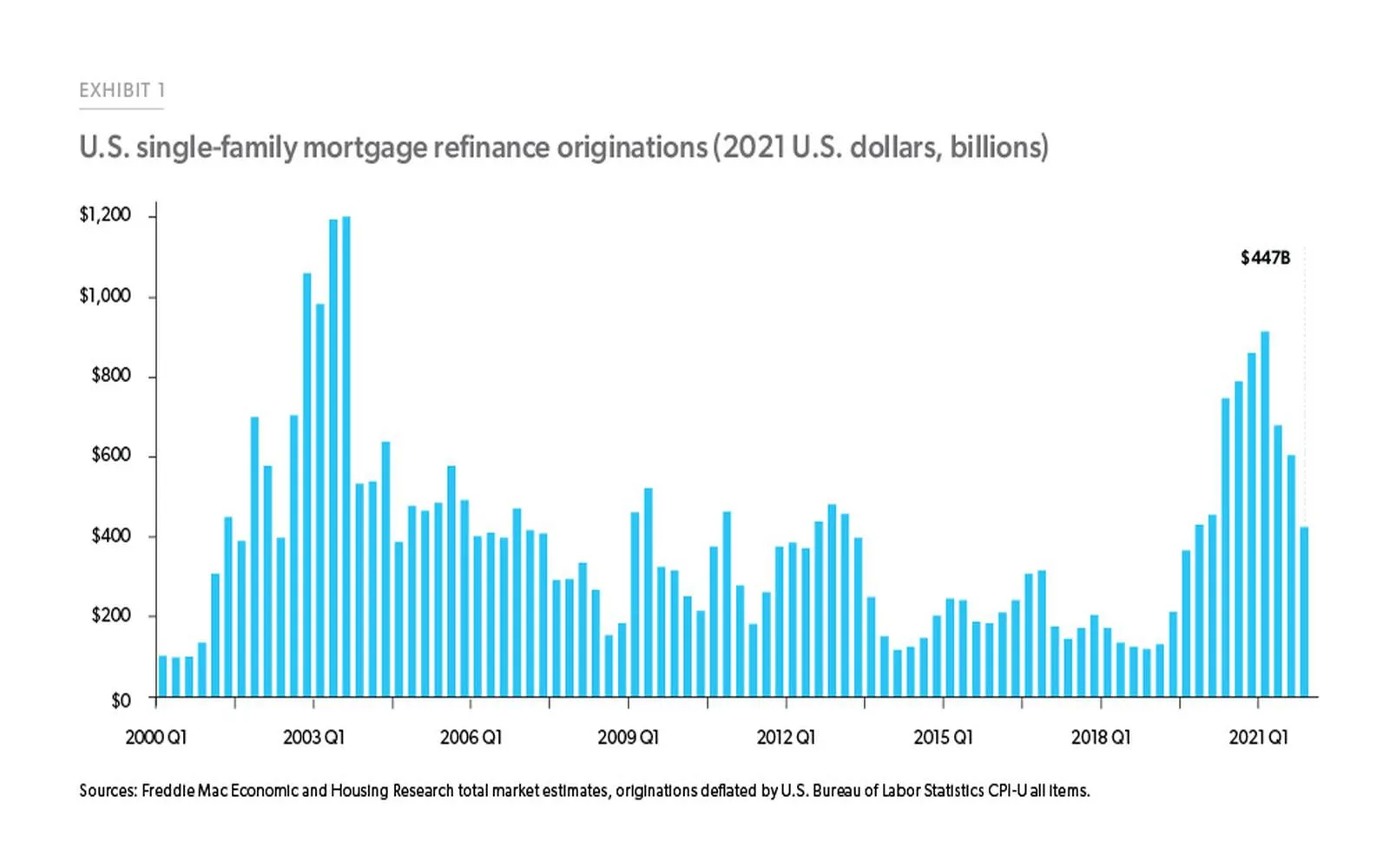

Mortgage Refinance Rates: Unlock the Best Savings Today

Top Business Internet Providers: Compare Speed, Reliability, and Pricing for Your Company

Unlock Your Adventure: How to Easily Compare Travel Insurance Quotes Online

Compare AARP Insurance Quotes for Affordable Coverage

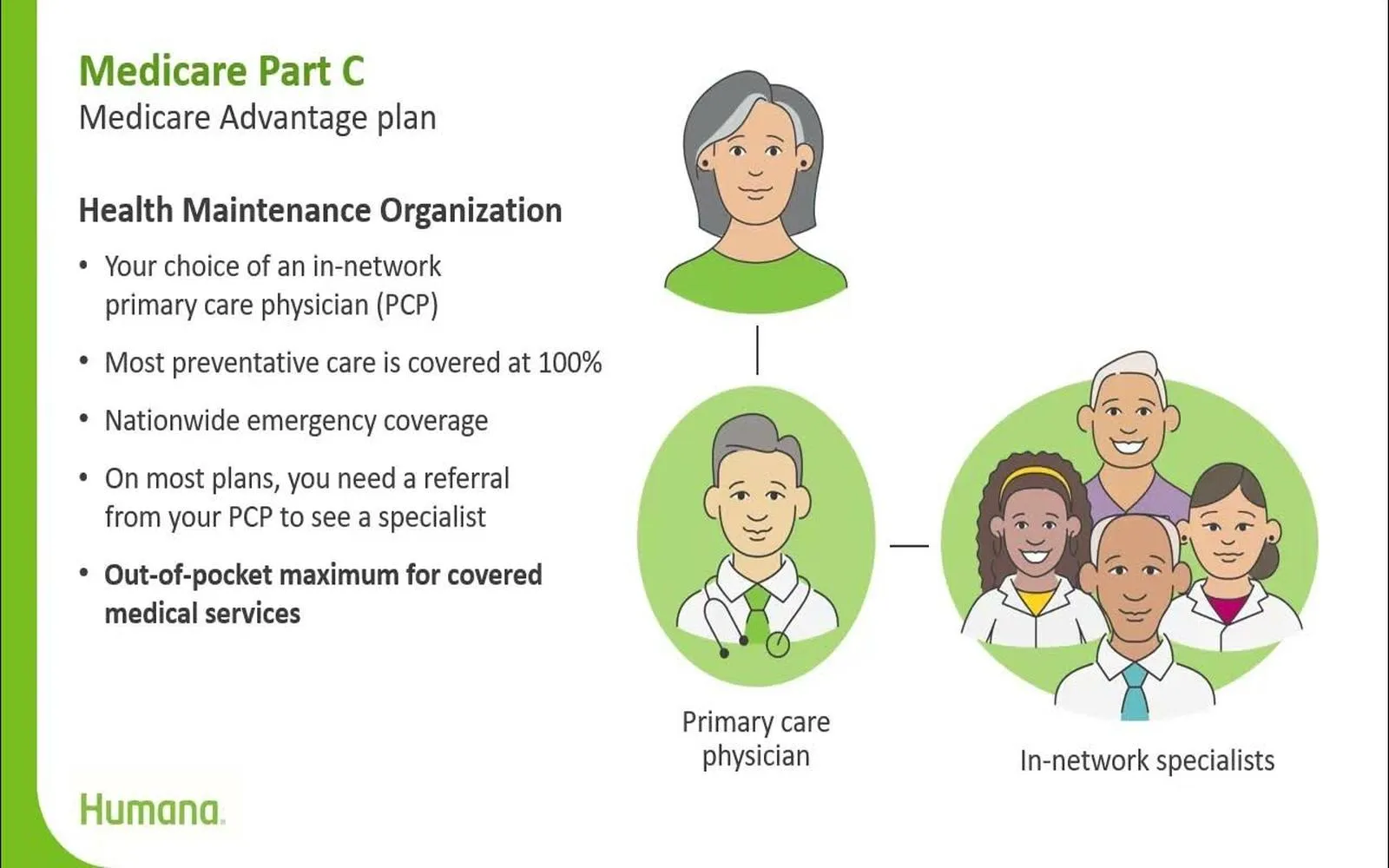

Humana Medicare Plans: Compare Coverage & Benefits

Private Health Insurance: Compare Plans, Costs & Benefits

Get Instant Travel Insurance Quotes: Compare Plans & Save Today!