Unlock Your Adventure: How to Easily Compare Travel Insurance Quotes Online

When planning your next getaway, one crucial aspect that often gets overlooked is travel insurance. Amidst the excitement of booking flights and accommodations, it’s easy to forget the importance of protecting your investment against unforeseen events. However, with the rise of digital tools, comparing travel insurance quotes online has never been easier. In this guide, we’ll walk you through the steps to efficiently navigate the world of travel insurance, ensuring you find the best coverage to suit your needs and budget. Unlock your adventure by making informed choices that keep your travels safe and worry-free!

Traveling is an exhilarating experience. The thrill of discovering new cultures, tasting exotic foods, and making memories that will last a lifetime is what draws millions of people to pack their bags and set off on adventures around the globe. However, amidst the excitement of planning your next getaway, one crucial aspect often gets overlooked: travel insurance. It's easy to dismiss it as an unnecessary expense, but the reality is that having the right travel insurance can make or break your trip. In this article, we will explore how you can easily compare travel insurance quotes online, ensuring that you find the perfect policy for your journey.

The Importance of Travel Insurance

Imagine this: you’ve just arrived in a picturesque town in Italy, your senses alive with the sights and sounds of the bustling piazza. You’re ready to explore, but suddenly, disaster strikes—your luggage is lost, and your carefully planned itinerary begins to unravel. This is where travel insurance comes into play. It provides a safety net, protecting you against unexpected events that could otherwise lead to financial loss or ruin your trip entirely.

Travel insurance can cover a wide array of situations, from trip cancellations and medical emergencies to lost luggage and personal liability. Each traveler's needs are different, which is why it's essential to find a policy that fits your specific situation. By comparing quotes online, you can make informed decisions and ensure you have the right protection for your journey.

Understanding the Different Types of Travel Insurance

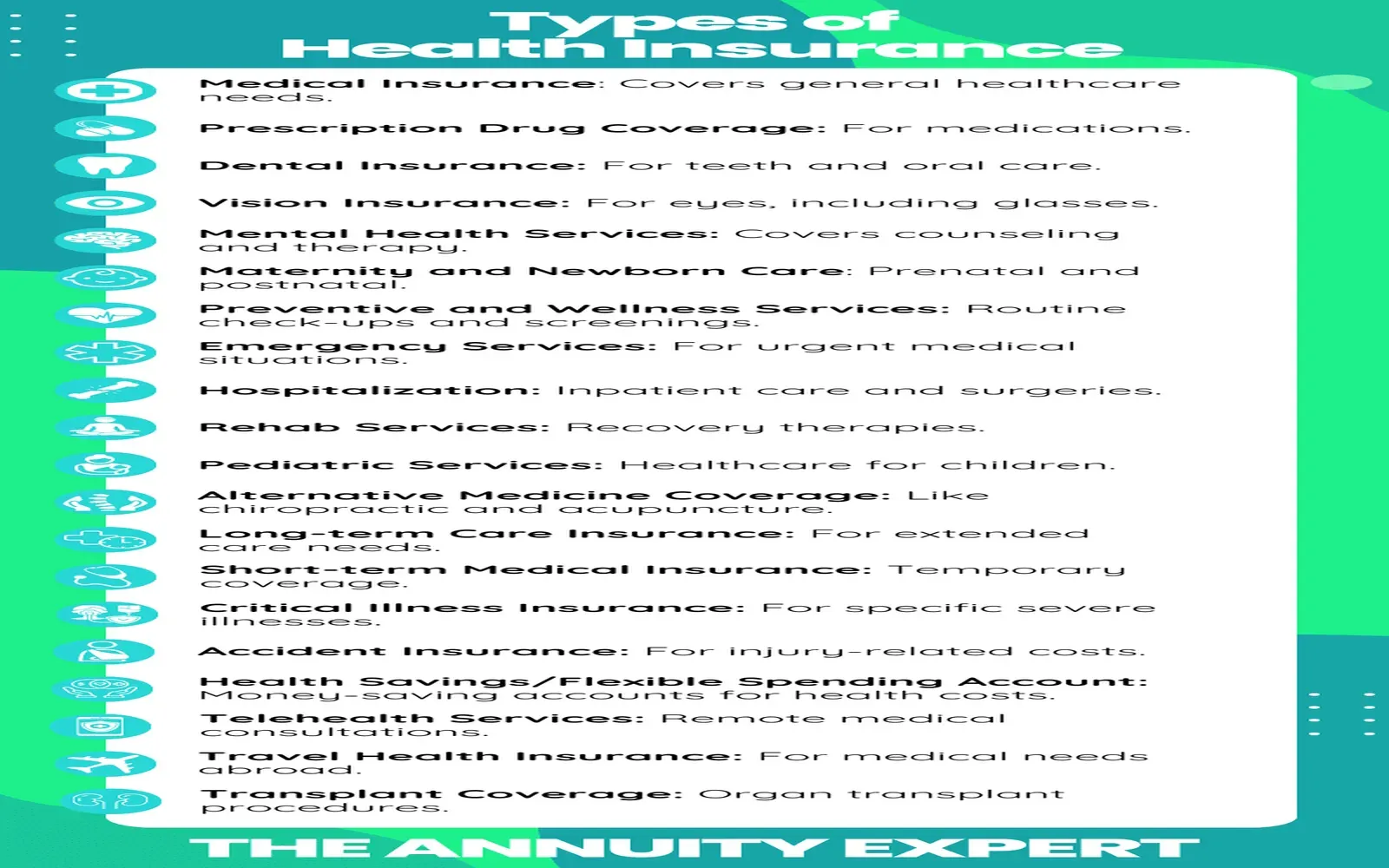

Before diving into the nitty-gritty of comparing quotes, it's vital to understand the various types of travel insurance available. Broadly speaking, travel insurance can be categorized into several types:

- Trip Cancellation Insurance: This type of policy reimburses you for non-refundable expenses if you need to cancel your trip due to unforeseen circumstances, such as illness or a family emergency.

- Medical Coverage: This is crucial for international travelers, as it covers medical expenses incurred while abroad, which can be exorbitantly high in some countries.

- Evacuation Insurance: In case of a medical emergency that requires you to be transported back home, this insurance covers the costs associated with such evacuations.

- Lost Luggage Insurance: If your bags go missing, this policy compensates you for the loss of your belongings.

- Accidental Death and Dismemberment Insurance: This coverage offers financial protection to your beneficiaries in the unfortunate event of your death or serious injury while traveling.

Understanding these types of insurance will help you identify what you need and what you can do without, making the comparison process smoother.

Why Compare Travel Insurance Quotes Online?

With countless travel insurance providers and policies available, finding the right coverage can feel overwhelming. However, comparing quotes online simplifies the process significantly. Here are a few compelling reasons to consider:

- Convenience: You can compare multiple quotes from the comfort of your home, eliminating the need for tedious phone calls or in-person visits to insurance agents.

- Transparency: Online platforms provide clear, side-by-side comparisons of coverage options, prices, and exclusions, allowing you to make an informed choice.

- Customization: Many online tools allow you to input specific details about your trip, such as destination, duration, and activities, to generate tailored quotes that meet your unique needs.

In an age where we can book flights, hotels, and even dinner reservations online, it makes sense to extend that convenience to securing travel insurance as well.

How to Effectively Compare Travel Insurance Quotes Online

Now that we’ve established the importance of travel insurance and the convenience of comparing quotes online, let’s delve into how to do it effectively.

1. Determine Your Coverage Needs

Before you begin comparing quotes, assess your specific needs. Consider factors such as:

- The destination you are traveling to and its healthcare system

- Your personal health and any pre-existing conditions

- The activities you plan to engage in (e.g., adventure sports may require additional coverage)

- The total cost of your trip, including non-refundable expenses

Understanding these aspects will help you narrow down the types of coverage you need.

2. Use Comparison Websites

There are several reputable comparison websites that aggregate quotes from multiple insurers, allowing you to see a range of options in one place. Some popular sites include:

- InsureMyTrip

- Squaremouth

- TravelInsurance.com

These platforms often offer filters to customize your search based on coverage type, price, and customer reviews, making it easier to find the right policy for your trip.

3. Read the Fine Print

When comparing quotes, it’s crucial to read the fine print of each policy. Look for:

- Coverage limits: Ensure that the policy provides adequate coverage for medical expenses and other potential costs.

- Exclusions: Be aware of what is not covered, including pre-existing conditions or specific activities.

- Claim process: Understand how to file a claim and what documentation is required.

By being thorough in your research, you can avoid unwelcome surprises later on.

4. Check Customer Reviews and Ratings

Customer reviews can provide valuable insights into an insurer's reliability and customer service. Look for reviews that discuss claim experiences, as these will give you a clearer understanding of how the insurer handles situations when they arise. A policy with a lower premium might not be worth it if the company has a poor reputation for processing claims.

5. Consult with a Travel Agent or Insurance Broker

If you feel overwhelmed by the options, consider consulting with a travel agent or insurance broker. These professionals can provide personalized recommendations based on your travel plans and needs. They often have access to exclusive deals or policies that you may not find online.

Real-Life Stories: The Impact of Travel Insurance

To further illustrate the importance of travel insurance, let’s explore a few real-life stories from travelers who experienced unforeseen events during their trips.

The Lost Luggage Debacle

Emma, an avid traveler, was on her way to Thailand for a month-long vacation. She meticulously planned every detail, but upon arrival, her luggage went missing. With vital items like her camera and clothing in that bag, Emma felt devastated. Fortunately, she had purchased travel insurance that included lost luggage coverage. After filing a claim, she received compensation that allowed her to replace her essentials and continue enjoying her trip without breaking the bank.

The Medical Emergency

Mark and Sarah were exploring the beautiful landscapes of New Zealand when Mark suddenly fell ill. What started as a mild fever escalated into something much more serious, requiring hospitalization. The medical bills quickly piled up, but thanks to their comprehensive travel insurance policy, they were able to focus on Mark's recovery without worrying about the financial burden. The insurance covered their medical expenses and even provided assistance in coordinating their travel arrangements to return home.

The Trip Cancellation Nightmare

Jessica had planned a dream vacation to Hawaii for her family. However, just days before their departure, her son came down with a severe illness, forcing them to cancel the trip. Initially feeling heartbroken, Jessica remembered she had opted for trip cancellation insurance. After submitting the necessary documentation, she was able to recover the majority of her non-refundable expenses, allowing her to rebook the trip for a later date without significant financial loss.

Conclusion: Adventure Awaits

Traveling offers a world of possibilities, but it also comes with its share of uncertainties. The key to unlocking your adventure is ensuring that you are well-protected against the unexpected. By easily comparing travel insurance quotes online, you can find a policy that meets your needs and gives you the peace of mind to explore the world.

Don’t let unforeseen circumstances ruin your adventure. Take the time to research, compare quotes, and secure the right travel insurance before you embark on your journey. With the right coverage, you can travel with confidence, knowing that you are prepared for whatever comes your way. So go ahead, pack your bags, and embrace the thrill of adventure—your next unforgettable trip awaits!

Explore

Get Instant Travel Insurance Quotes: Compare Plans & Save Today!

Compare AARP Insurance Quotes for Affordable Coverage

Private Health Insurance: Compare Plans, Costs & Benefits

Top Business Internet Providers: Compare Speed, Reliability, and Pricing for Your Company

Unlock Exclusive Business Class Flight Discounts: Tips for Affordable Luxury Travel

Finding the Best Home and Auto Insurance Quotes Online: A Complete Guide

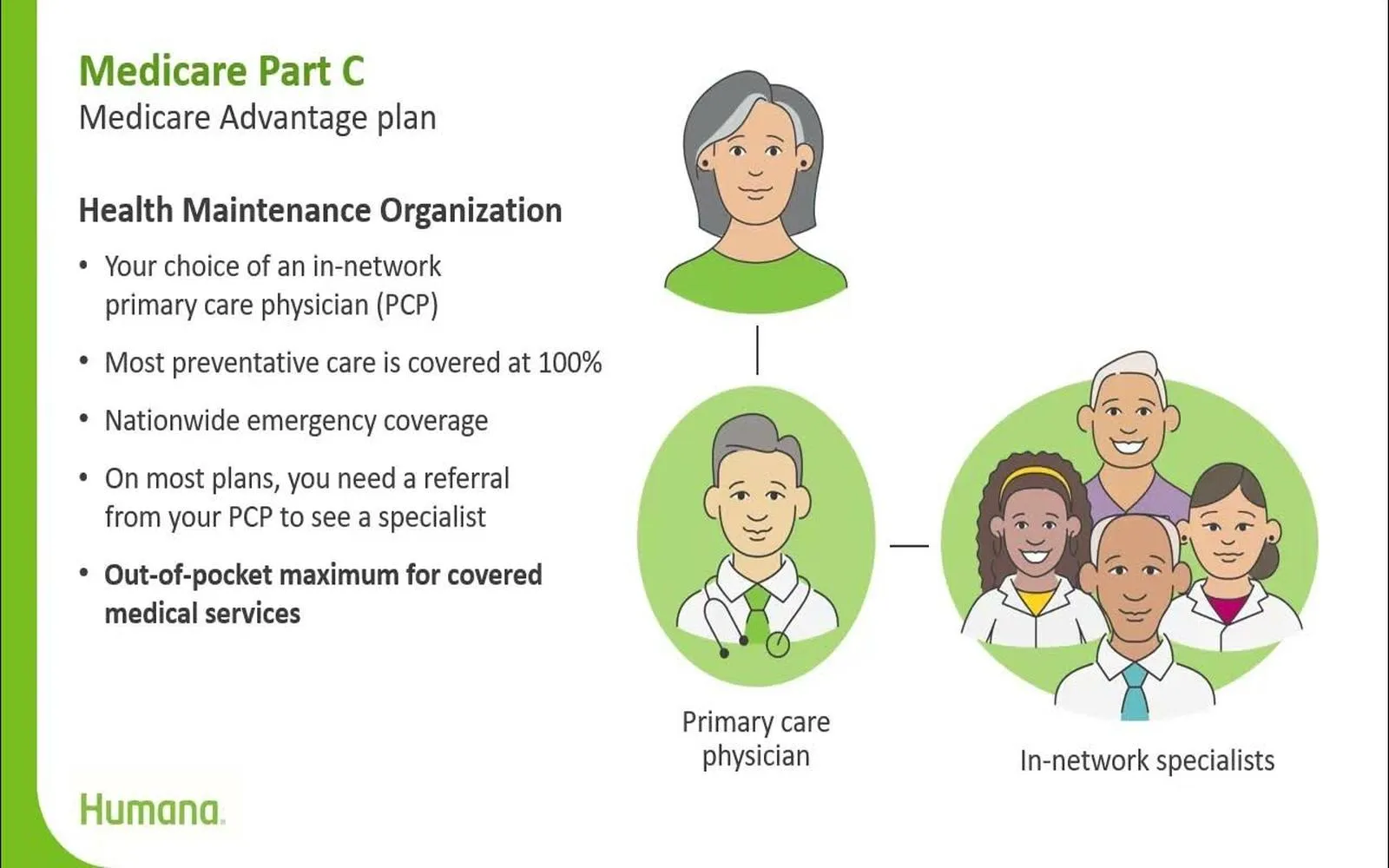

Humana Medicare Plans: Compare Coverage & Benefits

Best Personal Loan Offers: Compare Rates & Benefits