Understanding Health Insurance: Your Complete Guide

Health insurance is a type of coverage that pays for medical, hospitalization, and surgical expenses incurred by the insured individual. It helps cover the cost of healthcare, making it an essential part of financial planning and health management. There are many types of health insurance plans, ranging from employer-sponsored group policies to government programs like Medicare and Medicaid.

Here’s an overview of health insurance, including the different types, how it works, and its importance.

What is Health Insurance?

Health insurance is a contract between an individual (or their employer) and an insurance provider in which the insurer agrees to pay for medical expenses in exchange for monthly premiums, deductibles, co-payments, and/or co-insurance.

When you have health insurance, the insurer will cover some or all of the costs of medical services, which could include doctor visits, hospital stays, surgeries, prescription medications, and preventive care. Depending on the plan, coverage can vary, and the insured may still need to pay out-of-pocket costs.

How Health Insurance Works

Health insurance typically operates through a system of premiums, deductibles, co-pays, and co-insurance:

- Premium: The monthly amount paid to the insurance company, whether or not you use medical services.

- Deductible: The amount you must pay out-of-pocket for healthcare services before your insurance begins to pay. For example, if your deductible is $1,000, you need to pay this amount before your insurance coverage kicks in.

- Co-pay: A fixed amount you pay for a covered healthcare service after you've met your deductible. For example, you may pay $20 for a doctor's visit.

- Co-insurance: The percentage of costs you pay after meeting your deductible. For example, if your co-insurance is 20%, and your medical bill is $1,000, you pay $200, and the insurance covers the remaining $800.

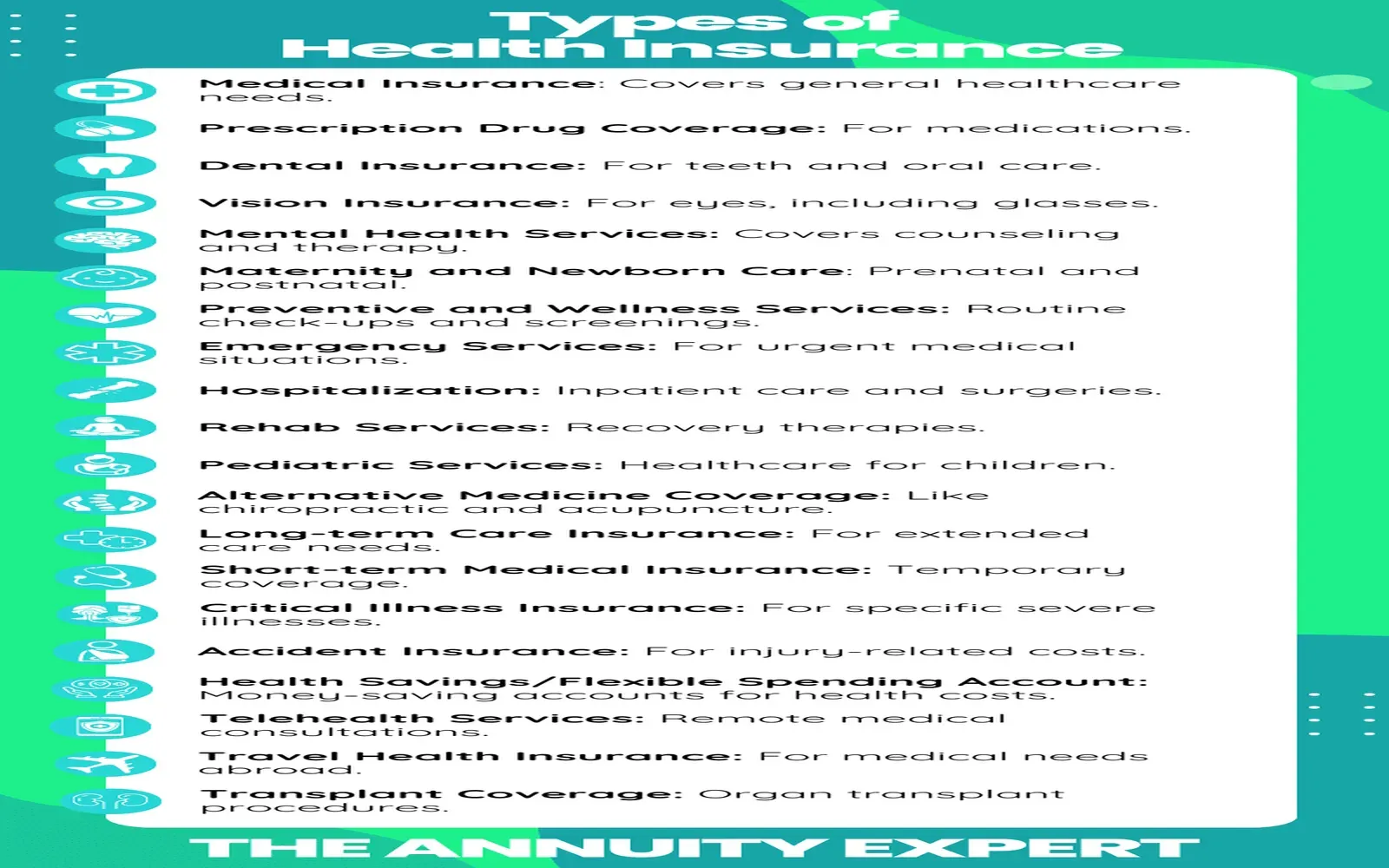

Types of Health Insurance Plans

There are several types of health insurance plans, each offering different coverage options and benefits. The most common types include:

1. Employer-Sponsored Health Insurance (Group Insurance)

Many employers offer health insurance as a benefit to their employees. These group plans tend to be more affordable than individual plans because the employer typically pays a portion of the premium. Group insurance can cover employees, their spouses, and dependents.

Pros:

- Lower premiums due to group rates

- Easier access to healthcare networks

- Pre-tax premium payments through payroll deductions

Cons:

- Limited plan options based on the employer

- Employees may be required to pay a portion of the premium or deductible

2. Individual and Family Health Insurance

Individuals who are self-employed or do not have access to employer-sponsored insurance can purchase individual health insurance plans through the marketplace or directly from insurance providers.

Pros:

- Flexibility in choosing a plan that meets specific needs

- Eligibility for subsidies based on income (if purchased through the Health Insurance Marketplace)

Cons:

- Typically higher premiums than employer-sponsored plans

- Out-of-pocket costs can be higher without employer contributions

3. Medicare

Medicare is a federal program that provides health insurance for individuals aged 65 and older, or those with certain disabilities or conditions like end-stage renal disease. It has different parts that cover hospital care (Part A), medical services (Part B), and prescription drugs (Part D). Some people opt for Medicare Advantage (Part C), a private plan that combines coverage from Parts A, B, and D.

Pros:

- Comprehensive coverage for older adults or those with disabilities

- Guaranteed enrollment for those over 65

Cons:

- May require additional private insurance for more comprehensive coverage (e.g., Medigap policies)

- Out-of-pocket costs can still be significant

4. Medicaid

Medicaid is a joint federal and state program that helps with healthcare costs for individuals and families with low income. Eligibility and coverage vary by state, and it often provides more extensive benefits than Medicare for eligible individuals.

Pros:

- Low or no-cost health coverage for eligible individuals

- Covers a wide range of services, including long-term care and home health services

Cons:

- Eligibility requirements vary by state

- Some people may face limited access to certain providers

5. Health Maintenance Organization (HMO)

HMO plans are a type of health insurance that requires members to choose a primary care physician (PCP) and obtain referrals from the PCP to see specialists. They typically have lower premiums but require patients to use a network of doctors and hospitals.

Pros:

- Lower premiums and out-of-pocket costs

- Coordinated care through a primary care physician

Cons:

- Less flexibility in choosing healthcare providers

- Requires referrals for specialist care

6. Preferred Provider Organization (PPO)

PPO plans offer more flexibility than HMO plans, allowing patients to see any healthcare provider without a referral, even outside the network. However, out-of-network care usually comes with higher costs.

Pros:

- Greater flexibility in choosing doctors and specialists

- No referral needed to see specialists

Cons:

- Higher premiums and out-of-pocket costs

- Higher costs for out-of-network care

7. Exclusive Provider Organization (EPO)

EPO plans combine features of HMO and PPO plans. They require members to use a network of doctors but do not require referrals for specialists. However, out-of-network care is not covered except in emergencies.

Pros:

- No referrals needed for specialists

- Lower premiums than PPO plans

Cons:

- No coverage for out-of-network care except in emergencies

Benefits of Health Insurance

- Access to a Network of Providers: Health insurance provides access to a wide network of healthcare professionals, hospitals, and specialists, ensuring you get the care you need.

- Protection from High Medical Costs: Insurance helps cover the cost of major medical expenses, reducing the financial burden of medical bills.

- Preventive Care: Many health insurance plans offer coverage for preventive services like vaccines, screenings, and wellness check-ups at little to no cost.

- Peace of Mind: With health insurance, you are better prepared for unexpected medical issues, knowing you have financial support for treatment.

- Health and Wellness: Some health insurance plans cover health and wellness services, including mental health care, physical therapy, and prescription medications, promoting overall health and well-being.

How to Choose a Health Insurance Plan

When selecting a health insurance plan, consider the following:

- Budget: Determine how much you can afford to pay in premiums, deductibles, co-pays, and out-of-pocket expenses.

- Coverage Needs: Consider your healthcare needs, including whether you need prescription drugs, specialist care, or frequent doctor visits.

- Provider Network: Ensure the plan includes doctors and hospitals that you prefer or need to use.

- Family Needs: If you’re insuring a family, consider a plan that covers dependents and provides comprehensive maternity, pediatric, and family healthcare options.

- Additional Benefits: Look for extra perks like dental, vision, mental health services, or wellness programs.

Conclusion

Health insurance is essential for managing the costs of healthcare and accessing necessary treatments. It comes in many forms, from employer-sponsored group insurance to government programs like Medicare and Medicaid, offering various levels of coverage and benefits. When choosing a health insurance plan, it’s important to assess your health needs, budget, and preferred providers to find the right coverage for you and your family.

Would you like more details on any specific type of health insurance or additional resources? Let me know!

Explore

Finding the Best Home and Auto Insurance Quotes Online: A Complete Guide

Driving Peace of Mind: A Complete Guide to Auto Insurance

Find the Best Nearby Solar Panel Installers: Your Complete Guide to Local Solar Solutions

Pennie Insurance Explained: Your Guide to Pennsylvania’s Health Plans

Understanding Workers Compensation Insurance for Small Businesses

Navig Health Insurance for Small Businesses

Best Health Insurance Plans for Comprehensive Coverage

Private Health Insurance: Compare Plans, Costs & Benefits