Understanding Workers Compensation Insurance for Small Businesses

For small business owners, having the right insurance is crucial to managing risk and ensuring the safety of your employees. Workers compensation insurance is one of the most important types of coverage for businesses that have employees. Here’s a comprehensive guide to help you navigate workers compensation insurance, from quotes and policies to finding the best providers for your small business.

Small Business Workers Compensation Insurance Companies

When searching for workers compensation insurance, you’ll find several companies offering tailored solutions for small businesses. The key is to choose a provider with a solid reputation, a history of excellent customer service, and a track record of handling claims efficiently. Some top providers, like The Hartford and Nationwide, specialize in small business workers compensation insurance and can offer the coverage you need to keep your workforce safe and your business protected.

Workers Comp Quotes for Small Business

Getting workers compensation insurance quotes is an essential part of selecting the right policy for your business. Insurance providers typically base their quotes on factors such as the size of your business, industry, number of employees, and payroll. Be sure to get quotes from several providers to compare costs and coverage options. This will help you make an informed decision that balances affordability and comprehensive coverage for your employees.

General Liability and Workers Comp Insurance for Small Business

For many small businesses, combining general liability insurance with workers compensation insurance is a smart choice. General liability covers third-party claims such as property damage or injury, while workers comp insurance covers medical expenses, lost wages, and rehabilitation for employees injured on the job. Combining both policies can often lead to cost savings and provide comprehensive protection for your business.

Best Small Business Workers Comp Insurance

The best workers compensation insurance for small businesses will depend on your industry, business size, and specific needs. Leading insurers for small business workers compensation include The Hartford, Travelers, and Hiscox. They provide flexible coverage options that can be customized to fit your business, as well as responsive customer service to support you throughout the claims process.

Workers Comp Insurance for Small Business

Workers comp insurance is a legal requirement in most states for businesses that have employees. This insurance provides benefits to workers who suffer job-related injuries or illnesses. It typically covers medical expenses, lost wages, and disability benefits. For small businesses, workers comp is essential for managing risks and ensuring that employees are financially supported in the event of an accident at work.

Small Business Workman’s Comp Insurance

Workman’s comp insurance, or workers compensation insurance, is designed to protect employees who are injured or become ill due to their work. This coverage not only ensures that employees are taken care of, but it also protects business owners from potential lawsuits related to workplace injuries. Workman’s comp insurance is often required by law, making it an essential component of any small business insurance plan.

Workers Comp for Small Business Owners

While small business owners are typically not covered by workers compensation insurance for their own injuries, many choose to purchase coverage for themselves. Some states offer workers comp coverage for owners or partners, or they may opt for a separate policy to ensure they have protection in case of a workplace injury.

Affordable Workers Comp Insurance

Finding affordable workers compensation insurance is essential for small businesses trying to keep costs under control. While rates can vary, businesses can lower their premiums by maintaining a safe work environment, offering employee training, and ensuring accurate payroll reporting. Shopping around for the best quote and considering bundling policies, such as general liability and workers comp, can also help reduce costs.

Cheap Workers Compensation Insurance

While "cheap" workers compensation insurance might sound appealing, it’s important to remember that you get what you pay for. Low-cost policies may have limited coverage or higher deductibles. Instead of focusing solely on price, look for a policy that offers the coverage you need at a competitive rate. Consider working with an insurance broker to help you find affordable yet comprehensive coverage.

Get Workers Compensation Insurance

If you’re just starting your small business or expanding your team, getting workers compensation insurance is an important step. It not only helps ensure your employees are protected, but it also keeps your business in compliance with state laws. Start by assessing your business needs, determining your payroll, and obtaining multiple quotes to find the right policy.

Workers Compensation Insurance Quote

To get a workers compensation insurance quote, contact multiple insurers or use online tools to receive estimates based on your business details. Be prepared to provide information about your industry, number of employees, and payroll. A thorough and accurate quote will give you a clear idea of your premiums and coverage options.

Workers Comp Insurance for Small Business: What to Look For

When selecting workers comp insurance for your small business, ensure that the policy includes medical coverage, wage replacement, rehabilitation costs, and legal protection. Look for insurers that specialize in small businesses and offer customizable coverage that suits your unique risks. Reviewing the terms, exclusions, and customer service ratings will help you make the right choice.

Workman's Comp Insurance Near Me

Looking for "workman’s comp insurance near me" can help you find local agents or insurance providers familiar with state-specific regulations. Many local agents can provide personalized service, answer questions about coverage, and guide you through the claims process. Finding a local provider can make communication easier and provide a more tailored experience for your small business.

The Hartford Workers Comp Quote

The Hartford is a well-known provider of workers compensation insurance, offering flexible policies and competitive rates for small businesses. Their workers comp insurance provides comprehensive coverage for medical expenses, lost wages, and rehabilitation costs, with additional support for risk management. For many small businesses, The Hartford is a trusted provider to consider when seeking workers comp coverage.

Workers Compensation for Electricians

Electricians face a higher risk of injury on the job due to the nature of their work. Workers compensation insurance for electricians is essential to protect against accidents and injuries that could lead to significant financial burdens. Specialized policies for electricians may include coverage for injuries related to electrical shock, falls, and equipment-related accidents. Make sure your policy is tailored to the specific risks of your industry.

Conclusion: Choosing the Right Workers Compensation Insurance for Your Small Business

Workers compensation insurance is essential for protecting both your employees and your business. By taking the time to research and compare quotes from various providers, you can find the best coverage for your small business. Whether you’re seeking general liability and workers comp insurance, looking for affordable options, or purchasing coverage for specialized industries like electricians, it’s important to partner with a reputable insurance company that understands your business needs and offers comprehensive protection.

Explore

Construction Accident Lawyer: Fighting for Injured Workers’ Rights

Understanding Health Insurance: Your Complete Guide

Navig Health Insurance for Small Businesses

Unlocking Justice: How Injury Compensation Lawyers Fight for Your Rights

Accident Lawyer Long Beach: Your Guide to Legal Support and Compensation

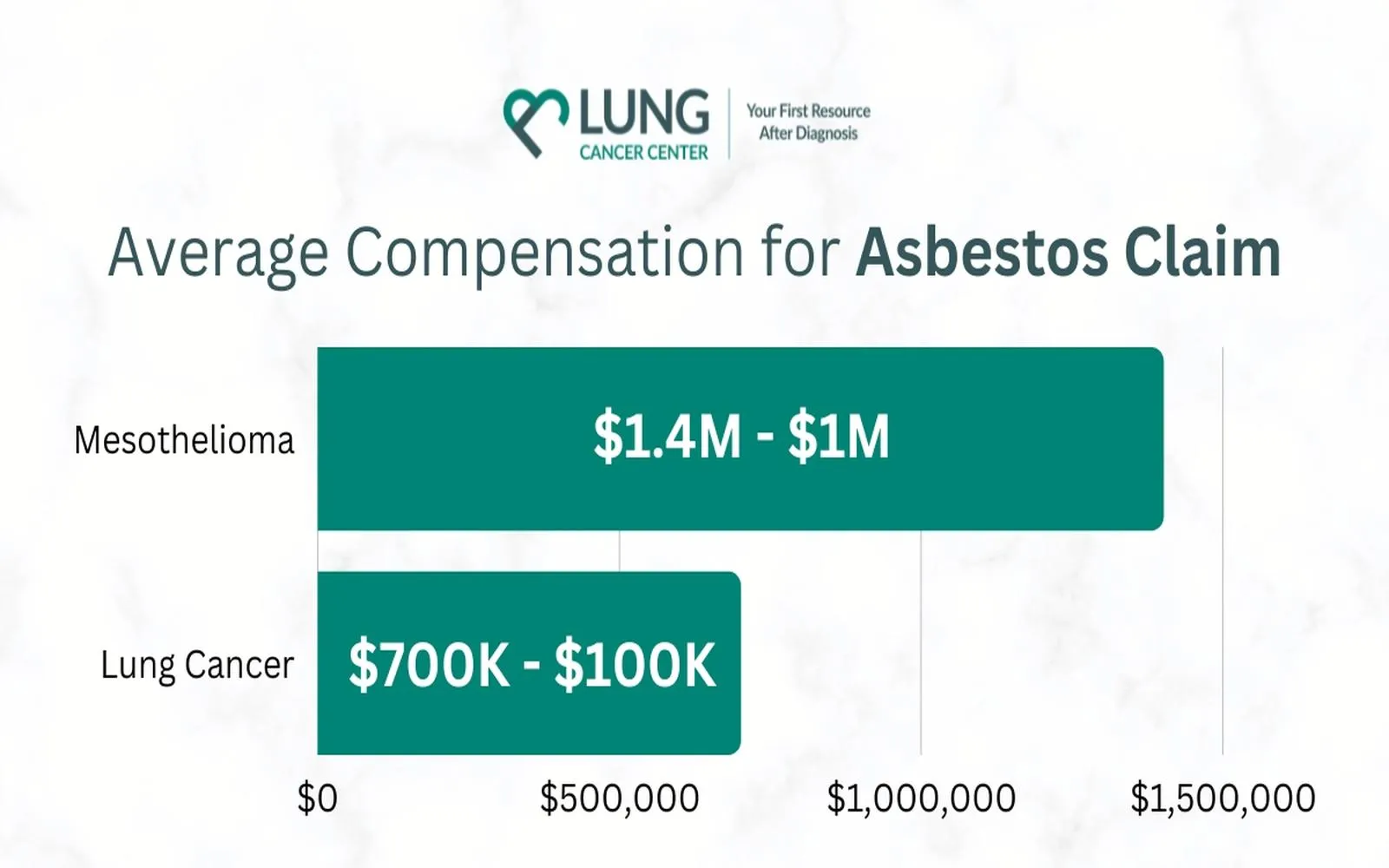

Maximizing Mesothelioma Compensation: Legal Options & Financial Recovery

Top Mesothelioma Lawyers: Secure Justice & Maximum Compensation

Best Car Accident Lawyers for Maximum Compensation