Top Personal Loan Platforms: Your Ultimate Guide to Finding the Best Rates and Terms

Introduction

In today's fast-paced financial landscape, personal loans have become a popular option for individuals seeking to meet their financial needs. Whether it's for consolidating debt, financing a major purchase, or covering unexpected expenses, personal loans can provide a solution. However, with numerous platforms available, navigating the options to find the best rates and terms can be a daunting task. This guide will explore the top personal loan platforms, helping you make an informed decision when seeking financial assistance.

Understanding Personal Loans

Before diving into the top platforms, it’s important to understand what personal loans are. A personal loan is an unsecured loan that borrowers can use for various purposes. Unlike a mortgage or auto loan, personal loans do not require collateral, which means that they are based largely on the borrower's creditworthiness. The amounts, terms, and interest rates can vary widely, making it essential to shop around for the best deal.

Factors to Consider When Choosing a Personal Loan Platform

When evaluating personal loan platforms, several key factors should be considered:

- Interest Rates: The interest rate significantly affects the total cost of the loan. It's crucial to compare rates across various lenders.

- Loan Terms: Different platforms offer varying loan terms, typically ranging from 2 to 7 years. Choose a term that fits your budget and repayment capability.

- Fees: Be aware of any origination fees, prepayment penalties, or late payment fees that may be associated with the loan.

- Approval Process: Some platforms provide quicker approvals and funding than others, which can be vital if you need funds urgently.

- Customer Service: A responsive customer service team can make the borrowing experience smoother, especially when issues arise.

Top Personal Loan Platforms

Now that you know what to look for, here are some of the top personal loan platforms worth considering:

LendingClub

LendingClub is one of the largest peer-to-peer lending platforms in the U.S. They offer personal loans ranging from $1,000 to $40,000 with terms from 36 to 60 months. The APR typically ranges from 10.68% to 35.89% depending on your credit score and other factors. One of the significant advantages of LendingClub is its transparency regarding fees and terms. Additionally, they offer a user-friendly online application process, making it easy to apply from the comfort of your home.

SoFi

SoFi is known for its competitive rates and excellent customer service. They offer personal loans ranging from $5,000 to $100,000 with fixed rates starting at 5.99%. SoFi does not charge any fees for origination, prepayment, or late payments, which makes it an attractive option for borrowers. Furthermore, SoFi provides additional benefits such as career coaching and financial planning, which can be advantageous for borrowers looking for long-term financial wellness.

Marcus by Goldman Sachs

Marcus offers personal loans without any fees, which is a significant advantage. Borrowers can apply for loans between $3,500 and $40,000 with terms ranging from 36 to 72 months. The fixed interest rates start at 6.99%, making it a competitive option for those with good credit. Marcus also provides a user-friendly online experience, allowing borrowers to manage their loans easily through their online portal or mobile app.

Upstart

Upstart uses artificial intelligence and machine learning to assess creditworthiness, making it a unique player in the personal loan space. They offer loans from $1,000 to $50,000, with terms between 36 and 60 months. The interest rates range from 5.4% to 35.99%. Upstart is especially beneficial for younger borrowers or those with limited credit history, as they consider various factors beyond just credit scores when determining eligibility.

Avant

Avant is an excellent choice for borrowers with less-than-perfect credit. They provide personal loans ranging from $2,000 to $35,000 with interest rates from 9.95% to 35.99%. Avant's application process is straightforward, and they offer same-day funding in some cases. While they do charge an administration fee, their focus on serving subprime borrowers makes them a viable option for those who might struggle to get approved elsewhere.

Discover Personal Loans

Discover is well-known for its credit cards but also offers personal loans. Borrowers can apply for loans between $2,500 and $35,000 with no origination fees. Interest rates range from 6.99% to 24.99%. Discover's customer service is highly rated, and they provide a 30-day satisfaction guarantee, allowing borrowers to change their minds without penalty within the first 30 days.

Payoff

Payoff specializes in personal loans for consolidating credit card debt. They offer loans from $5,000 to $40,000 with fixed rates starting at 5.99%. Payoff focuses on helping borrowers improve their credit scores, providing tools and resources to manage debt effectively. While they may have slightly higher rates for those with lower credit scores, their emphasis on financial education is a significant benefit.

LightStream

LightStream, a division of SunTrust Bank, offers personal loans with some of the lowest rates available. They provide loans from $5,000 to $100,000 with terms ranging from 24 to 144 months. The interest rates start as low as 3.99% for borrowers with excellent credit. LightStream also has a unique feature called the “Rate Beat Program,” where they promise to beat any competitor’s rate by 0.10%.

Best Egg

Best Egg is known for its quick and simple online application process. They offer loans from $2,000 to $50,000 with interest rates ranging from 5.99% to 35.99%. Best Egg is a good option for borrowers with good to excellent credit, and they provide funding as quickly as one business day. Their focus on providing an easy borrowing experience makes them a popular choice among consumers.

Prosper

Prosper is another peer-to-peer lending platform that allows borrowers to obtain loans from $2,000 to $40,000. The interest rates range from 7.95% to 35.99%. Prosper’s unique model allows investors to fund loans, providing a diversified approach to personal lending. The platform also offers a straightforward application process and flexible repayment options.

How to Apply for a Personal Loan

Applying for a personal loan typically involves several steps:

- Check Your Credit Score: Know your credit score before applying, as this will impact your eligibility and the rates you receive.

- Research and Compare Lenders: Use the information provided in this guide to compare rates, terms, and fees across various platforms.

- Pre-qualify: Many lenders offer a pre-qualification process that allows you to see potential rates without affecting your credit score.

- Complete the Application: Once you've chosen a lender, fill out the application form with the required documentation, such as income verification and identification.

- Review the Terms: Before accepting the loan, carefully review the terms, including the interest rate, repayment schedule, and any fees.

- Accept and Receive Funds: If approved, you’ll receive the funds according to the lender's timeline, often within a few business days.

Conclusion

Finding the right personal loan platform requires careful consideration of your financial needs and a thorough evaluation of available options. By understanding the factors that influence your choice and exploring the top platforms listed in this guide, you can make an informed decision that aligns with your financial goals. Remember to read the fine print, ask questions when necessary, and choose a loan that offers competitive rates, favorable terms, and a reliable borrowing experience. With the right personal loan in hand, you can achieve your financial aspirations and navigate life's unexpected challenges with confidence.

Explore

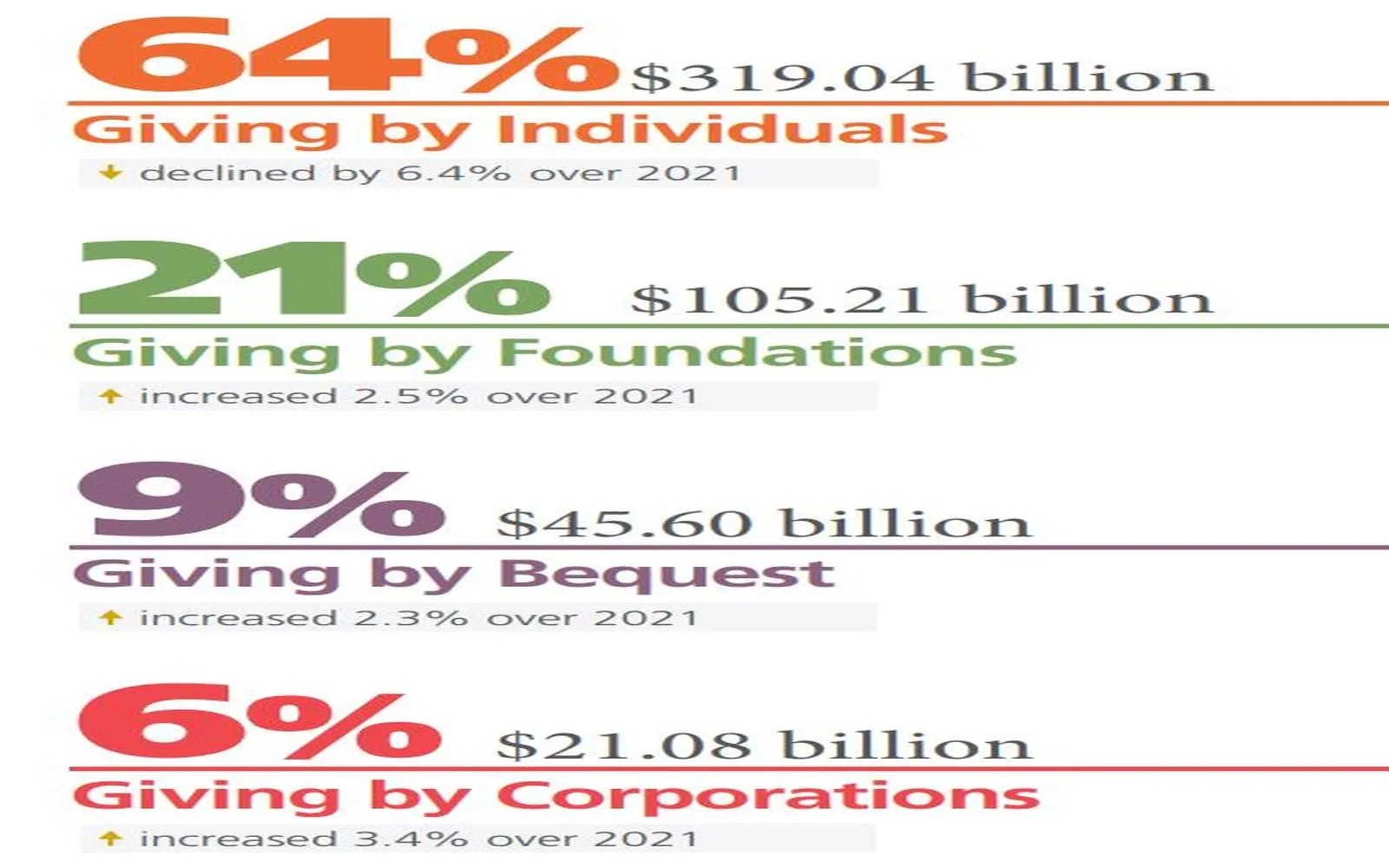

Ultimate Guide: How to Donate Effectively in the USA - Tips and Resources

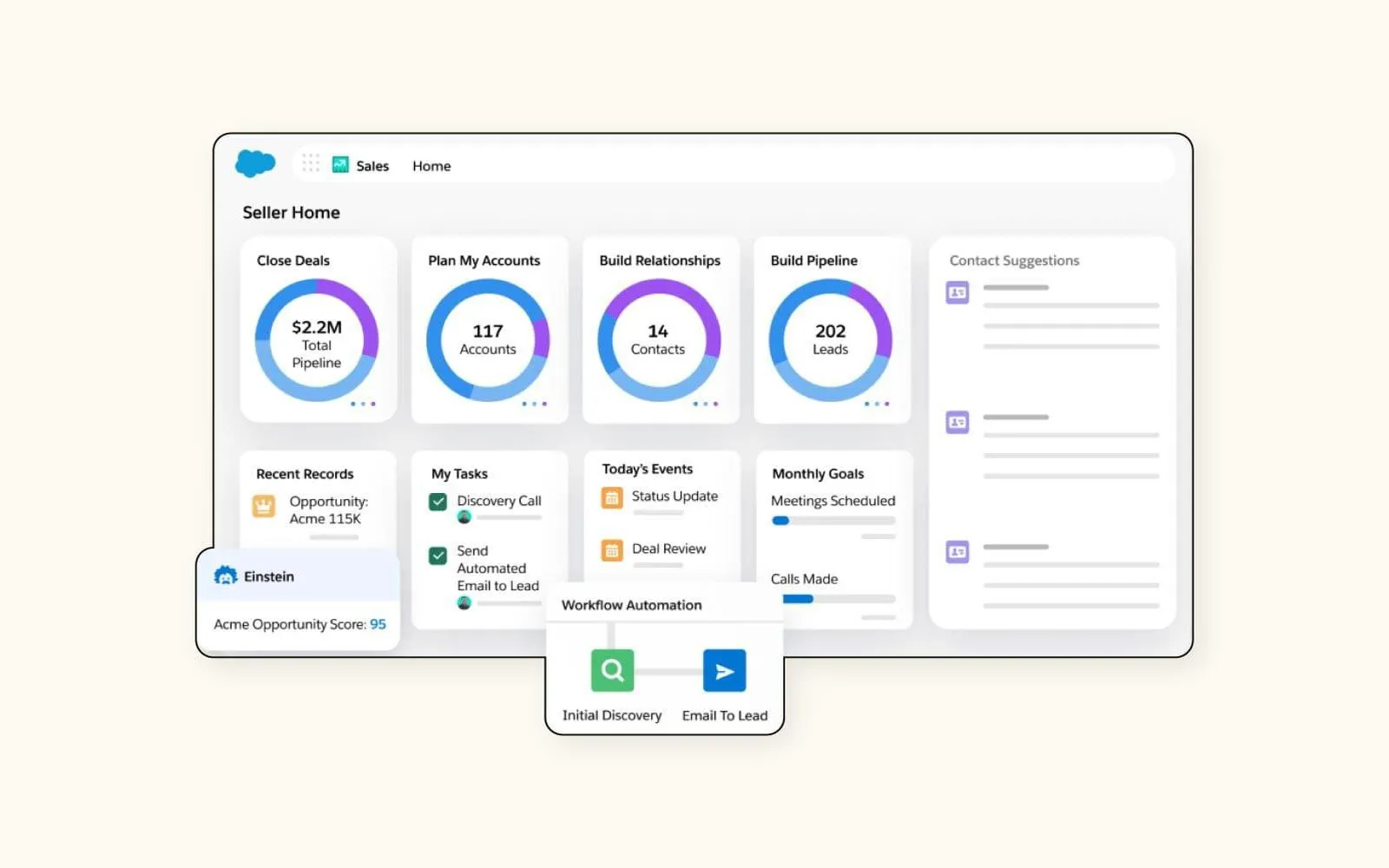

Streamline Your Small Business: The Ultimate Guide to Easy CRM Solutions

Top Accredited Online Business Schools: Your Guide to Quality Education and Career Advancement

Comprehensive Guide to Humana Health Coverage Plans: Benefits, Options, and Enrollment Tips

Top ERP Systems for Small Businesses: Streamline Your Operations and Boost Growth

Top Local SEO Agencies: Boost Your Business's Online Visibility and Rankings

Top Trusted Moving Services: Your Guide to a Stress-Free Relocation

Find Top Nearby Legal Experts: Your Guide to Local Legal Assistance