Unlocking Homeownership: Your Guide to Choosing the Right Mortgage Lender

Finding the right mortgage lender is key to securing a home loan that fits your budget and financial goals. Whether you're a first-time buyer, refinancing, or looking for low rates, comparing lenders can help you save money and get better terms. Online and local lenders offer various options, from FHA and VA loans to jumbo and self-employed mortgages. Fast pre-approval and low down payment options can make homeownership more accessible. With so many choices, researching trusted lenders ensures you find competitive rates and reliable service. Explore the best mortgage lenders for 2025 to make an informed decision.

Best Mortgage Lenders for 2025

As we look toward 2025, the mortgage landscape is evolving, offering borrowers a variety of options tailored to their unique financial situations. Selecting the best mortgage lender is crucial, as it can significantly impact your interest rates, loan terms, and overall borrowing experience. In this article, we’ll explore the top mortgage lenders for different needs, from first-time buyers to those seeking refinancing options.

Top Mortgage Lenders for First-Time Buyers

First-time homebuyers often face challenges, including navigating the lending process and securing favorable terms. Among the best mortgage lenders for first-time buyers are Quicken Loans, known for its user-friendly online platform and strong customer service, and Wells Fargo, which offers various loan options tailored for new buyers. Additionally, Chase provides special programs that may include down payment assistance and educational resources to help first-time buyers understand the process.

Affordable Mortgage Lenders

Affordability is a primary concern for many homebuyers. SoFi and LoanDepot stand out as affordable mortgage lenders, offering competitive rates and flexible terms that cater to various budgets. Additionally, Better.com is famous for its no-fee approach, significantly reducing the overall cost of borrowing.

Reliable Mortgage Lenders Near You

Finding a reliable mortgage lender in your area can make the home-buying process smoother. Local credit unions and community banks, such as USAA for military families or BMO Harris Bank for those in the Midwest, often provide personalized service and competitive rates. Researching customer reviews and local reputation can help you identify trustworthy lenders nearby.

Mortgage Lenders with Low Rates

Low-interest rates can save borrowers thousands over the life of a loan. Lenders like Ally Bank and Discover Home Loans frequently offer lower rates than traditional banks. Additionally, checking rates from online lenders like Rocket Mortgage can help you find the best deals available in 2025.

Best Online Mortgage Lenders

Online mortgage lenders provide convenience and often streamlined processes. Better.com and Rocket Mortgage lead the industry with their intuitive platforms, allowing borrowers to apply for loans and track their progress online. These lenders also offer a range of mortgage products, making it easy to find a suitable loan option without the hassle of in-person meetings.

Compare Mortgage Lenders for Better Rates

To secure the best mortgage rates, it's vital to compare multiple lenders. Websites like LendingTree and Zillow allow users to compare loan offers from various lenders side by side. By inputting your financial information, you can receive personalized rate quotes, helping you make an informed decision and save money in the long run.

Mortgage Lenders for Bad Credit

For those with bad credit, finding a lender willing to work with you can be challenging. However, Carrington Mortgage Services and Caliber Home Loans specialize in loans for borrowers with less-than-perfect credit. Additionally, government-backed loans, like FHA loans, may be available through various lenders for those with lower credit scores.

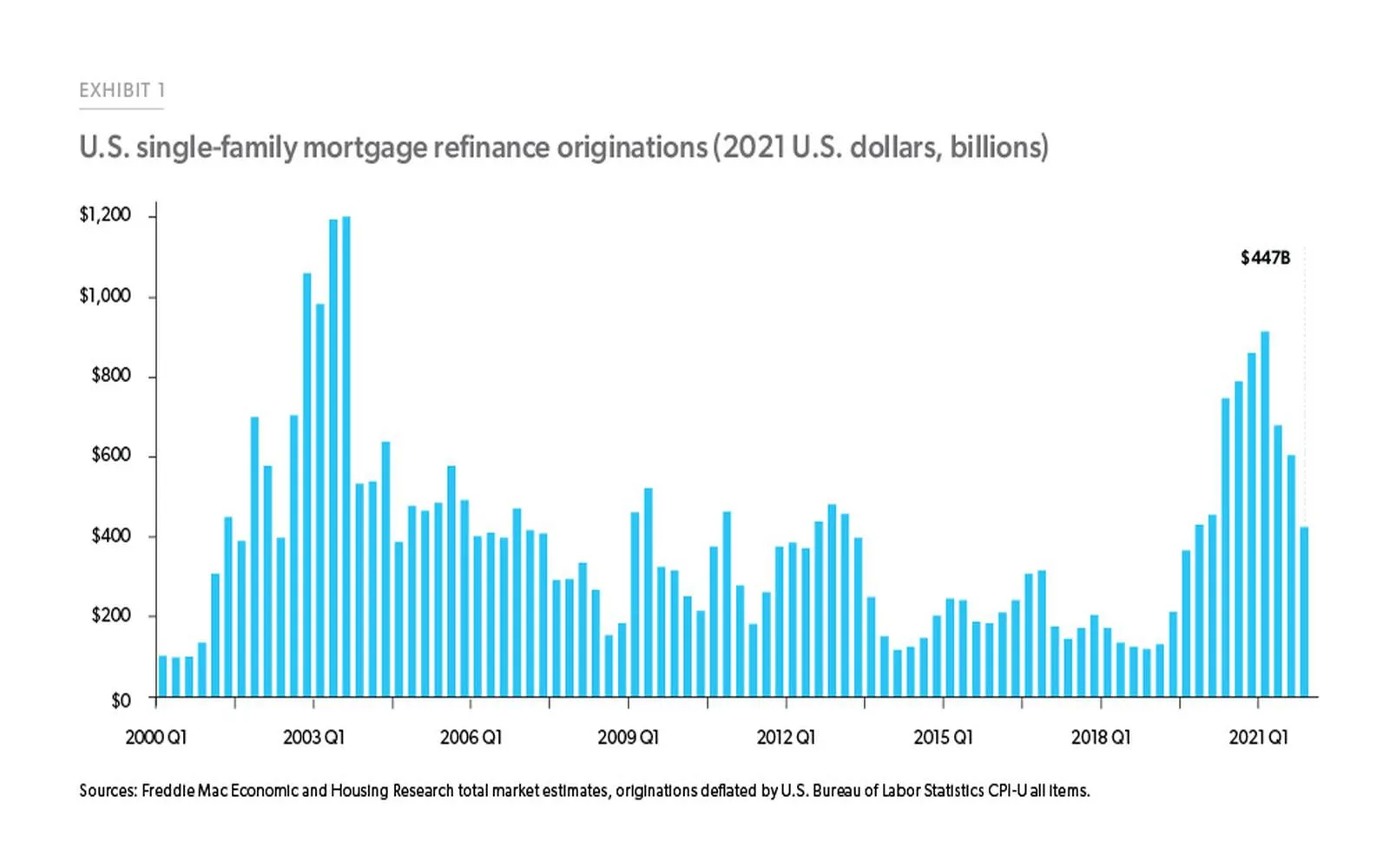

Best Mortgage Lenders for Refinancing

Refinancing can help homeowners lower their monthly payments or access home equity. Lenders like LoanDepot and Quicken Loans are highly regarded for their refinancing options, providing guidance and competitive rates. It's essential to evaluate your current mortgage terms and compare offers from multiple lenders to ensure you get the best refinancing deal possible.

Top Mortgage Lenders for Home Loans

When it comes to home loans, Bank of America and Wells Fargo consistently rank among the top mortgage lenders. They offer a variety of loan products, including conventional, FHA, and VA loans, along with solid customer service. These lenders provide the resources and support necessary for a successful home-buying experience.

Local Mortgage Lenders for Homebuyers

Choosing a local mortgage lender can provide advantages such as community knowledge and personalized service. Institutions like PNC Bank and Regions Bank often cater to local markets, offering tailored mortgage solutions for homebuyers in specific areas. Community banks and credit unions can also provide competitive rates and lower fees.

Best Lenders for FHA Loans

FHA loans are popular among first-time homebuyers due to their lower down payment requirements. Guild Mortgage and Caliber Home Loans are renowned for their FHA loan programs, offering competitive rates and a straightforward application process. These lenders also have extensive experience in working with FHA loans, making them reliable choices for prospective borrowers.

Mortgage Lenders for VA Loans

Veterans and active-duty military personnel can benefit from VA loans, which offer favorable terms and no down payment options. USAA and Navy Federal Credit Union are two of the most reputable lenders for VA loans, specifically catering to military members and their families. They understand the unique challenges of military life and provide tailored support throughout the loan process.

Best Mortgage Lenders for Self-Employed

Self-employed individuals may face challenges when securing a mortgage due to variable income. Lenders like Self-Employed Mortgage and New American Funding are experienced in working with self-employed borrowers, offering flexible documentation options and understanding the nuances of self-employment income. It’s crucial for self-employed applicants to keep thorough financial records to present to potential lenders.

Quick Mortgage Lenders for Fast Approvals

In a competitive housing market, speed is essential. Lenders like Rocket Mortgage and LoanDepot are known for their quick approval processes, often providing same-day approvals. Utilizing technology and streamlined applications, these lenders can expedite the mortgage process, allowing you to make offers on homes swiftly.

Mortgage Lenders with Low Down Payments

Many buyers are concerned about the upfront costs of purchasing a home. Lenders like Freddie Mac and Fannie Mae offer programs that allow for low down payments, sometimes as low as 3%. Additionally, Chase and Wells Fargo provide special programs aimed at minimizing down payment requirements, making homeownership more accessible.

Conclusion

As we move into 2025, the mortgage market continues to provide diverse options for borrowers. Whether you are a first-time buyer, self-employed, or looking to refinance, understanding your options and comparing various lenders can lead to better financial outcomes. By researching the best mortgage lenders for your specific needs, you can secure a loan that aligns with your financial goals and makes your home-buying experience positive.

Explore

Mortgage Refinance Rates: Unlock the Best Savings Today

Top Mortgage Lenders in the U.S.: Compare Rates, Services, and Reviews

Choosing the Right Credit Card: A Comprehensive Guide

Essential Guide to Choosing the Right Online Marketing Agency

Maximizing Your ROI: Choosing the Right Google Ads Management Company

Choosing the Best Small Business Liability Insurance: A Guide

Comprehensive Guide to Student Loan Assistance Options: Find the Right Help for Your Education Debt

Boosting Your Law Firm’s Online Presence: Choosing the Best SEO Services for Lawyers