Unlock Your Financial Future: How to Open a Free Bank Account Today!

In today's digital age, opening a free bank account online has never been easier, offering a convenient way to manage your finances without the burden of monthly fees or hidden charges. As we move into 2025, numerous banks are competing to provide attractive options, including free checking and savings accounts with no minimum deposit requirements. Whether you're a student seeking a no-fee account, a small business owner in need of efficient banking solutions, or someone looking for high-interest savings, there are plenty of secure choices that cater to your needs. This guide will explore the best banks for opening a free account, highlighting their features and benefits for easy online banking.

How to Open a Free Bank Account Online

Opening a free bank account online has never been simpler. With the advent of digital banking, many banks offer the convenience of setting up an account from the comfort of your home. To get started, you'll typically need to follow these steps:

1. **Research Banks**: Begin by researching banks that offer free checking or savings accounts. Consider their features, fees, and accessibility.

2. **Gather Required Information**: Most banks will ask for personal information such as your name, address, Social Security number, and date of birth. Also, be prepared to provide identification, such as a driver's license or passport.

3. **Visit the Bank's Website**: Go to the bank's official website and navigate to the section for opening a new account.

4. **Complete the Application**: Fill out the online application form. Be sure to double-check your information for accuracy.

5. **Fund Your Account**: Some banks may require an initial deposit, but many offer accounts with no minimum deposit requirement. You can fund your account through electronic transfer from another bank account or via a debit card.

6. **Review Terms and Conditions**: Before finalizing your application, review the bank's terms and conditions, ensuring there are no hidden fees.

7. **Submit Your Application**: After ensuring all information is correct, submit your application. You may receive instant approval or be notified later via email.

Best Banks for Opening a Free Account

When searching for the best banks for opening a free account, consider those that offer robust features without the burden of monthly fees. Some of the top choices include:

- Chime: An online-only bank known for its user-friendly app and no monthly fees.

- Ally Bank: Offers a high-interest savings account with no minimum balance and no monthly fees.

- Discover Bank: Provides a free checking account with no monthly fees and cashback on debit card purchases.

- Capital One 360: Offers both checking and savings accounts with no fees and no minimum balance.

- Bank of America: Features a free checking account option for those who meet certain requirements.

Open a Free Checking or Savings Account

Choosing between a checking and savings account depends on your financial needs. Checking accounts are ideal for everyday transactions such as bill payments and grocery shopping, while savings accounts are best for building interest on your savings. Many banks allow you to open either type of account without monthly fees and with no minimum deposit, making it easy to manage your finances.

No-Fee Bank Accounts for 2025

In 2025, the trend of no-fee bank accounts is expected to grow. More banks are recognizing the demand for transparent banking options. Look for accounts that offer no monthly maintenance fees, no overdraft fees, and no charges for ATM usage. Many digital banks are leading the charge in this area, making banking more accessible and affordable.

Best Free Bank Accounts with No Minimum Deposit

Several banks stand out for offering free accounts with no minimum deposit requirements. These include:

- Chime: No minimum deposit requirement and no monthly fees.

- Ally Bank: Offers competitive interest rates with no minimum balance.

- Discover Bank: No minimum deposit for their checking and savings accounts.

- American Express Banking: High-yield savings accounts with no minimum deposits.

Open a Free Bank Account for Easy Online Banking

Easy online banking is a significant advantage of modern banking. Most banks now offer user-friendly apps that allow you to manage your finances on the go. Look for banks that provide features such as mobile check deposits, real-time transaction alerts, and budget tracking tools to enhance your banking experience.

Top Banks Offering Free Checking Accounts

The following banks are notable for their free checking account offerings:

- Chime: Known for its lack of fees and easy online banking.

- Bank of America: Offers various options for free checking when requirements are met.

- Capital One 360: No monthly fees and access to a network of ATMs.

- PNC Bank: Free checking if you maintain a minimum balance.

- Wells Fargo: Offers a free checking account with certain conditions.

How to Open a Free Bank Account with Instant Access

To open a free bank account with instant access, opt for an online-only bank. These banks usually provide immediate account numbers and online access upon approval. Ensure you have all necessary documents ready to expedite the process. After opening, you can start using your account for transactions almost immediately.

Free Bank Accounts with Free Debit Cards

Many banks offer free debit cards with their accounts. This feature allows you to make purchases easily without incurring extra fees. Some banks that provide free debit cards include:

- Chime: Comes with a free Visa debit card.

- Ally Bank: Offers a debit card linked to your checking account.

- Discover Bank: Provides a free debit card with their checking account.

Open a Free Bank Account with No Monthly Fees

To find a free bank account with no monthly fees, look for online banks or credit unions. Make sure to read the fine print to confirm there are no conditions that would result in charges. Many banks will waive fees if you set up direct deposit or maintain a minimum balance.

Best Free Bank Accounts for Students

Students often benefit from specialized accounts designed to meet their financial needs. Some of the best free bank accounts for students include:

- Chase College Checking: Offers no monthly service fee for college students.

- Bank of America Advantage Banking: No monthly fees for students under 24.

- Wells Fargo Student Checking: Free for students with no monthly fees.

Open a Free Bank Account for International Transfers

For those who need to send or receive money internationally, consider banks that offer free accounts with favorable foreign transaction fees. Online banks like Wise (formerly TransferWise) allow you to hold multiple currencies without monthly fees, making international banking straightforward and cost-effective.

Free Bank Accounts with High-Interest Rates

Finding a free bank account that also offers high-interest rates can help your savings grow. Look for online banks that provide competitive rates on savings accounts without monthly fees. Some options include:

- Ally Bank: Known for its high-interest rates on savings accounts.

- Marcus by Goldman Sachs: Offers attractive rates with no monthly fees.

- American Express High Yield Savings: Competitive rates with no maintenance fees.

Easy Online Application to Open a Free Bank Account

The online application process for opening a free bank account is designed for convenience. Most banks have streamlined their applications, allowing you to complete the process in a matter of minutes. Just ensure you have all your personal information and identification ready to make it as seamless as possible.

Best Free Bank Accounts for Small Business

Small business owners can benefit from free bank accounts that cater to their needs. Some of the best options include:

- BlueVine: A free business checking account with no monthly fees and high interest.

- Axos Bank: Offers a business checking account with no monthly maintenance fees.

- NBKC Business Account: No monthly fees and unlimited transactions.

Open a Free Bank Account for Direct Deposit

Most banks offer free accounts that allow for direct deposit, which is a convenient way to receive your paycheck. When selecting a bank, ensure they support direct deposit and check for any requirements to avoid monthly fees.

No-Fee Bank Accounts for Everyday Transactions

If you're looking for no-fee bank accounts for everyday transactions, consider online banks that cater to frequent users. Such accounts typically offer unlimited transactions, access to a large network of ATMs, and free debit cards, all without monthly fees. This allows you to manage your finances without worrying about additional costs.

Explore

How to Open a Bank Account Online for Free: A Step-by-Step Guide

Top 10 Free Online Business Bank Accounts for Entrepreneurs in 2023

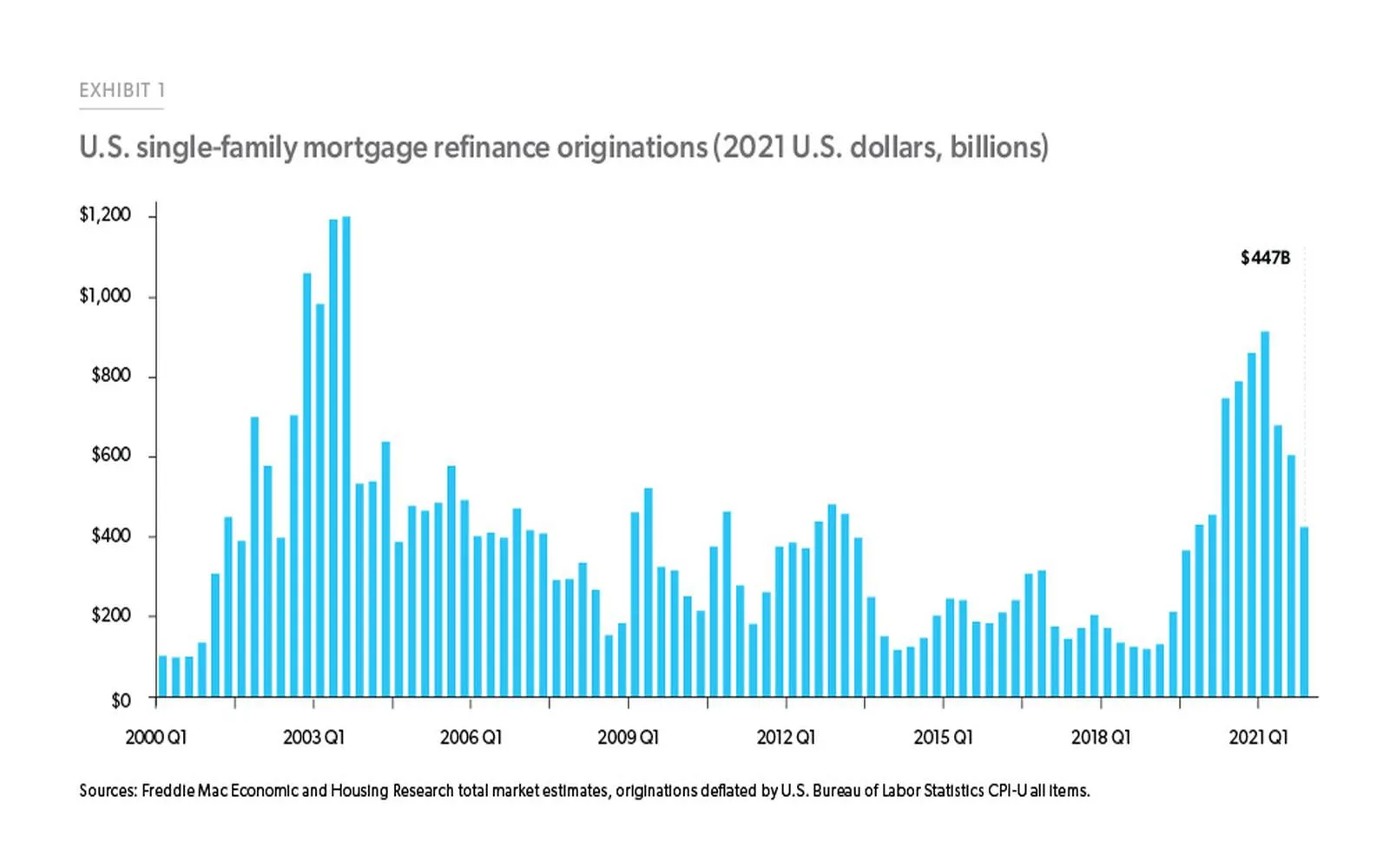

Mortgage Refinance Rates: Unlock the Best Savings Today

How a Financial Advisor Can Help You Break Free from Debt

Affordable Cloud Security: Protect Your Data Without Breaking the Bank

Top Affordable Pet Insurance Plans: Protect Your Furry Friends Without Breaking the Bank!

Top 10 Effective Hair Loss Solutions: Restore Your Confidence Today!

Top Trusted Moving Services: Your Guide to a Stress-Free Relocation