Top 10 Free Online Business Bank Accounts for Entrepreneurs in 2023

Introduction

With the rise of online banking, entrepreneurs now have numerous options for managing their business finances without the burden of traditional bank fees. Free online business bank accounts offer convenience, flexibility, and essential features that can help new and established businesses thrive. In this article, we will explore the top 10 free online business bank accounts available to entrepreneurs in 2023, detailing their features, benefits, and what makes them stand out in the crowded marketplace.

1. Novo

Founded with entrepreneurs in mind, Novo provides a seamless banking experience without monthly fees or minimum balance requirements. With its user-friendly app and online platform, Novo offers features like invoicing tools, expense tracking, and integrations with popular business apps like QuickBooks and Xero. Entrepreneurs can also access their accounts anytime, anywhere, making it ideal for those on the go.

2. BlueVine

BlueVine is a standout option for small business owners, offering a free business checking account that comes with no monthly fees, no minimum balance, and interest on deposits. With competitive interest rates, entrepreneurs can earn on their balances while enjoying unlimited transactions. BlueVine also provides access to lines of credit and invoice factoring, making it a comprehensive banking solution for growing businesses.

3. Axos Bank

Axos Bank's Business Interest Checking account is tailored for entrepreneurs who want to earn interest on their deposits. With no monthly fees and a minimum opening deposit of $1,000, this account allows unlimited transactions and offers free online banking. Axos Bank also provides tools for startups, including online bill pay and mobile check deposits, making it easy to manage finances from anywhere.

4. Radius Bank

Radius Bank’s Tailored Checking account is designed for entrepreneurs looking for a free banking solution with robust features. This account requires no minimum balance and offers a high-interest rate on deposits. Radius Bank provides unlimited transactions, mobile banking, and a suite of financial tools that cater to small business needs, including expense tracking and reporting capabilities.

5. Lili

Lili is a banking solution specifically for freelancers and self-employed individuals. This free online business bank account offers features such as automatic expense categorization, tax savings tools, and invoicing capabilities. With no monthly fees and no minimum balance, Lili is perfect for entrepreneurs who want to simplify their financial management while maximizing their time and resources.

6. NorthOne

NorthOne is designed for small business owners looking for a straightforward banking solution. With a flat monthly fee, NorthOne provides access to a digital banking platform with no minimum balance requirements. Entrepreneurs can enjoy features like mobile check deposits, expense tracking, and the ability to create sub-accounts for better budgeting and financial planning.

7. Tide

Tide offers a free business bank account that caters primarily to small businesses and startups in the UK. Entrepreneurs can open an account quickly using the mobile app, with no credit checks required. Tide provides features such as invoicing, expense management, and integrations with accounting software, making it a practical choice for entrepreneurs wanting to streamline their finances.

8. PayPal Business Account

While primarily known as a payment processing platform, PayPal also offers a free business account that provides a unique banking experience for entrepreneurs. With no monthly fees, users can accept payments, send invoices, and manage their finances all in one place. PayPal’s extensive network and integration capabilities with e-commerce platforms make it an attractive option for online businesses.

9. Chime

Chime is a popular online banking option that offers a business account for entrepreneurs with no monthly fees or minimum balance requirements. Chime provides features like mobile banking, direct deposit, and no overdraft fees. While it lacks some traditional banking features, Chime's user-friendly app and modern approach to banking can be highly appealing to tech-savvy entrepreneurs.

10. Mercury

Mercury is an online bank designed specifically for startups and tech companies. It offers a free checking account with no monthly fees, allowing businesses to manage their finances efficiently. With features like virtual debit cards, integrations with popular financial tools, and the ability to create multiple accounts for different purposes, Mercury is a top choice for tech-savvy entrepreneurs looking for flexibility and innovation in their banking experience.

Conclusion

Choosing the right online business bank account can significantly impact your entrepreneurial journey. Each of the accounts mentioned above offers unique features and benefits tailored to different business needs. Whether you are a freelancer, startup founder, or small business owner, these free online business bank accounts in 2023 can provide you with the tools and resources necessary to manage your finances effectively without the burden of high fees.

As you explore your options, consider your specific business needs, including transaction volume, integration with existing tools, and whether you prefer a mobile-centric banking experience. With the right banking partner, you can streamline your operations and focus on what matters most: growing your business.

Explore

Top Payroll Software Solutions: Streamline Your Business's Payroll Process in 2023

Top Affordable Pet Insurance Plans: Protect Your Furry Friends Without Breaking the Bank!

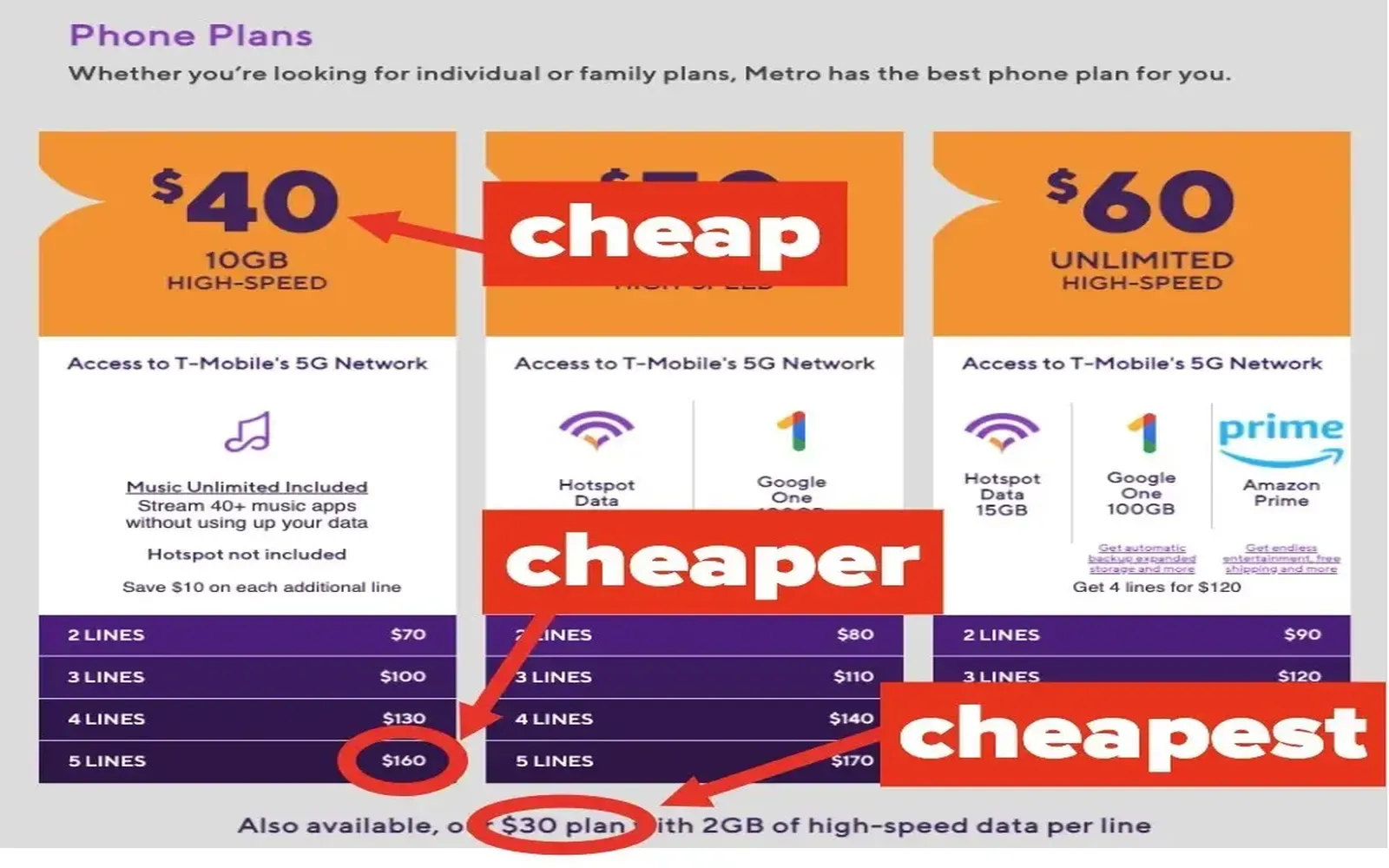

Top 10 Best Cell Phone Plans of 2023: Affordable Options for Every Budget

Top Trusted Moving Services: Your Guide to a Stress-Free Relocation

Top Accredited Online Business Schools: Your Guide to Quality Education and Career Advancement

Top Local SEO Agencies: Boost Your Business's Online Visibility and Rankings

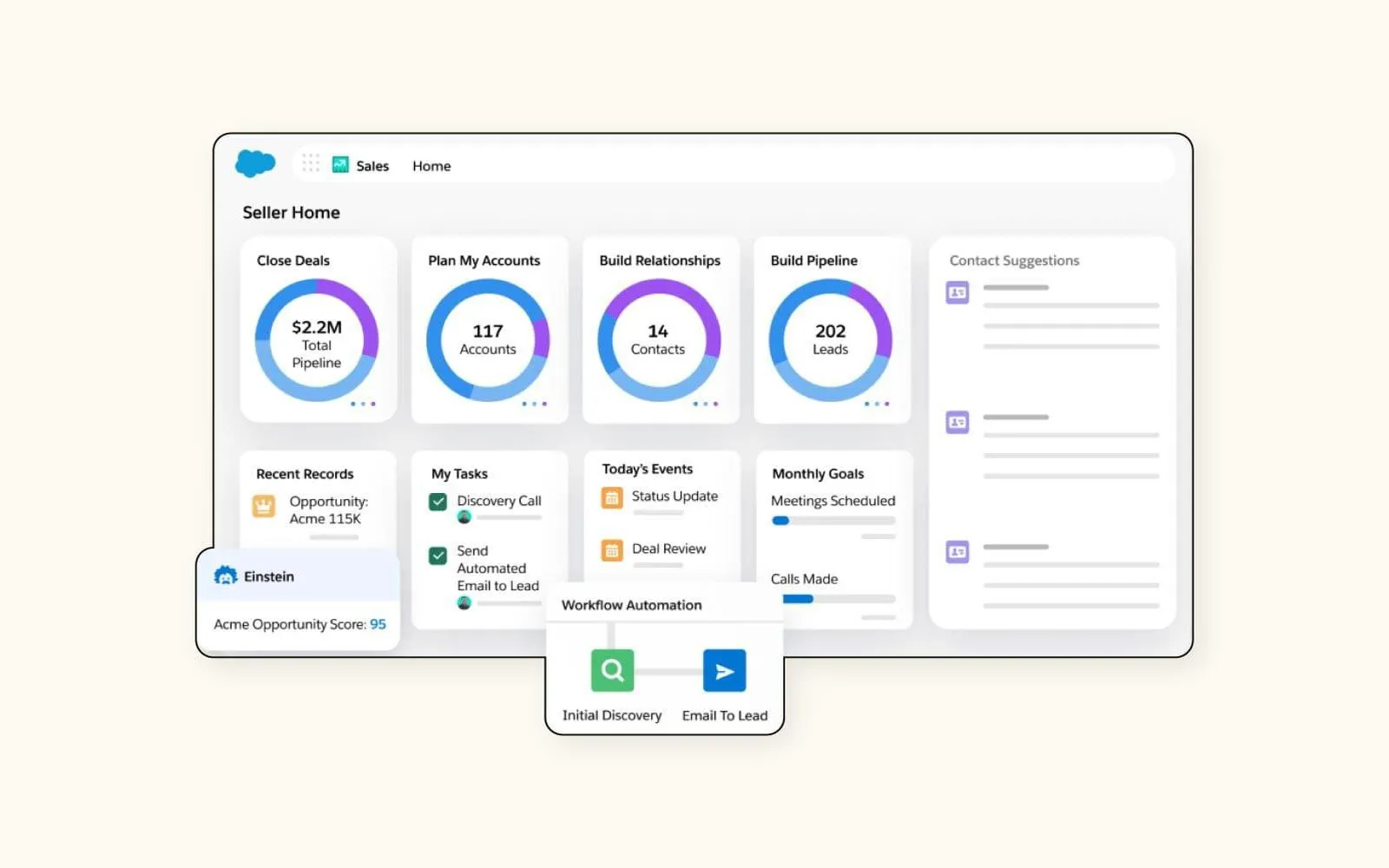

Streamline Your Small Business: The Ultimate Guide to Easy CRM Solutions

Unlock Exclusive Business Class Flight Discounts: Tips for Affordable Luxury Travel