Top High-Yield Savings Accounts

High-yield savings accounts (HYSAs) are an excellent way to grow your savings while keeping funds accessible. Unlike traditional savings accounts, HYSAs offer significantly higher interest rates—often more than 10 times the national average. Here's a breakdown of the top options available in 2025.

What Is a High-Yield Savings Account?

A high-yield savings account is a federally insured deposit account that pays a much higher interest rate than a standard savings account. Offered mainly by online banks and credit unions, these accounts are ideal for emergency funds, short-term goals, or simply earning more from your idle cash.

Top High-Yield Savings Accounts of 2025

🏦 Ally Bank

- APY: 4.25%

- Minimum Balance: $0

- Fees: No monthly fees

- Why Choose It: Excellent customer service, user-friendly mobile app, and no minimum deposit.

🏦 Marcus by Goldman Sachs

- APY: 4.30%

- Minimum Balance: $0

- Fees: None

- Why Choose It: Simple platform with a strong reputation; good for savers who prefer a straightforward experience.

🏦 Synchrony Bank

- APY: 4.35%

- Minimum Balance: $0

- Fees: No monthly fees

- Why Choose It: ATM access included; solid rate with flexibility.

🏦 Discover Online Savings

- APY: 4.30%

- Minimum Balance: $0

- Fees: No maintenance fees

- Why Choose It: Backed by a major brand, excellent online interface, and reliable support.

🏦 SoFi High-Yield Savings

- APY: Up to 4.60% (with direct deposit)

- Minimum Balance: $0

- Fees: No monthly fees

- Why Choose It: Bundles checking and savings, with bonuses for direct deposit users.

How to Choose the Right HYSA

When comparing high-yield savings accounts, consider the following:

- Interest rate (APY)

- Monthly fees and minimum balance requirements

- Transfer limits and accessibility

- Mobile banking features

- FDIC or NCUA insurance

Pros and Cons of HYSAs

✅ Pros:

- Earn higher interest on your savings

- Low or no fees

- Safe and FDIC-insured

- Great for emergency funds and short-term goals

❌ Cons:

- Limited withdrawals per month (per federal guidelines)

- Interest rates can fluctuate

- Not ideal for frequent access or transactions

Tips to Maximize Your Savings

- Set up auto-deposits to grow your savings consistently.

- Avoid fees by choosing accounts with no minimum requirements.

- Use goal tracking features offered by some banks to stay motivated.

Conclusion

High-yield savings accounts offer a smart way to grow your money without risk. With many options exceeding 4.00% APY in 2025, there's no reason to leave your cash in a low-interest account. Choose a provider that fits your needs and start earning more on your savings today.

Explore

Unlocking Financial Freedom: The Benefits of Online Savings Accounts

Top 10 Free Online Business Bank Accounts for Entrepreneurs in 2023

Bright Savings: Your Guide to Affordable Solar Panels for Every Home

Certified Used Toyota RAV4: Quality, Reliability & Smart Savings

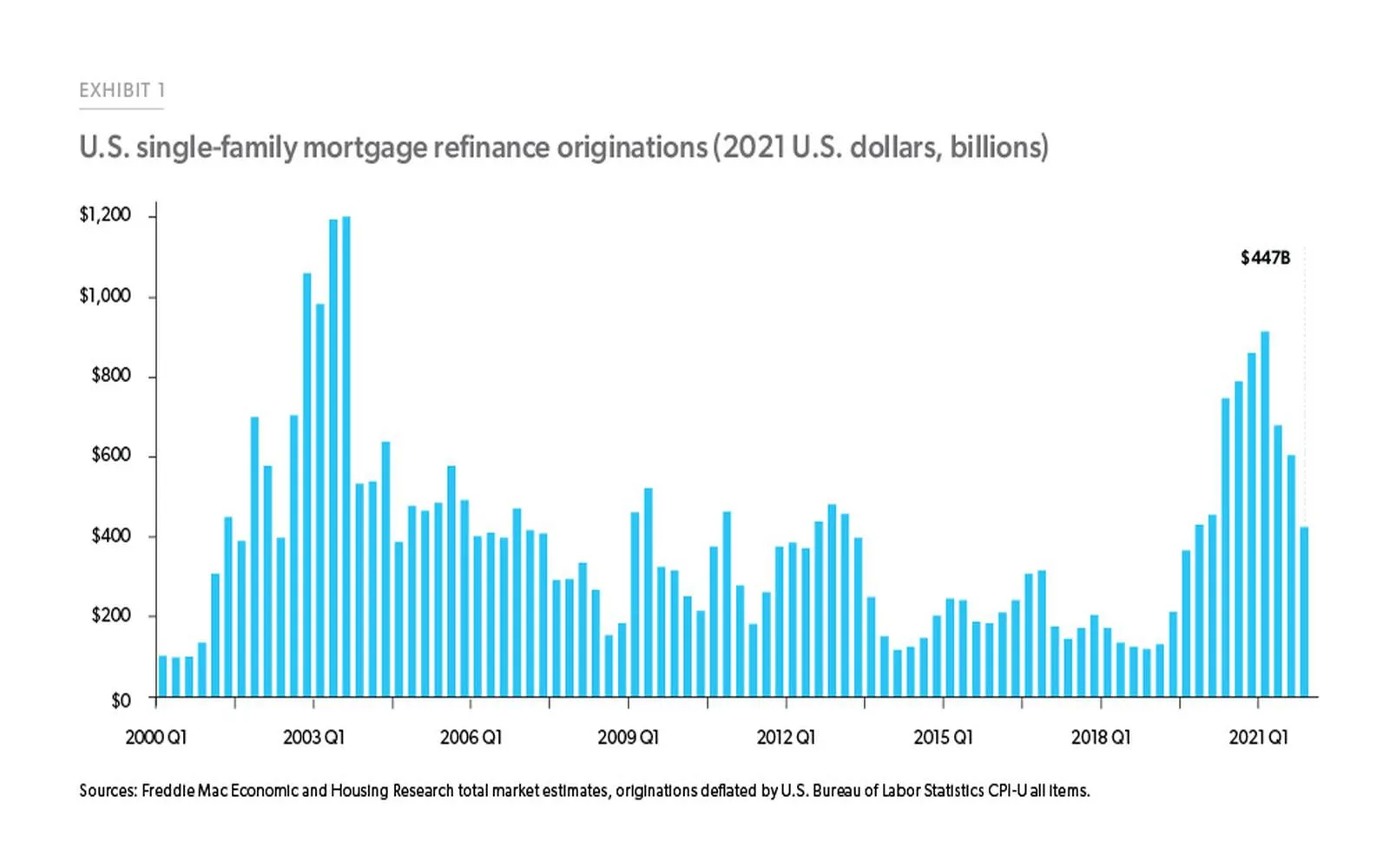

Mortgage Refinance Rates: Unlock the Best Savings Today

Senior Cell Phone Deals: Best Plans & Offers for Savings

Defending Justice: The Vital Role of Criminal Defense Attorneys in the Legal System

The Ultimate Guide to Internet Business Phone Systems