Unlocking Financial Freedom: The Best Credit Cards of 2025 for Every Lifestyle

As we approach 2025, navigating the credit card landscape can feel overwhelming, especially with the myriad options available tailored to various needs and spending habits. Whether you’re seeking the best credit cards for rewards, easy approval, or travel perks, this comprehensive guide will help you identify the top choices for your financial goals. From high cash back offers and no annual fee options to cards designed for students and beginners, we've curated a list that highlights the best credit cards for every situation. Discover how to maximize your benefits, earn points for free flights, and save on everyday purchases with the ultimate credit card options for the year ahead.

Best Credit Cards for 2025

As we approach 2025, the credit card market continues to evolve, providing consumers with a plethora of options tailored to various needs. Whether you’re seeking rewards, cash back, or travel benefits, there’s a credit card designed for you. Here's a comprehensive look at the best credit cards available in 2025.

Top Credit Cards for Rewards

Reward credit cards allow cardholders to earn points or miles for every dollar spent. The Chase Sapphire Preferred Card stands out with its generous sign-up bonus and versatile points that can be transferred to travel partners. The American Express® Gold Card also offers excellent rewards on dining and groceries, making it a favorite among foodies.

Easiest Credit Cards to Get

If you’re new to credit or have a less-than-perfect credit history, consider cards like the Capital One Platinum Credit Card. It offers a straightforward approval process and no annual fee. Additionally, the Discover it® Secured Card is ideal for building credit with a security deposit while offering rewards on purchases.

Best Travel Credit Cards for Points

For avid travelers, the Chase Sapphire Reserve® is hard to beat. With 3x points on travel and dining, an extensive rewards program, and valuable travel insurance benefits, it’s a top choice. Another great option is the Platinum Card® from American Express, offering luxury travel perks, including access to exclusive lounges and travel credits.

Highest Cash Back Credit Cards

The Citi® Double Cash Card is celebrated for its straightforward cash back structure, providing 2% cash back on all purchases—1% when you buy and another 1% when you pay. The Discover it® Cash Back card is also worthy of mention, offering 5% cash back in rotating categories each quarter, plus a unique cash back match for the first year.

No Annual Fee Credit Cards You Need

No annual fee credit cards are perfect for those who want to avoid extra costs. The Chase Freedom Unlimited® offers a solid 1.5% cash back on all purchases with no annual fee. Another excellent option is the Capital One QuicksilverOne Cash Rewards Credit Card, which provides unlimited 1.5% cash back on every purchase.

Best Credit Cards for Beginners

Beginners should look for cards that are easy to manage and offer educational resources. The Discover it® Student Cash Back card provides rewards and offers a cash back match for the first year, making it an excellent choice for students starting their credit journey. The Journey Student Rewards from Capital One is another good option, offering rewards for on-time payments.

Best Credit Cards for Students

The Discover it® Student Chrome card is a standout for students, offering 2% cash back at gas stations and restaurants, plus a cash back match in the first year. The Chase Freedom® Student credit card is also a great choice, providing a $50 bonus after your first purchase and 1% cash back on all purchases.

Top Business Credit Cards

Business owners can benefit from cards like the Ink Business Preferred® Credit Card, which offers 3x points on travel and select business categories. The American Express® Business Gold Card is another excellent option, providing flexible rewards and the ability to earn 4x points in the highest spending category each month.

Best Credit Cards with Big Sign-Up Bonuses

Sign-up bonuses can significantly enhance the value of a credit card. The Chase Sapphire Preferred® offers a substantial sign-up bonus that can be worth thousands in travel when redeemed wisely. The Hilton Honors American Express Surpass® Card also provides a large bonus in Hilton Honors points, perfect for frequent travelers.

Best Credit Cards for Bad Credit

If you’re looking to rebuild your credit, the Secured Mastercard® from Capital One is a great choice, allowing you to establish a credit line with a refundable security deposit. The OpenSky® Secured Visa® Credit Card is another option that doesn’t require a credit check, making it easier for those with bad credit to gain access.

Low Interest Credit Cards You Can’t Miss

Low-interest credit cards are ideal for those who may carry a balance. The BankAmericard® credit card offers a low introductory APR for the first 18 billing cycles and no annual fee. The Citi® Diamond Preferred® Card also features a long 0% introductory APR on balance transfers and purchases for 18 months.

Best Credit Cards for Everyday Purchases

For everyday spending, the American Express Blue Cash Everyday® Card is a top contender, offering 3% cash back on groceries (up to $6,000 per year) and 1.5% on other purchases. The Citi® Double Cash Card is also perfect for everyday use, providing 2% cash back on all purchases—1% at the time of purchase and 1% when you pay off your balance.

Ultimate Guide to Credit Cards with Rewards

When selecting a credit card with rewards, consider your spending habits. Cards like the Chase Freedom Flex℠ provide rotating categories that offer 5% cash back, while the American Express Membership Rewards program allows flexible points redemption. Always read the fine print to understand how to maximize your rewards.

Top Credit Cards for Free Flights

The Chase Sapphire Preferred® is excellent for earning points that can be redeemed for free flights. Alternatively, the Southwest Rapid Rewards® Premier Credit Card offers points that can be used for free flights on Southwest Airlines, making it a favorite among frequent flyers.

Best Credit Cards for Dining Out

The American Express® Gold Card is particularly appealing for dining, offering 4x points at restaurants and 3x points on flights booked directly with airlines. Another solid choice is the Capital One SavorOne Cash Rewards Credit Card, which provides 3% cash back on dining and entertainment.

Best Credit Cards for Shopping Sprees

For shopping enthusiasts, the Amazon Prime Rewards Visa Signature Card is unbeatable, offering 5% back on Amazon.com purchases for Prime members. The Target REDcard™ also provides 5% off every purchase at Target, making it a top choice for regular shoppers.

Best Credit Cards for Gas Discounts

The Costco Anywhere Visa® Card by Citi offers 4% cash back on eligible gas purchases, making it an excellent choice for frequent drivers. The Fuel Rewards® Credit Card also provides savings on gas purchases, allowing you to earn rewards at participating gas stations.

Best Credit Cards for Building Credit Fast

To build credit quickly, consider the Discover it® Secured Card, which reports to all three major credit bureaus and offers cash back on purchases. The Capital One Secured Mastercard is another great option, providing an opportunity to increase your credit limit with responsible use.

0% APR Credit Cards for Balance Transfers

0% APR cards are perfect for managing existing debt. The Citi® Diamond Preferred® Card offers a lengthy 0% intro APR on balance transfers for 18 months, allowing you to pay down debt without accruing interest. The Chase Slate Edge℠ also provides a 0% intro APR on balance transfers for 15 months.

Exclusive Credit Cards for High Earners

High earners may benefit from premium cards like the J.P. Morgan Reserve Card, which offers luxury travel perks and a high level of service. The Centurion® Card from American Express is another elite option, providing exclusive benefits and access to high-end services.

Best Credit Cards for Saving on Travel

The Capital One Venture Rewards Credit Card is a great choice for travelers, offering 2x miles on every purchase and flexible redemption options. The Hilton Honors American Express Aspire Card also provides valuable travel benefits and points for hotel stays, making it ideal for frequent travelers.

Explore

Explore the 2025 Crossover SUV Lineup: Perfect Choices for Every Lifestyle

Unlocking Financial Freedom: Your Guide to Tax Debt Relief Solutions

Unlocking Financial Freedom: The Benefits of Online Savings Accounts

Maximizing Benefits: A Comprehensive Guide to the Best Credit Cards for Rewards

Bright Savings: Your Guide to Affordable Solar Panels for Every Home

Every Paw Counts: The Power of Your Donations in Transforming Animal Lives

Best Personal Loan Platforms for Every Need

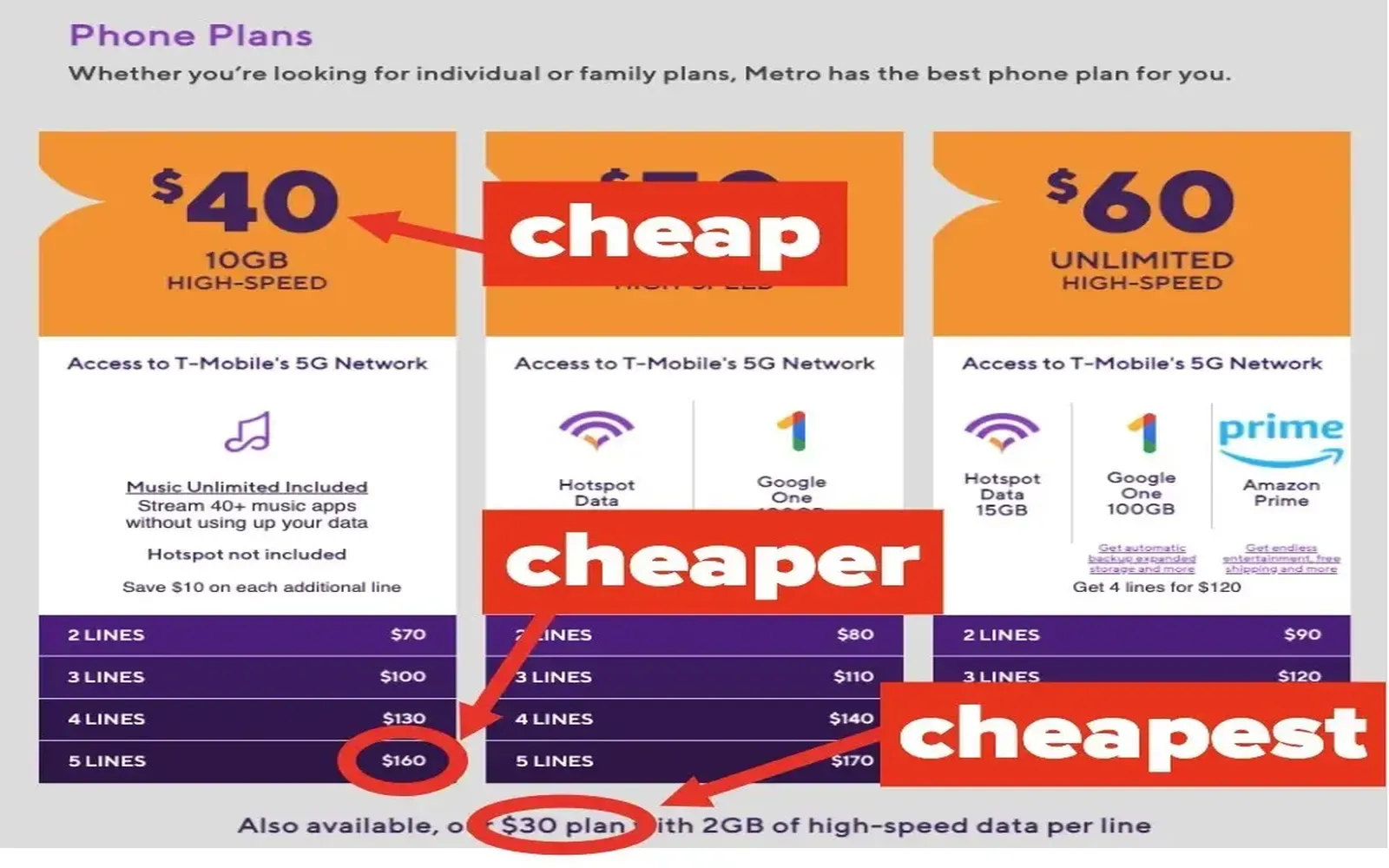

Top 10 Best Cell Phone Plans of 2023: Affordable Options for Every Budget