Unlocking Cash Flow: The Power of Invoice Factoring for Your Business

In the competitive world of trucking, cash flow is essential for maintaining operations and seizing new opportunities. Factoring companies provide a vital financial solution for trucking companies by purchasing their accounts receivable, allowing them to access immediate funds instead of waiting for customer payments. Invoice factoring, particularly popular among small businesses, enables trucking firms to convert invoices into cash quickly, alleviating financial strain. With various options available—including recourse and non-recourse factoring—business owners can choose the best fit for their needs. For those seeking local support, numerous trucking factoring companies and freight broker factoring firms are ready to assist in optimizing cash flow.

Understanding Factoring Companies for Trucking Businesses

In the fast-paced world of trucking, cash flow is essential for operations to run smoothly. Trucking companies often face delays in receiving payments from clients, which can create financial strain. This is where factoring companies come into play, offering a solution through accounts receivable factoring and invoice factoring. This article will explore the various aspects of factoring companies, specifically tailored for trucking companies, and help you understand their significance in maintaining operational efficiency.

What is Accounts Receivable Factoring?

Accounts receivable factoring is a financial transaction where a business sells its invoices to a third-party financial institution, known as a factoring company, at a discount. This allows businesses to receive immediate cash flow rather than waiting for clients to pay their invoices. For trucking companies, this means they can cover operational expenses such as fuel, maintenance, and payroll without the burden of waiting weeks or even months for payment.

Invoice Factoring Companies

Invoice factoring companies specialize in purchasing invoices from businesses. They provide a quick and efficient way for trucking companies to access cash, which can be critical for maintaining the flow of operations. When a trucking company partners with an invoice factoring company, they submit their unpaid invoices, and the factoring company advances a percentage of the total invoice amount—typically around 70% to 90%—immediately. Once the client pays the invoice, the factoring company releases the remaining balance, minus their fee.

Finding a Trucking Factoring Company Near You

When looking for a factoring company specifically for trucking, it’s essential to find one that understands the unique challenges faced by the industry. Searching for a "trucking factoring company near me" can yield local options that may provide personalized service and support. Local factoring companies may also offer more flexibility in terms of terms and fees, catering specifically to the needs of regional trucking businesses.

Financial Factoring Companies

Financial factoring companies vary in their offerings, but they generally provide similar services that cater to businesses in need of immediate cash flow. These companies can offer recourse and non-recourse factoring options, allowing trucking companies to choose the best fit for their financial situation. Understanding the differences between these two types of factoring is crucial for making informed decisions.

Invoice Factoring for Small Businesses

Small businesses, including trucking companies, often face cash flow challenges. Invoice factoring for small business allows these companies to stabilize their finances without taking on debt. Instead of waiting for clients to pay, small businesses can convert their invoices into cash, ensuring they can meet immediate financial obligations. This is particularly beneficial for trucking companies that need to pay drivers, fuel costs, and other operational expenses regularly.

Small Business Factoring Invoice Process

The small business factoring invoice process begins with the company submitting their unpaid invoices to the factoring company. After evaluating the invoices and the creditworthiness of the clients, the factoring company will provide an advance payment. Once the invoice is paid by the client, the factoring company will deduct their fees and release the remaining balance to the trucking company. This straightforward process allows trucking firms to access cash quickly and efficiently.

Recourse vs. Non-recourse Factoring

One of the critical decisions trucking companies must make when choosing a factoring company is whether to opt for recourse or non-recourse factoring. In recourse factoring, the trucking company is liable for any unpaid invoices. If a client fails to pay, the trucking company must buy back the invoice from the factoring company. This option usually comes with lower fees but carries more risk.

In contrast, non-recourse factoring protects the trucking company from the risk of non-payment. If the client does not pay the invoice, the factoring company absorbs the loss, making this a safer option for trucking companies. However, non-recourse factoring typically comes with higher fees and stricter underwriting standards.

Freight Broker Factoring Companies

Freight broker factoring companies provide specialized services for businesses involved in freight brokerage. These companies understand the unique financial challenges faced by freight brokers and trucking companies alike. They offer tailored factoring solutions that can help manage cash flow, ensuring that brokers can pay carriers promptly while waiting for their clients to settle invoices.

Advantages of Factoring for Trucking Companies

The advantages of factoring for trucking companies are numerous. Firstly, it provides immediate cash flow, allowing businesses to cover expenses without delay. This financial boost can help trucking companies invest in maintenance, fuel, and wages, keeping operations running smoothly. Secondly, factoring helps trucking companies manage their finances more effectively, as they can predict cash flow based on the invoices they have sold.

Additionally, factoring companies often handle the collections process, relieving trucking companies of the burden of following up with clients for payment. This not only saves time but also allows trucking companies to focus on their core operations rather than administrative tasks. The overall benefit is an enhanced ability to grow and scale the business without the constraints of cash flow issues.

Choosing the Right Factoring Company

When selecting a factoring company, trucking companies should consider several factors. First, they should assess the fees and rates associated with the factoring service. Understanding the costs upfront can help avoid surprises later. Secondly, the reliability and reputation of the factoring company are crucial. Researching reviews and testimonials can provide insights into their service quality.

It’s also essential to ensure that the factoring company specializes in the trucking industry. A firm with experience in freight factoring will likely understand the nuances of the business and provide better terms and support. Finally, consider the level of customer service offered. A responsive and supportive factoring company can make a significant difference in managing cash flow effectively.

Conclusion

Factoring companies offer valuable financial solutions for trucking companies facing cash flow challenges. By understanding accounts receivable factoring, invoice factoring, and the differences between recourse and non-recourse options, trucking businesses can make informed decisions that align with their financial needs. Whether seeking a local trucking factoring company or specialized freight broker factoring services, the right partnership can lead to improved cash flow, operational efficiency, and overall business growth.

Explore

Unlocking Cash Flow: How Invoice Financing Can Transform Your Business

Unlocking Success: The Power of SMS Marketing Services for Your Business

Unlocking Efficiency: The Power of a Managed Travel Program for Modern Businesses

Unlocking the Power of Digital Signage Solutions

Elevate Your Small Business Communication: Discover the Power of Cloud Phone Systems

Every Paw Counts: The Power of Your Donations in Transforming Animal Lives

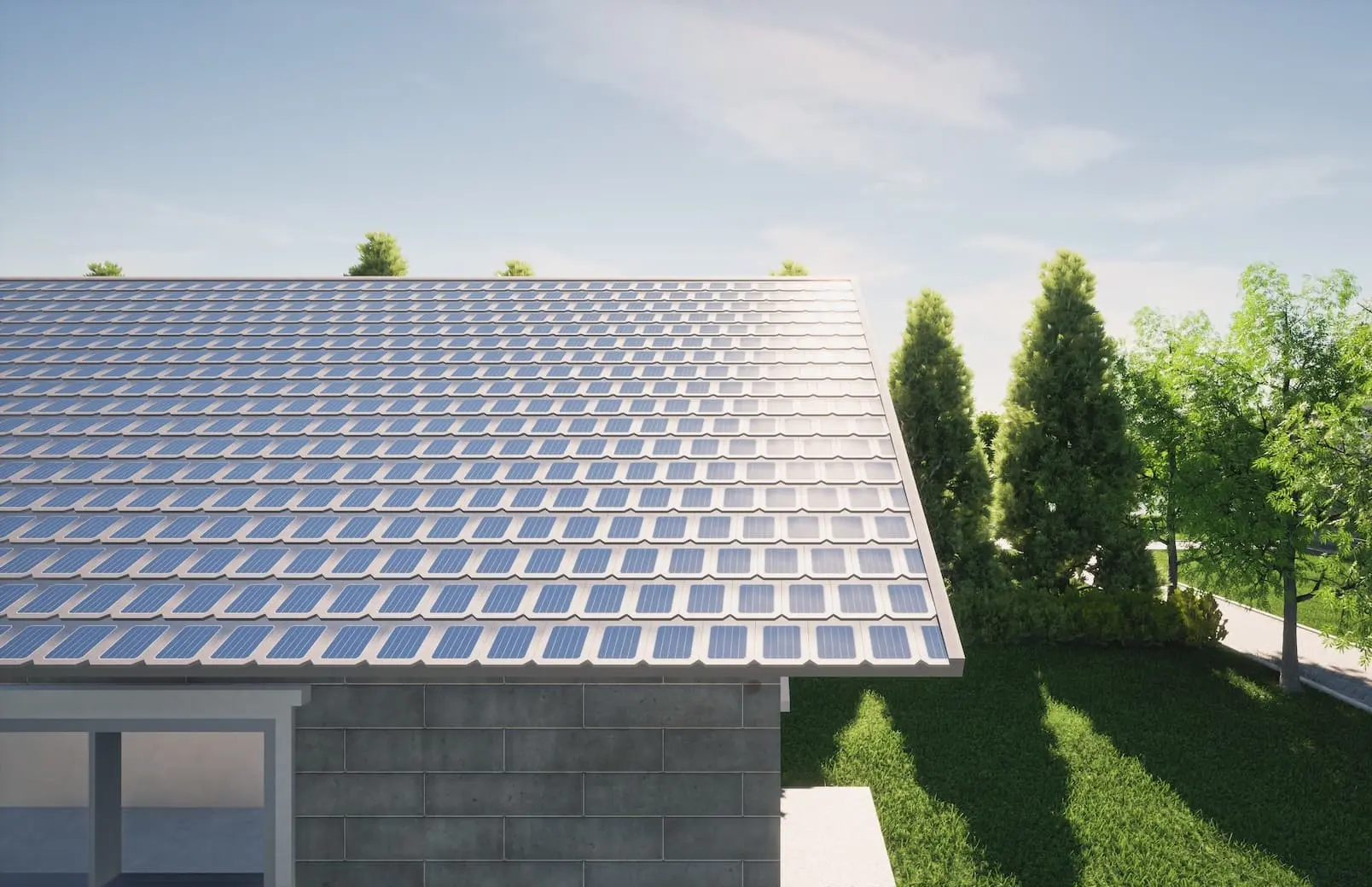

The Future of Solar Roofing: Harnessing the Power of the Sun for Your Home

Embracing Independence: The Transformative Power of Assisted Home Care